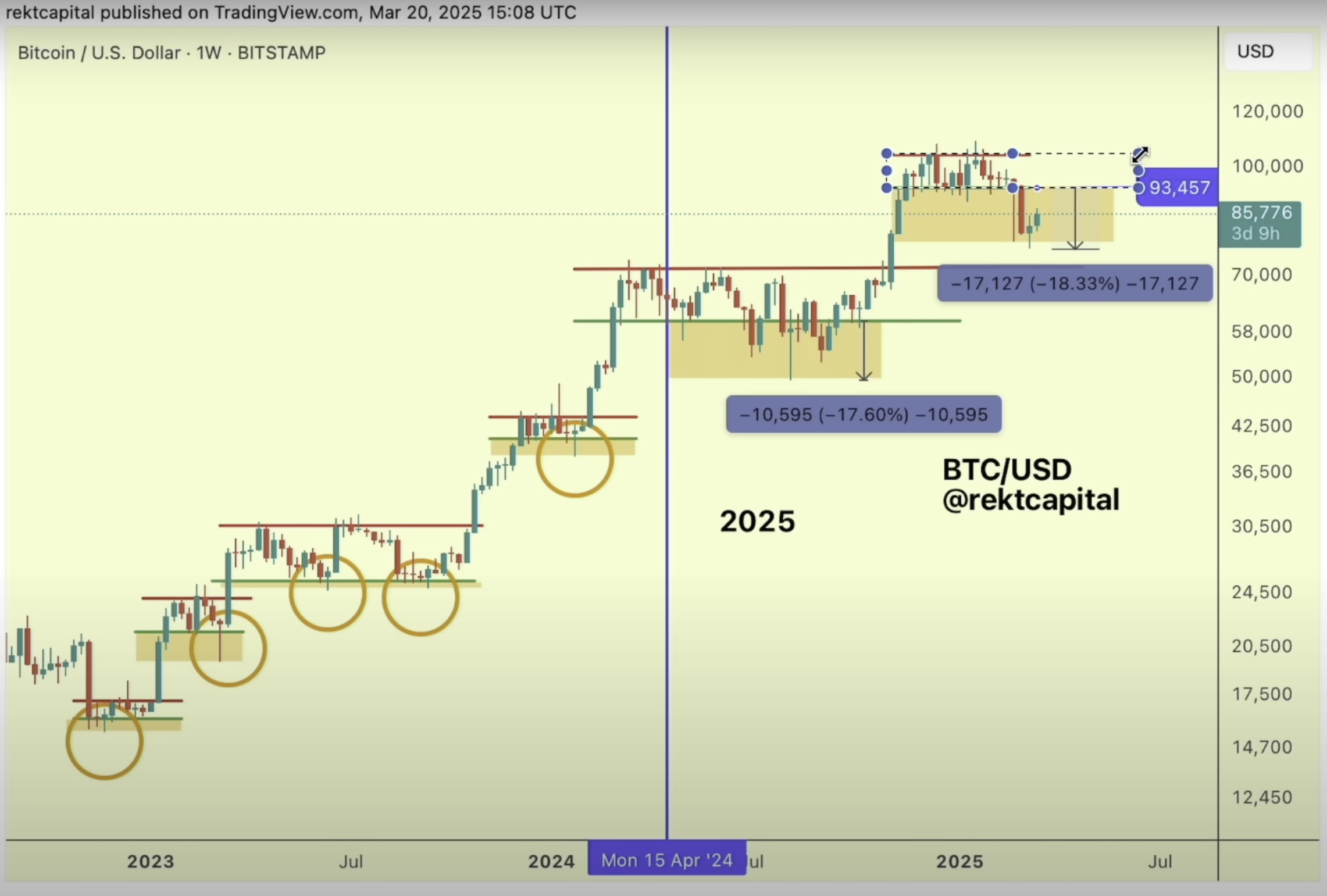

An analyst who nailed Bitcoin’s pre-halving correction final 12 months says a key indicator is flashing a bullish sign for BTC.

The analyst pseudonymously generally known as Rekt Capital tells his 107,000 YouTube subscribers that the Relative Energy Index (RSI) indicator is breaking out of a months-long downtrend, suggesting Bitcoin might quickly soar to the upside.

The RSI is a momentum oscillator used to find out whether or not an asset is oversold or overbought. The RSI’s values vary from zero to 100 with the extent between 70 to 100 indicating that an asset is overbought whereas the zero to 30 degree signifies that an asset is oversold.

“What’s fascinating about this complete interval proper now could be that this has been a downtrend on the RSI, a day by day downtrend relationship again to actually mid-November 2024. So breaking this downtrend is fairly pivotal, as a result of it signifies that the RSI doesn’t wish to be trending downwards anymore.

And that is really very doubtless a hidden signal of rising power in Bitcoin’s worth motion, as a result of now the RSI desires to enter a brand new macro uptrend after downtrending for successfully some 5 months or so, and now we’re seeing the RSI attempt to verify this breakout and breach of the downtrend in order that it may well rally greater. And this comes on the heels of actually simply worth motion constructing a bullish divergence.”

Supply: Rekt Capital/YouTube

Supply: Rekt Capital/YouTube

He additionally says Bitcoin might quickly break via resistance at $88,500.

“We have to be careful for additional continuation, which goes to be reclaiming $88,500 to get us again nearer and nearer to reclaiming this re-accumulation vary [around $100,000]. And many individuals have been speaking about this being a bear market, however it does seem like it’s a draw back deviation interval similar to what we’ve seen again previously.”

Supply: Rekt Capital/YouTube

Supply: Rekt Capital/YouTube

Bitcoin is buying and selling at $83,998 at time of writing, down 2.3% within the final 24 hours.