Ethereum (ETH) market maintains its place beneath necessary resistance zones, as April ends with technical indicators supporting a rising bearish market sentiment. Ethereum traded round $1,760 on April 30 after experiencing a 3.06% worth lower in 24 hours, and failed to interrupt the $1,800–$1,825 resistance space.

TradingView knowledge confirmed that the value established a transparent downward development with weakening peaks in the course of the earlier week. ETH skilled robust resistance at $1,850, whereas help was $1,750. The closing worth of the each day candle on April 30 reached $1,771.80, demonstrating persistent promoting strain amongst traders throughout brief timeframes.

Whales took benefit of the current worth surge, promoting 262,000 #Ethereum $ETH, price round $445 million. pic.twitter.com/sQ0PhAzyfX

— Ali (@ali_charts) April 29, 2025

Technical Indicators Sign Continued Weak spot

The technical indicators level towards no upcoming bullish development conduct. The bearish crossover continued to deepen within the 4-hour MACD, with the MACD line at 4.89 whereas the sign line reached 10.45. Technical indicators confirmed the RSI reaching 42.36, signaling rising market bearishness.

Supply: TRADINGVIEW

Supply: TRADINGVIEW

Help Ranges Come Underneath Stress as Quantity Drops

As well as, on-chain quantity and technical chart patterns level in direction of additional draw back for ETH. Buying and selling quantity for Binance inside the final 4 hours was 4.63K ETH, which exhibits that curiosity on this pump was low. In the meantime, DEX exercise plummeted with roughly $1.439 billion in each day quantity, effectively beneath common ranges of DEX exercise seen in 2023 and early 2024.

Ethereum resisted falling beneath the $1,743 help space at press time, remaining trapped inside the Fibonacci zone, extending from $1,784 to $1,743. As soon as the value falls beneath the crucial worth level of $1,743, which coincides with the 50% Fibonacci stage, the following help stage stands at $1,710. Beneath that, $1,677 serves as the following possible goal.

The realized cap and “sizzling capital” influx chart from Glassnode confirmed a 66.9% rise in capital circulation over the previous two weeks, reaching $4.34 billion. Nevertheless, this surge was led by short-term holders, making the market weak to fast exits if costs drop.

Layer 2 Development Contrasts Brief-Time period Market Weak spot

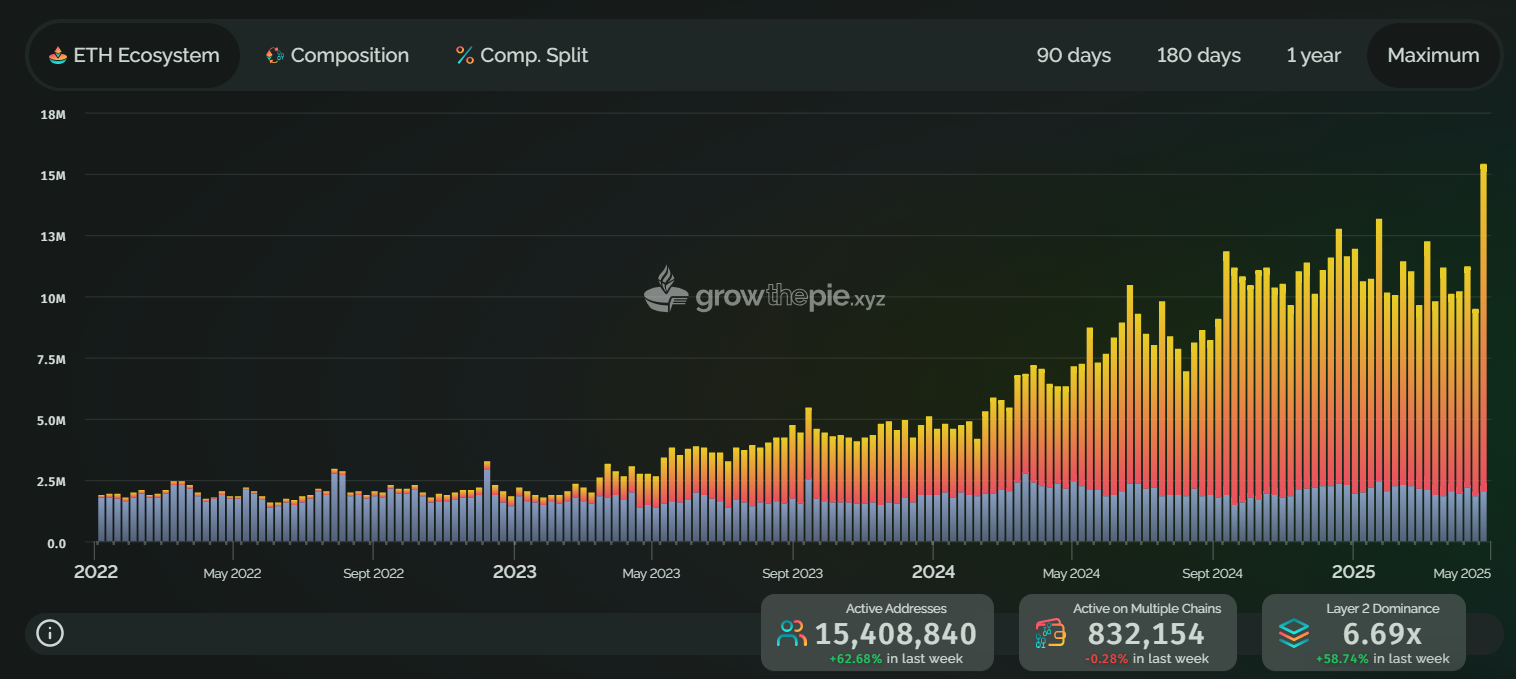

In accordance with knowledge from GrowThePie.xyz, the Ethereum community reached its all-time peak with 15.4 million energetic addresses in April, whereas Layer 2 adoption exceeded Layer 1 utilization by 6.69 occasions. Nevertheless, the present worth motion of ETH stays restricted as a result of spot market demand is weak and investor confidence is low.

In his roadmap, Vitalik Buterin, the co-founder of Ethereum, outlined two key growth objectives for the community: attaining single-slot finality and stateless structure. The outlined future developments will increase privateness and scalability, whereas they need to not affect Ethereum’s near-term market efficiency.

Outlook: Additional Declines Doable With out Breakout

Additional draw back for ETH appears possible within the close to time period until the value can decisively push above the $1,825 resistance stage with sustained quantity to reclaim $1,800.

If $1,750 breaks, a major improve in bearish strain might trigger Ethereum to fall to both $1,710 or $1,677 in the course of the first week of Could.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version shouldn’t be chargeable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.