May 23, 2024

Editors' notes

This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

proofread

Unlocking cryptocurrency profits: AI-powered trading strategies tame market swings

The dynamic landscape of cryptocurrencies, marked by rapid growth and high volatility since Bitcoin's inception in 2009, has attracted significant attention from investors and traders. The emergence of new digital currencies challenges traditional financial models, necessitating advanced analytical tools to navigate the market's unpredictability.

The quest for effective trading strategies has led to the exploration of AI and machine learning techniques, which promise to enhance decision-making in this speculative yet lucrative field.

Researchers from the University of Barcelona and the University of Málaga unveiled a pioneering study in Quantitative Finance and Economics on March 26, 2024. Their research demonstrates the powerful integration of Exponential Generalized Autoregressive Conditional Heteroskedasticity (EGARCH) with cutting-edge machine learning techniques to adeptly manage the volatility endemic to cryptocurrency markets.

This innovative approach significantly enhances the accuracy of predictions regarding cryptocurrency trading decisions.

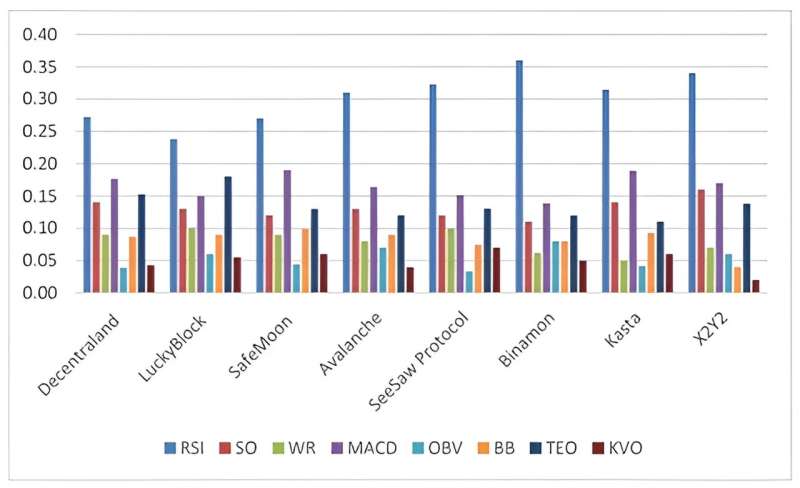

The investigation assessed several machine learning models, such as Adaptive Genetic Algorithms with Fuzzy Logic and Quantum Neural Networks, to forecast buying or selling actions across various cryptocurrencies.

A key finding from the study was the superior performance of these models when combined with EGARCH, which markedly improved prediction accuracy by effectively modeling the price volatility characteristic of cryptocurrencies.

Notably, the cryptocurrency X2Y2 showed the highest prediction accuracy, underscoring the potential of combining sophisticated machine learning methods with volatility models to substantially mitigate trading risks and refine investment decisions.

Dr. David Alaminos, the lead researcher at the University of Barcelona, commented, "Our method harnesses the strengths of both neural networks and genetic algorithms, augmented by the volatility modeling prowess of EGARCH. This synergy fosters more dependable market movement predictions and significantly diminishes trading risks."

This methodology offers tools for investors aiming to reduce risks in cryptocurrency investments. Moreover, the insights gained from this study could assist regulatory bodies in formulating policies to enhance market fairness and stability, while also aiding developers in advancing predictive algorithms for financial technologies.

More information: David Alaminos et al, Managing extreme cryptocurrency volatility in algorithmic trading: EGARCH via genetic algorithms and neural networks, Quantitative Finance and Economics (2024). DOI: 10.3934/QFE.2024007

Provided by TranSpread Citation: Unlocking cryptocurrency profits: AI-powered trading strategies tame market swings (2024, May 23) retrieved 23 May 2024 from https://techxplore.com/news/2024-05-cryptocurrency-profits-ai-powered-strategies.html This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no part may be reproduced without the written permission. The content is provided for information purposes only.

Explore further

Machine learning models improve the prediction of groundwater depth in the Ningxia area of China 1 shares

Feedback to editors