XRP is buying and selling at $2.18 to $2.21 over the previous hour with a market capitalization of $126 billion and a 24-hour buying and selling quantity of $5.61 billion. The value has fluctuated between $2.07 and $2.23 inside the final 24 hours, remaining 35.9% under its all-time excessive of $3.40.

XRP

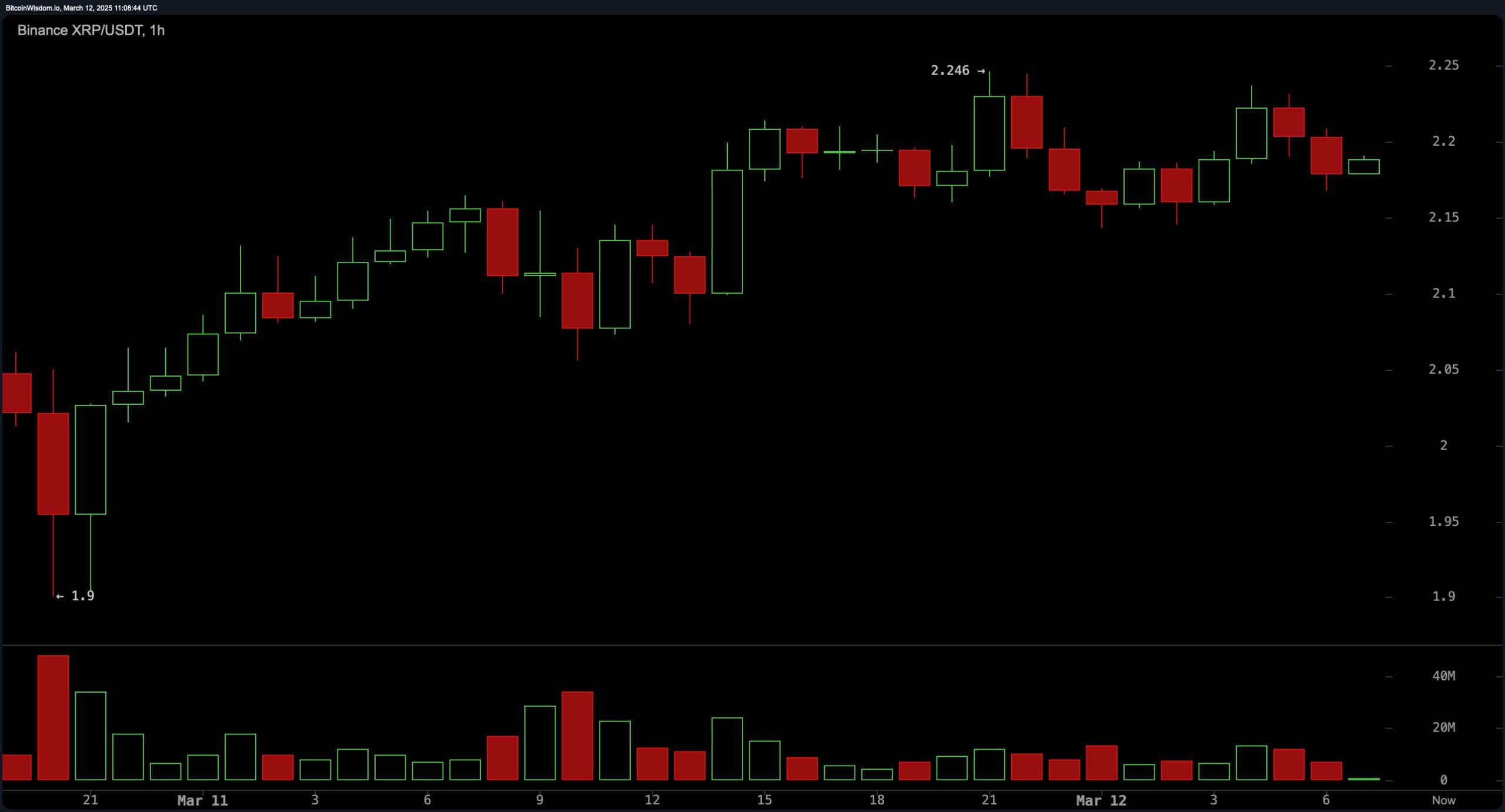

On the 1-hour chart, XRP is exhibiting indicators of a short-term uptrend, forming increased lows after a pointy decline. The value lately examined assist close to $2.07 and rebounded, indicating shopping for strain at decrease ranges. Resistance is forming round $2.25, and a break above this degree might sign additional bullish momentum. Nonetheless, failure to maintain above $2.20 might lead to a retest of decrease assist. Quantity evaluation exhibits consumers stepping in, however the development stays fragile till a decisive breakout is confirmed.

XRP/USDT 1H chart on March 12, 2025.

XRP/USDT 1H chart on March 12, 2025.

XRP’s 4-hour chart presents a broader perspective, exhibiting that XRP lately discovered assist at $1.90 and is now trying to ascertain the next vary. The asset is dealing with resistance between $2.20 and $2.30, a zone that must be breached for a sustained restoration. The value motion suggests a doable shift from a downtrend to consolidation, with elevated quantity supporting a possible breakout. A transfer above $2.30 might open the door to increased ranges, whereas a failure to carry above $2.10 might result in renewed bearish strain.

XRP/USDT 4H chart on March 12, 2025.

XRP/USDT 4H chart on March 12, 2025.

On the day by day chart, XRP stays in restoration mode after a serious rejection from the $3.00 degree, which resulted in a pointy decline. The value is presently stabilizing between key assist ranges at $1.90 and $2.20, whereas resistance looms at $2.50 and $2.75. The current downward momentum seems to be slowing, and a profitable breakout above $2.50 might point out a extra important development reversal. Market sentiment stays cautious, as merchants search for affirmation earlier than committing to lengthy positions.

XRP/USDT 1D chart on March 12, 2025.

XRP/USDT 1D chart on March 12, 2025.

Oscillator readings present a combined outlook, with the relative energy index (RSI) at 43.81 in impartial territory, suggesting neither overbought nor oversold situations. The Stochastic at 18.59 signifies a constructive sign, whereas the commodity channel index (CCI) at -64.59 stays impartial. The typical directional index (ADX) at 23.40 indicators weak development energy, and the superior oscillator exhibits unfavorable momentum at -0.24. The momentum indicator at -0.75 and the transferring common convergence divergence (MACD) degree at -0.10 each sign bearish sentiment, reinforcing the necessity for a confirmed breakout.

Transferring averages (MAs) proceed to point a bearish development throughout most timeframes. The exponential transferring averages (EMA) and easy transferring averages (SMA) for 10, 20, 30, 50, and 100 durations are all signaling a promote. Nonetheless, long-term transferring averages, together with the 200-period EMA at 1.86 and the 200-period SMA at 1.62, are giving purchase indicators, suggesting underlying assist at decrease ranges. The alignment of those indicators implies that whereas short-term traits stay bearish, XRP’s long-term construction should assist a possible restoration if key resistance ranges are damaged.

Bull Verdict:

XRP’s worth motion is exhibiting early indicators of restoration, with sturdy shopping for assist close to $2.07 and a possible breakout above $2.30 on the horizon. The short-term uptrend, mixed with rising quantity, suggests a shift in momentum. If XRP can surpass key resistance at $2.50 and keep energy above $2.75, a bullish continuation towards $3.00 may very well be in play. The long-term transferring averages additionally point out underlying assist, reinforcing the potential for a sustained uptrend.

Bear Verdict:

Regardless of XRP’s current bounce, the general development stays bearish, with a number of key resistance ranges but to be damaged. Oscillators and transferring averages recommend weak momentum, and failure to clear $2.30 might lead to additional draw back strain. If XRP loses assist at $2.07 and falls under $2.00, a retest of decrease ranges, together with $1.90 or decrease, turns into more and more doubtless. Till a decisive breakout happens, the chance of additional draw back outweighs bullish prospects.