Bitcoin has the monetary world in its clutches with its newest surge to report highs. Studying underlying market traits has revealed indicators of the place BTC value is and the place it’s going.

Utilizing the freshest information, this evaluation unlocks codes of BTC value traits in holder conduct, ETF flows, and complete market responses. It leads buyers by way of the complicated panorama of cryptocurrency funding.

Holder Dynamics: Quick-term vs. Lengthy-term

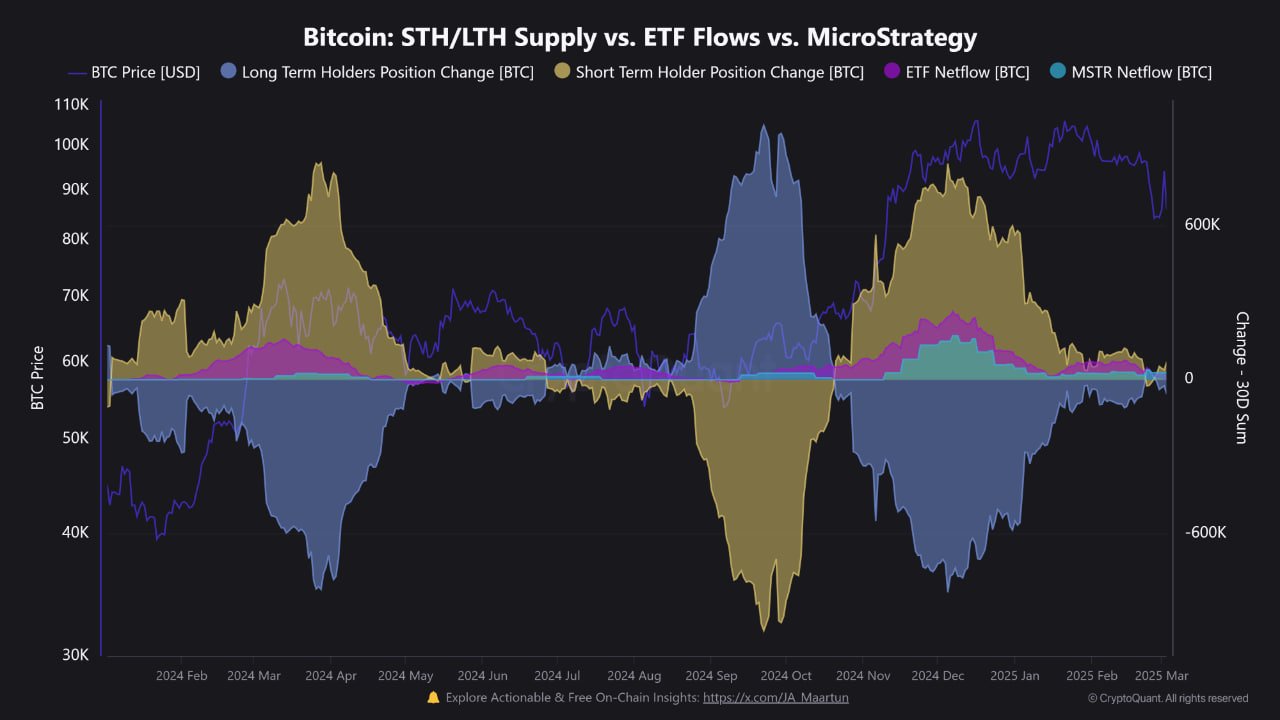

The latest value motion of Bitcoin mirrored a shift within the perspective of holders. Evaluation signifies that whereas short-term holders have been constructing positions, long-term veterans have begun promoting elements of their positions.

The development is greatest defined within the context BTC value. Whereas the forex was making new all-time highs, the quantity of Bitcoin held by short-term holders rose, however that of long-term veterans fell.

Particularly, short-term holder place focus could be quantified through a pointy spike of their availability, reaching peaks concurrently with these of Bitcoin. For example, the short-term holder provide rose by leaps and bounds, up by tons of of hundreds of Bitcoins in latest months.

In the meantime, long-term holders are equally offsetting their positions. It probably alerts a shift in market sentiment and technique among the many most dedicated Bitcoin buyers.

MicroStrategy Accumulation and ETF Inflows

The second most necessary half of the present Bitcoin narrative is what the large institutional gamers like MicroStrategy and Bitcoin ETFs have been doing. All through all the time interval as much as and together with the worth excessive, ETFs saved shopping for Bitcoin. It’s exactly the identical short-term holder conduct.

The conduct signifies forceful conviction in long-term BTC price no matter antagonistic excessive costs that in any other case demand warning. MicroStrategy, additionally with its enormous BTC bets, seems to have performed likewise.

BTC STH/LTH provide v ETF Flows v MSTR | Supply: CryptoQuant

BTC STH/LTH provide v ETF Flows v MSTR | Supply: CryptoQuant

The corporate’s web inflows present repeated shopping for, in keeping with the broad market development of shopping for at top-of-the-market costs. That’s institutional bull whilst longer-term buyers, extra conservative in perspective, promote a few of their holdings.

Publish-All-Time Excessive Correction Part in BTC Value

At present, BTC value is seemingly coming into the correction section following its historic run to all-time highs. The correction section is characterised by elevated market volatility and establishments and particular person buyers rebalancing their portfolios.

The correction section is supported by the redistribution of Bitcoin from long-term to short-term buyers, placing liquidity into the market as more and more extra cash are traded.

The latest retracement signifies that whereas the market is consolidating to new heights, it could be clever to attend and watch.

The perfect plan of action could also be to attend for the market to relax. The proof of long-term buyers getting confidence again and beginning place rebuilding would point out a more healthy development in BTC costs.

Final, the present BTC value is marked by an intricate internet of holder motion, institutional coverage, and macroeconomic stress.

Whereas short-term holders drive additional into Bitcoin publicity, and ETFs and bigger gamers like MicroStrategy proceed so as to add to their binge, the market undergoes a large cycle of adjustment.

These occasions should be noticed rigorously by buyers with nice significance since they offer us important details about what awaits us within the BTC value motion. Watching the shift between short- and long-term holder exercise shall be particularly useful in guiding the longer term phases of Bitcoin’s cycle.