Crypto merchants and buyers will witness roughly $3 billion value of Bitcoin (BTC) and Ethereum (ETH) choices expire right now.

Expiring choices are likely to trigger notable value volatility, that means crypto market members ought to monitor right now’s developments intently and presumably alter their buying and selling methods round 8:00 UTC.

$2.95 Billion Bitcoin and Ethereum Choices Expiring

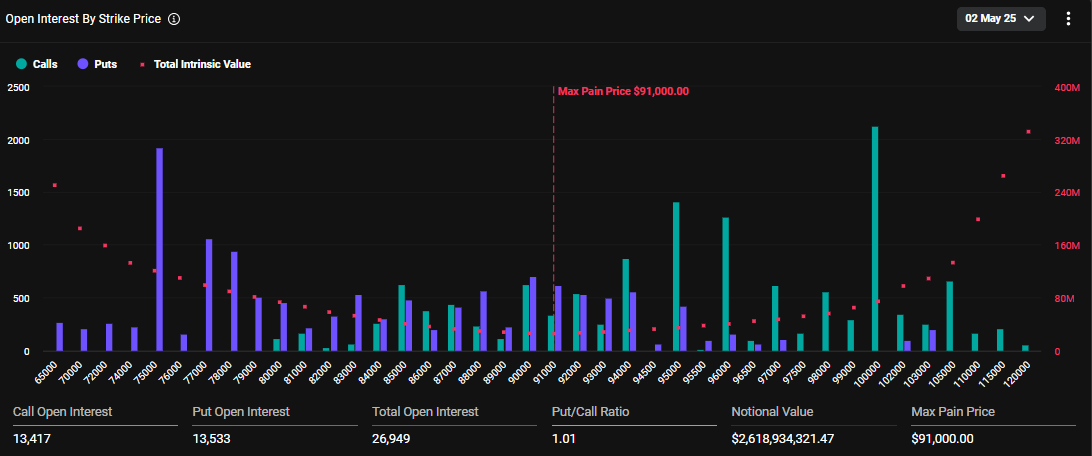

Knowledge on Deribit exhibits that 26,949 Bitcoin contracts will expire right now. The expiring choices have a notional worth of roughly $2.6 billion.

The utmost ache level at which the asset will trigger monetary losses to the best variety of holders is $91,000. At this level, most contracts will expire nugatory.

Bitcoin Choices Expiration. Supply: Deribit

Bitcoin Choices Expiration. Supply: Deribit

Bitcoin’s put-to-call ratio is 1.01. This implies a bearish sentiment as buyers make extra gross sales (Put) than buy (Name) orders.

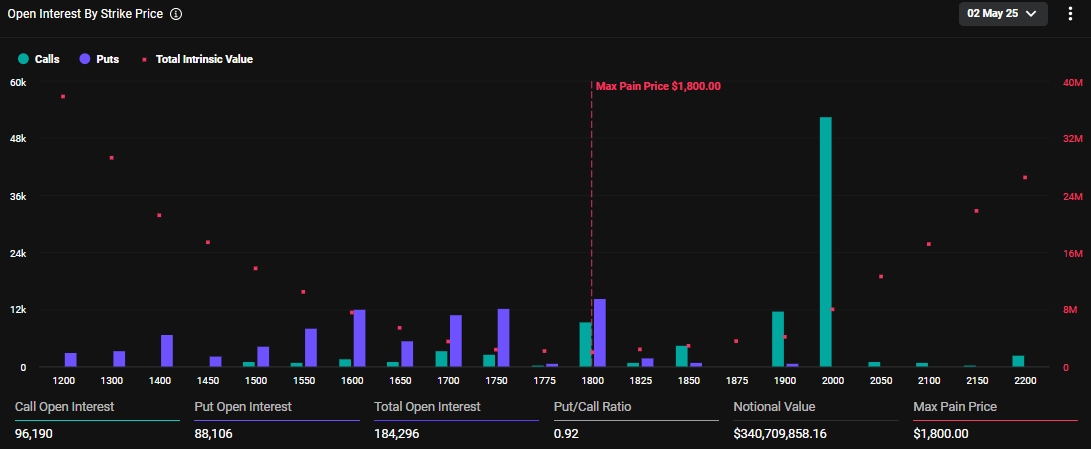

In distinction, Ethereum’s put-to-call ratio is 0.92, indicating a usually bullish market outlook for ETH. Primarily based on Deribit information, 184,296 Ethereum contracts will expire right now. These expiring contracts have a notional worth of roughly $340.7 million and a most ache level of $1,800.

Ethereum has seen a modest enhance of two.27% since Friday’s session opened, to commerce at $1,848 as of this writing.

Expiring Ethereum Choices. Supply: Deribit

Expiring Ethereum Choices. Supply: Deribit

Regardless of Bitcoin gross sales calls exceeding buy calls, analysts at Greeks.reside cite a predominantly bullish sentiment out there. Additionally they be aware that many merchants count on a push towards $100,000, citing low volatility and market construction.

“Key ranges being watched embrace the $96,000 NPOC [Naked Point of Control] that was simply hit and the $94,400 rolling VWAP [Volume-Weighted Average Price], although some specific issues about promote in Might and go away seasonality,” wrote Greeks.reside.

With low volatility, merchants see alternatives for lengthy positions. In response to Greeks.reside, market makers are promoting calls at 30% implied volatility (IV) to gather gamma, whereas leverage stays low. This implies a possible upside with merchants anticipating extra fee cuts.

Gathering gamma means promoting choices to revenue from secure costs, managing small value strikes, and incomes premiums in a low-volatility market.

With ETH underperforming in comparison with BTC, some merchants are shorting it. In the meantime, others give attention to BTC’s regular rise and think about July volatility positions for vega beneficial properties. This displays a strategic break up in market focus.

Vega beneficial properties occur when possibility costs rise because of elevated market volatility, benefiting merchants holding choices with increased Vega sensitivity.

In the meantime, analysts at Deribit agree that some merchants are specializing in Bitcoin’s regular rise. In opposition to this backdrop, there may be vital BTC stacking above $95,000.

“Market exhibits sturdy BTC name stacking above $95K, what affect will the expiry do?,” Deribit analysts posed.

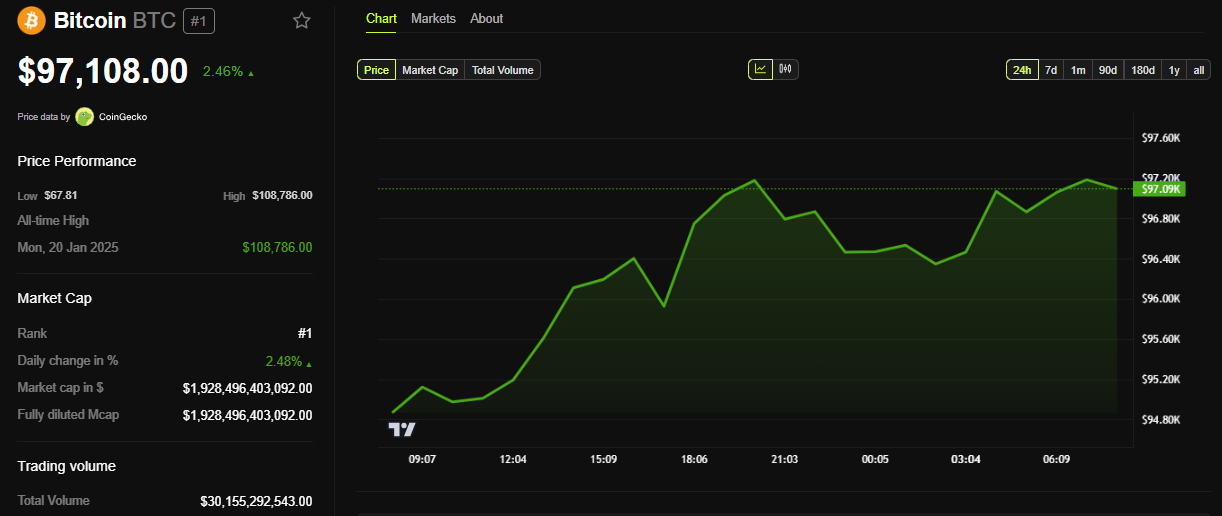

As of this writing, Bitcoin was buying and selling for $97,108, with beneficial properties of virtually 3% during the last 24 hours.

Bitcoin (BTC) Value Efficiency. Supply: BeInCrypto

Bitcoin (BTC) Value Efficiency. Supply: BeInCrypto

Due to this fact, heavy Bitcoin name choices stacking above $95,000 factors to dealer optimism for a value surge.

However, it’s crucial to notice that choices expiring can set off volatility, as seen with final week’s $8.05 billion choices expiry, which induced short-term value consolidation. Nonetheless, volatility round choices expiry tends to ease down as soon as the contracts are settled round 8:00 UTC on Deribit.