Story’s IP has emerged because the market’s prime gainer over the previous 24 hours. It has bucked the broader market decline, noting a 4% worth uptick throughout that interval.

The asset’s rally is fueled by robust demand, as mirrored in its surging buying and selling quantity and brief liquidations. With the bulls regaining their power, they may propel IP towards new highs within the coming days.

IP’s Rally Fueled by Demand, However Quick Sellers Are Piling In

IP’s each day buying and selling quantity has surged by 53% up to now 24 hours, reaching $159.47 million. This spike comes regardless of a broader market downturn, which has worn out $148 billion from the full crypto market capitalization over the identical interval.

IP Value and Buying and selling Quantity. Supply: Santiment

IP Value and Buying and selling Quantity. Supply: Santiment

An increase in an asset’s worth, accompanied by surging buying and selling quantity, indicators robust market curiosity and rising demand. For IP, this pattern signifies that its worth rally is pushed by precise demand, not speculative buying and selling exercise.

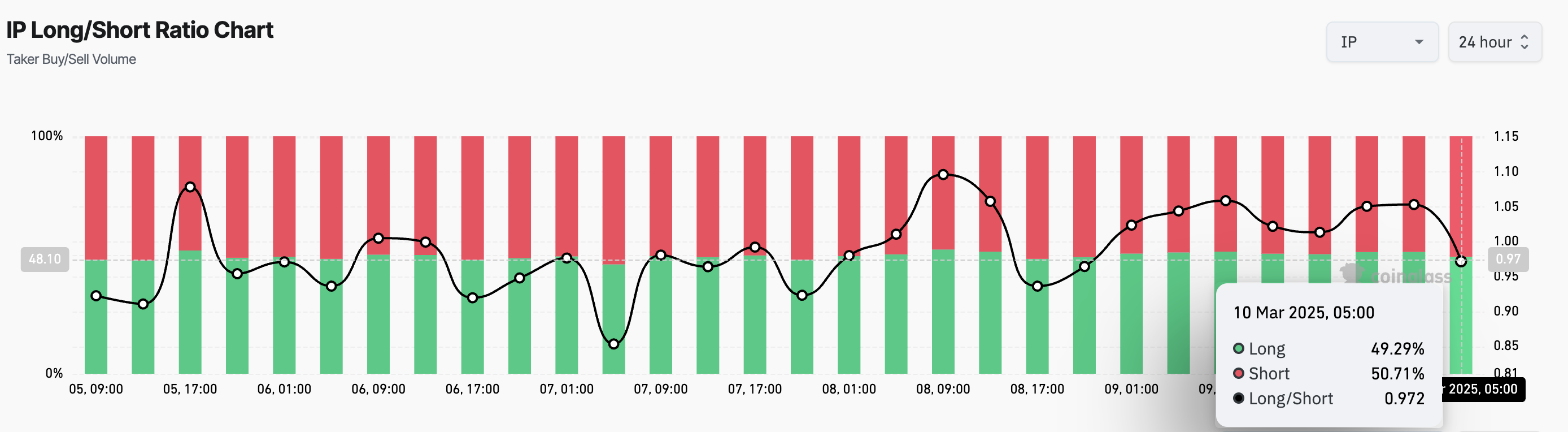

Regardless of the present bullish momentum, futures market knowledge reveals that IP merchants have been aggressively opening brief positions in opposition to it, as indicated by its lengthy/brief ratio. At press time, this ratio is beneath one, at 0.97.

IP Lengthy/Quick Ratio. Supply: Coinglass

IP Lengthy/Quick Ratio. Supply: Coinglass

The lengthy/brief ratio measures the proportion of lengthy positions (bets on worth will increase) to brief positions (bets on worth declines) in a market. The next ratio signifies bullish sentiment, whereas a decrease ratio suggests rising bearish stress.

As with IP, when the ratio falls beneath 1, it means there are extra brief positions than lengthy positions, signaling its merchants are predominantly betting on a worth drop.

Nonetheless, IP’s rising worth has triggered a brief squeeze of just about $1 million up to now 24 hours. That is forcing brief sellers to cowl their positions, which might additional propel the asset’s worth greater within the brief time period.

IP’s Upward Momentum Holds Agency

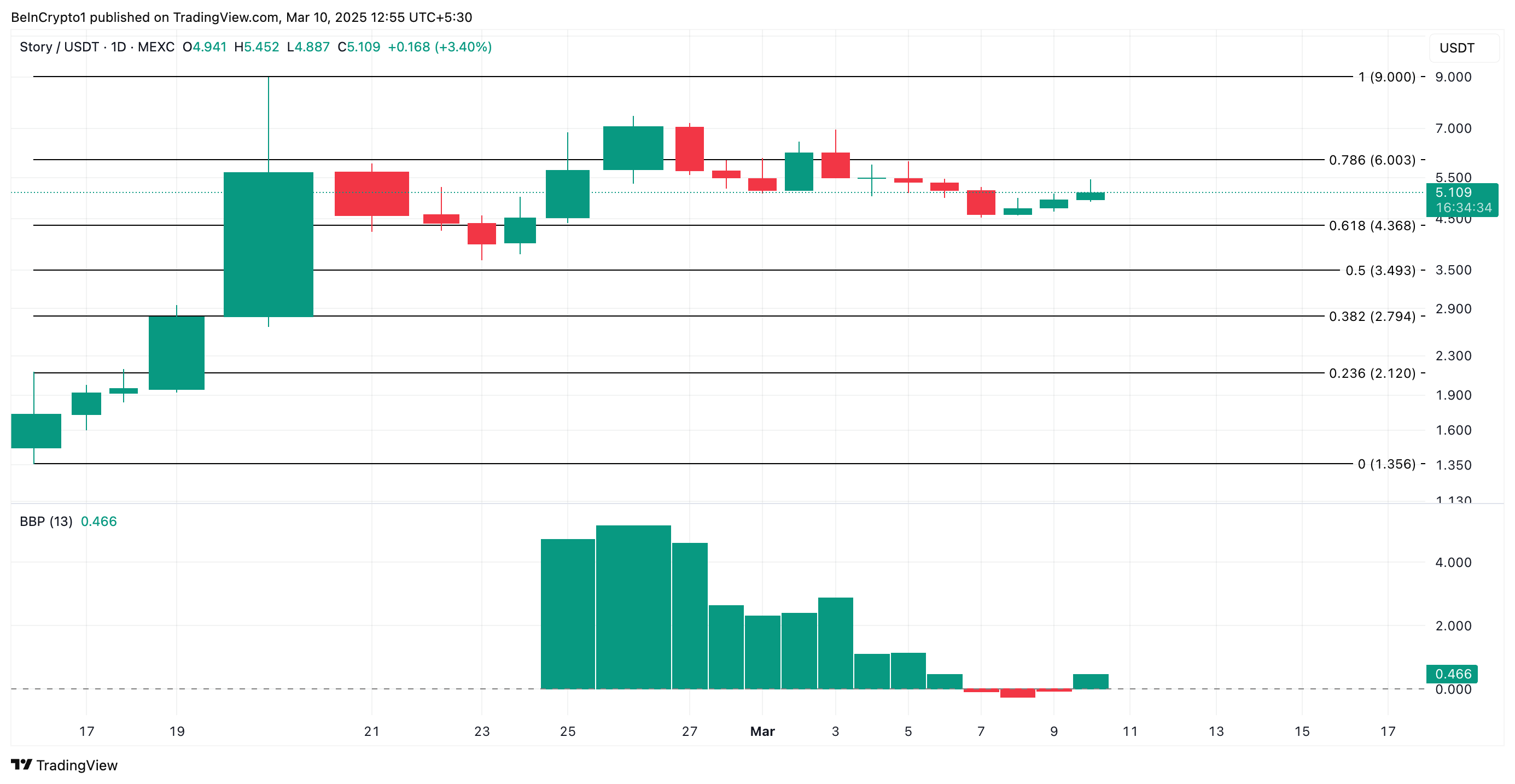

Readings from IP’s Elder-Ray Index help the bullish outlook. As of this writing, the indicator, which measures an asset’s bull and bear power, is at 0.46.

When the indicator’s worth is constructive, bulls are in management. The pattern signifies that IP at present trades at a worth greater than the bear energy worth, signaling upward momentum. Ought to this proceed, the token’s worth might rally to $6.

IP Value Evaluation. Supply: TradingView

IP Value Evaluation. Supply: TradingView

Alternatively, if demand stalls, IP’s worth might fall to $4.36.