XRP is at the moment priced at $2.08, with a market capitalization of $121 billion and a 24-hour buying and selling quantity of $4.08 billion. The cryptocurrency has fluctuated narrowly between $2.04 and $2.17 over the previous day, remaining 38.7% under its all-time excessive of $3.40. Although no indicators of an imminent rebound are evident, the growing downward momentum signifies XRP could also be on the precipice of a steeper decline.

XRP

On the 1-hour chart, XRP displays short-term consolidation with indicators of eroding help. The $2.02 stage has been examined repeatedly, whereas resistance close to $2.10 and $2.20 continues to carry agency. Small surges in shopping for quantity recommend fleeting curiosity, however the lack of upward follow-through leaves the asset prone to additional weak spot. A decisive drop under $2.02 may set off accelerated promoting, intensifying market nervousness.

XRP/ USDT on March 31, 2025, 1H chart.

XRP/ USDT on March 31, 2025, 1H chart.

The 4-hour chart presents a extra regarding outlook, marked by a collection of decrease highs and fading shopping for stress. Resistance at $2.45 stays untested, whereas help at $2.02 weakens below persistent pressure. Failed restoration makes an attempt, coupled with lackluster quantity, reinforce the prevailing pessimism. If XRP breaches the psychologically important $2.00 stage, panic-driven liquidation may ship it spiraling into uncharted draw back territory.

XRP/ USDT on March 31, 2025, 4H chart.

XRP/ USDT on March 31, 2025, 4H chart.

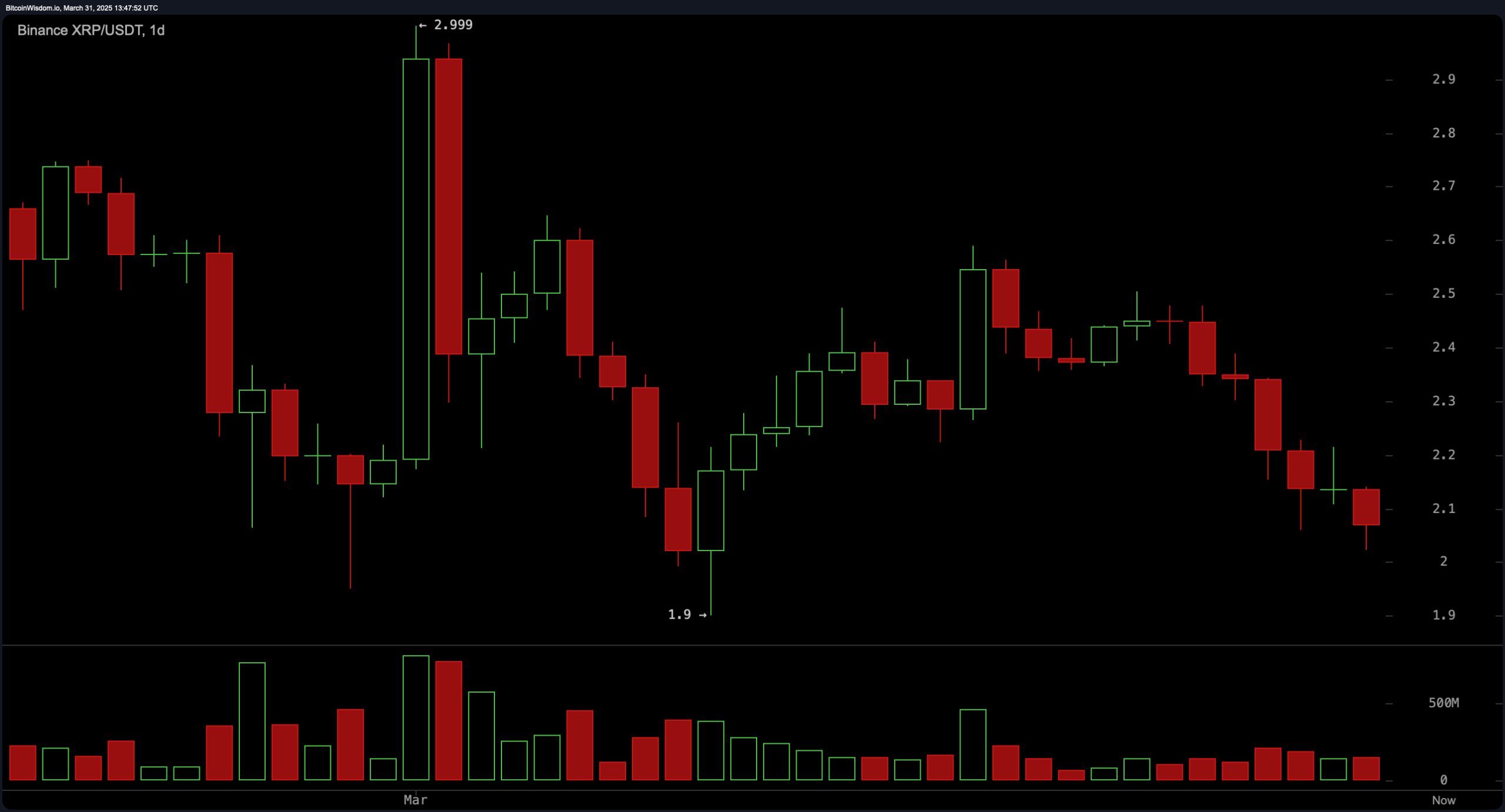

The every day chart solidifies the broader downtrend. Following a pointy rejection from $2.99, XRP has steadily declined with progressively decrease closes. The $2.00 help stage stands because the final bastion of protection—ought to it falter, losses might escalate quickly. Dwindling buying and selling volumes replicate eroding confidence, whereas prolonged purple candles recommend mounting capitulation threat. And not using a substantial bullish catalyst, the percentages of additional depreciation develop more and more worrisome.

XRP/ USDT on March 31, 2025, 1D chart.

XRP/ USDT on March 31, 2025, 1D chart.

Technical indicators unanimously reinforce the bearish bias. The relative energy index (RSI) sits at 37.67, signaling feeble momentum beneath the impartial 50 mark. The stochastic %Ok at 12.00 highlights a stark lack of shopping for curiosity, whereas the commodity channel index (CCI) at -182.70, although deep in oversold territory, reveals no indicators of revival. The superior oscillator stays detrimental at -0.13, additional cementing vendor dominance. In the meantime, the momentum indicator lingers at -0.31, and the shifting common convergence divergence (MACD) at -0.06 points an unambiguous promote sign.

Shifting averages amplify the downward narrative, with almost all timeframes favoring continued weak spot. Exponential and easy shifting averages throughout the ten, 20, 30, and 50-period spans uniformly flash promote indicators. The EMA (10) at $2.24 and SMA (10) at $2.29 each hover above the present value, reinforcing overhead resistance. Longer-term metrics just like the EMA (100) at $2.30 and SMA (100) at $2.51 provide no solace, whereas the EMA (200) at $1.94 and SMA (200) at $1.79, although mildly supportive, stay too distant to encourage confidence. A breakdown under $2.00 may swiftly dismantle any residual bullish optimism.

Bull Verdict:

Regardless of the overwhelming bearish indicators, a resilient protection on the $2.00 help stage may spark a short-term rebound. Ought to consumers step in with substantial quantity, XRP might reclaim the $2.20 resistance stage, with a possible push towards $2.45. A sustained breakout past this vary may restore investor confidence and pave the way in which for additional upside. Nevertheless, for this situation to materialize, market sentiment should shift quickly, with broader crypto market help driving renewed shopping for curiosity.

Bear Verdict:

The technical panorama stays decisively bearish, with XRP on the point of a catastrophic breakdown. A breach under the $2.00 help stage would invalidate any short-term restoration makes an attempt, probably triggering panic promoting. With oscillators and shifting averages signaling persistent downward momentum, the trail of least resistance is clearly to the draw back. If sellers proceed to dominate, XRP may spiral towards the $1.80 vary or decrease, leaving it entrenched in no-man’s land. Warning is suggested, because the chance of additional losses stays alarmingly excessive.