Bitcoin’s value was rejected this week, showcasing the inadequate bullish momentum out there.

Nonetheless, the asset faces a considerable assist vary on the $80K mark, which is anticipated to carry the value within the brief time period.

Technical Evaluation

By Shayan

The Each day Chart

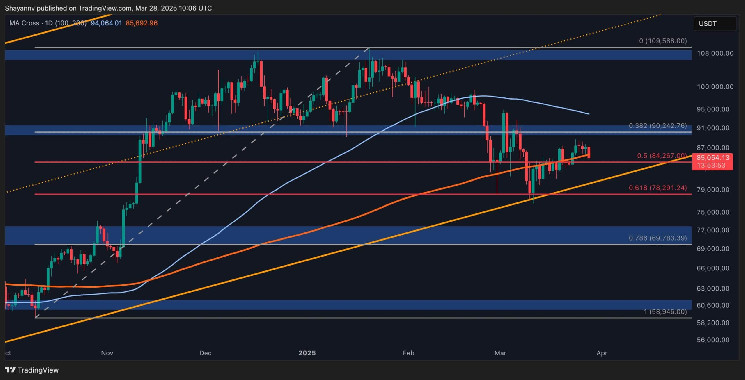

Bitcoin has not too long ago skilled a notable rejection after briefly breaking above the 100-day MA, signaling a false breakout and inadequate bullish momentum. This failure to interrupt via reinforces the prevailing bearish sentiment out there.

Nonetheless, BTC is approaching a considerable assist vary, together with the psychological $80K stage and the 0.5 ($84K) – 0.618 ($78K) Fibonacci retracement zone. This significant area is anticipated to behave as a assist zone, doubtlessly resulting in a brand new consolidation section across the $80K mark.

Given these situations, Bitcoin is more likely to proceed its decline towards $80K within the brief time period, the place value motion will decide the subsequent vital transfer.

The 4-Hour Chart

On the decrease timeframe, Bitcoin encountered elevated promoting stress on the higher boundary of its descending channel, resulting in a powerful rejection. The worth is at the moment testing short-term assist at $83K, aligning with a previous swing low. Whereas some shopping for curiosity might emerge at this stage, general market situations lack bullish momentum, and sellers stay dominant.

Because of this, BTC is more likely to break beneath $83K and transfer towards the channel’s mid-boundary at $80K, which is a crucial inflection level. Whereas it could assist the value and provoke a consolidation section, a breakdown beneath this stage might set off a deeper decline towards the $77K threshold.

On-chain Evaluation

By Shayan

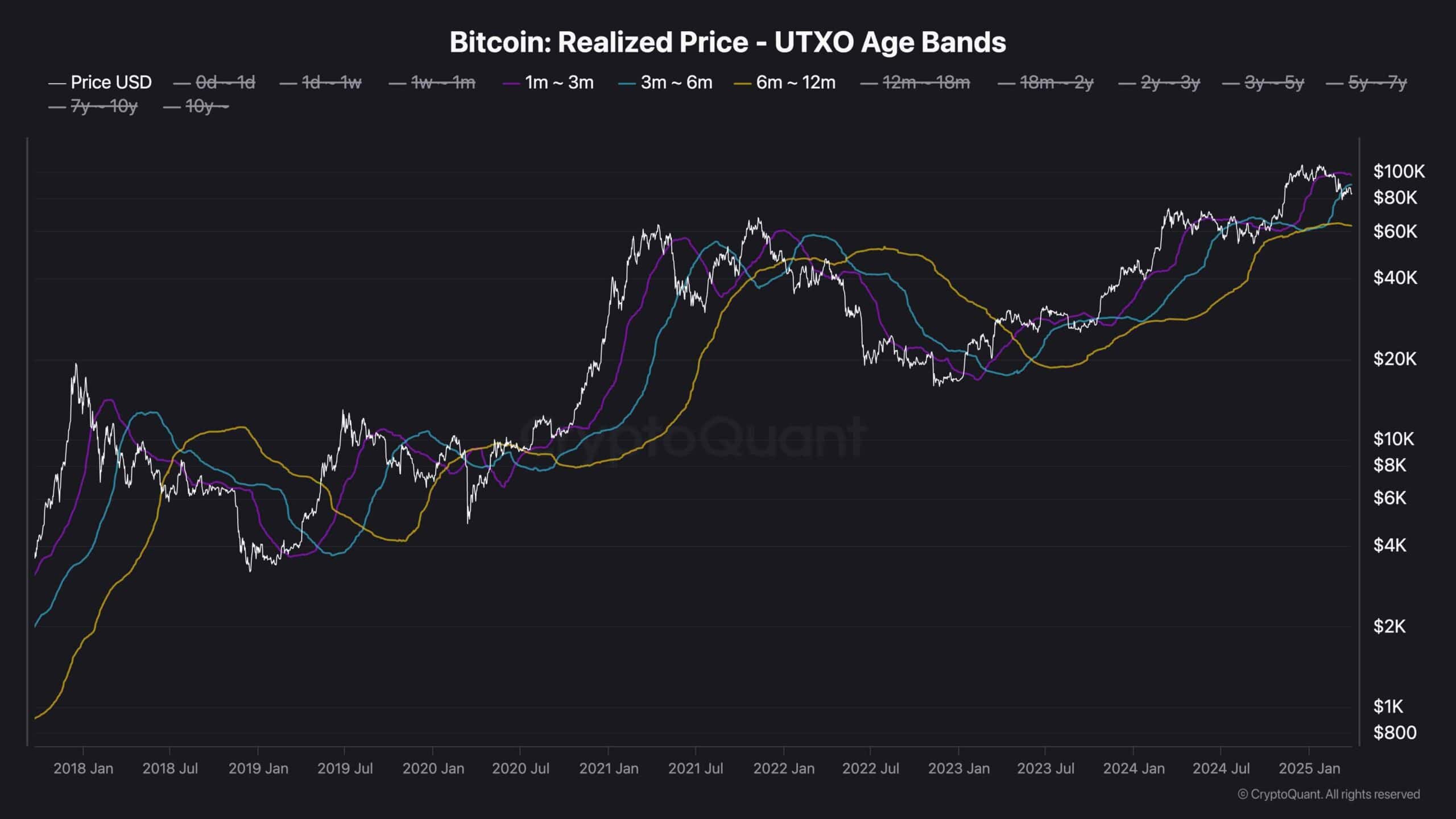

Bitcoin’s interplay with the Realized Value of long-term holders’ UTXOs has traditionally been a key indicator of market course, because it represents the typical acquisition value of those holders. Bear markets sometimes start when the value drops beneath the realized value of the 6-12 month cohort, signaling losses and potential distribution by these massive traders.

At the moment, BTC is buying and selling beneath the realized value of the 3-6 month cohort at $88K however stays above the 6-12 month cohort’s realized value of $62K. This means that whereas the market is present process a deep correction, it’s too early to substantiate the onset of a bear market.

Bitcoin is more likely to proceed its corrective retracement inside this vary till new demand enters the market. The $88K stage stays a crucial threshold, the place a breakout above it might sign the beginning of a recent uptrend.