The US President raised eyebrows as soon as once more after asserting that high holders of his TRUMP meme coin would have the prospect to have an unique dinner with him or a VIP tour of the White Home. The choice to make use of public workplace for personal acquire drew scrutiny over whether or not the President was committing Constitutional violations.

In a dialog with BeInCrypto, former George W. Bush Ethics Lawyer Richard Painter defined that Trump didn’t violate the US Structure however could possibly be sued for fraud if he fails to meet his guarantees by the Could deadline.

Preliminary Announcement and Public Response

If President Trump’s involvement in crypto ventures raised moral considerations earlier than, they’ve now turned authorized following his current announcement concerning the buying and selling of his meme coin.

Final week, Trump introduced a contest during which the highest 220 holders of TRUMP can be invited to an unique gala dinner to fulfill the President, whereas the highest 25 holders would additionally get a VIP tour of the White Home.

Official Trump Dinner Announcement. Supply: gettrumpmemes.com

Official Trump Dinner Announcement. Supply: gettrumpmemes.com

The general public has till Could 12 to build up tokens past the 220 threshold, whereas the dinner is ready to happen on Could 22. The announcement instantly raised criticism over corruption and market manipulation.

A current report, co-authored by Painter, signifies that as of mid-March, President Trump’s cryptocurrency holdings, together with TRUMP and WLFI, had been valued at $2.9 billion, constituting about 37% of his whole wealth. The launch of the USD1 stablecoin by World Liberty Monetary would drive additional progress within the worth of those belongings.

Although visibly unethical, Trump’s actions usually are not legally liable.

Circumventing Constitutional Emoluments Clauses

Regardless of public and legislative criticism and scrutiny from our bodies just like the Senate Banking Committee, President Trump has prevented authorized challenges thus far. Although riddled with moral questions, his crypto ventures have efficiently skirted authorized and constitutional breaches of belief.

Underneath the US Structure, the Overseas and Home Emoluments Clauses are anti-corruption provisions designed to make sure the integrity and independence of people holding positions of public belief inside the authorities.

They intention to forestall exterior and inside influences from doubtlessly compromising the judgment and loyalty of presidency officers. Nevertheless, these clauses primarily handle presents or advantages from overseas governments or the US authorities itself.

“[Trump’s] utilizing the presidency to earn money for himself off his meme coin and auctioning off White Home excursions and a dinner with the President in his official capability. If overseas governments get entangled, that might violate the emoluments clause of the Structure. I haven’t seen that but, however they might. However it’s clearly corrupt,” Painter advised BeInCrypto.

In different phrases, the perks provided by a non-public meme coin challenge, although intently related to the President, wouldn’t fall below the strict definition of an “emolument.”

Trump’s current bulletins elevate questions on different legal guidelines, however his presidential standing presents him a level of authorized insulation.

Battle of Curiosity Legal guidelines and Presidential Exemption

A sure part of the US Code explicitly addresses conflicts of curiosity involving the federal authorities. This part, often called “Acts affecting a private monetary curiosity,” is designed to make sure that authorities workers act within the public’s finest curiosity, free from the influences of their very own financial place.

The statute usually prohibits federal workers from collaborating “personally and considerably” in any “specific matter” that might have a “direct and predictable impact” on their monetary pursuits.

If an individual violates this statute, they face legal and civil penalties, starting from substantial fines to time served in jail. Nevertheless, there are exceptions to this statute.

“The monetary battle of curiosity statute doesn’t apply to the President, the Vice President, and members of Congress. It’s a criminal offense for everyone else within the authorities. That’s why the members of Congress are buying and selling in shares, and President Trump can do that. It is a large downside, and I believe we might must amend that legal statute,” Painter defined.

This legislation has been this fashion for the reason that founding of the Republic. The statute’s exceptions have by no means been amended regardless of repeated questioning over time.

At the moment, Trump’s plans for a non-public dinner with high meme coin holders usually are not topic to federal prosecution. Nevertheless, failing to meet these guarantees may result in authorized motion on the state degree or by means of non-public lawsuits.

Meme Cash and Securities Rules

A month after Trump launched his meme coin, the SEC declared that meme cash usually are not labeled as securities.

In consequence, neither patrons nor holders of meme cash are afforded the protections of federal securities legal guidelines. This example doesn’t bode effectively for any TRUMP holders who misplaced cash from the depreciating worth of the meme coin. In consequence, they can’t sue for securities fraud.

Nevertheless, they will make a case by suing for fraud below the 5 widespread legislation rules, significantly if President Trump’s promised gala dinner and White Home tour fall by means of.

Widespread Legislation Fraud and Potential Lawsuits

In contrast to securities fraud, which is ruled by particular legal guidelines, widespread legislation fraud is a wider authorized precept that addresses misleading actions in varied contexts. Its enforcement in the US usually happens on the state degree by means of judicial rulings reasonably than federal statutes concentrating on securities.

Such a fraud has 5 essential components. First, somebody makes a false assertion a couple of important truth, and so they comprehend it’s unfaithful.

Second, they intend the opposite individual to imagine and act primarily based on this false assertion. Third, the opposite individual really and fairly believes the false assertion. Fourth, they act primarily based on that perception. Lastly, this motion causes them hurt or loss.

Non-public residents may sue President Trump if he doesn’t ship on his guarantees. If damages are significantly in depth, state lawyer generals may additionally take measures into their very own fingers.

“If there may be any materials misrepresentation made or a lie being advised by anybody within the sale of a meme coin, there could possibly be a non-public proper of motion for fraud and the state lawyer basic may transfer in on that and file an enforcement motion. I have no idea that there’s sufficient proof to carry a fraud declare, however that is beginning to transfer in that route,” Painter advised BeInCrypto.

Finally, authorized motion concerning the dinner will depend on whether or not President Trump fulfills his promise. In the meantime, Painter voiced severe considerations that such market manipulations may precipitate a bigger monetary disaster.

Market Manipulation and Threat of Monetary Disaster

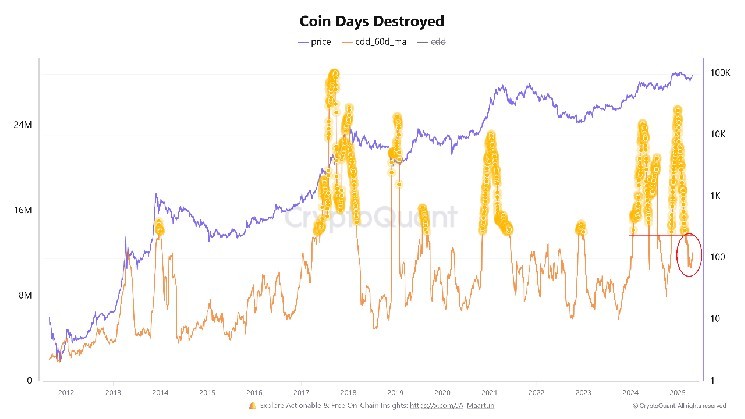

The chronology of Trump’s dinner announcement sparked deep considerations over unmistakable market manipulation.

Per week earlier than the announcement, the workforce behind TRUMP unlocked $300 million price of recent tokens. Given the crypto market’s larger bearish circumstances, the larger circulation provide, and the shortage of demand for the meme coin, the value naturally went down.

Naturally, this case prompted many to quick the meme coin, anticipating a worth decline. Nevertheless, the announcement triggered a surge in shopping for. The value immediately rose by 50%, and people merchants who shorted TRUMP misplaced their cash.

TRUMP Worth Chart For the reason that Presidential Dinner Announcement. Supply: TradingView

TRUMP Worth Chart For the reason that Presidential Dinner Announcement. Supply: TradingView

To the bare eye, this was a transparent instance of synthetic worth inflation.

Painter seen it as one other signal pointing to the pressing want for crypto regulation earlier than it unleashes a series response.

The Want for Crypto Regulation

The authorized classification of meme cash as non-securities, coupled with the exemption of high-ranking officers from conflict-of-interest legal guidelines, prompts Painter to warn that this lack of oversight may result in monetary catastrophe.

“Crypto is unregulated, it’s speculative. The belongings are extraordinarily risky, and we may have a monetary disaster popping out of crypto if we don’t get a deal with on this. And what I see is the President, members of his cupboard, members of Congress buying and selling in crypto, making a living off crypto, and taking marketing campaign contributions from the crypto business as a substitute of regulating it,” Painter stated.

The potential fallout is important. Past the losses already impacting TRUMP holders, this political involvement in crypto may injury the business’s future and set off a confidence bubble, resulting in wider monetary instability.

“For 5 or 6 years, I’ve urged Congress to behave and so as to add crypto to the definition of a safety. I believe it’s actually destroys the credibility of our authorities and undermines public confidence. This isn’t going to finish effectively. The difficulty is how harmful this could possibly be for the financial system if we don’t regulate this, and [instead] we simply hear increasingly more hypothesis. It is a large downside and it will probably have a systemic impact within the monetary system,” Painter concluded.

Though Trump’s meme coin promotion isn’t at present dealing with federal prosecution, the moral violations and potential for market manipulation are substantial. Finally, authorized motion will depend upon whether or not Trump follows his unique guarantees.

However within the larger scheme of issues, if laws aren’t applied, this unchecked political involvement in crypto may result in broader monetary instability and a decline in public belief.