The Lazarus Group has already laundered all of the unfrozen funds it stole from the current Bybit hack. The group used THORChain’s DEX to transform ETH tokens, sparking neighborhood criticisms.

Some customers blamed THORChain validators for negligence, claiming that they may’ve stopped the transactions. Others defended the platform, claiming it’s an open-source and decentralized group, not a legislation enforcement company.

Lazarus Laundered Bybit’s Cash

Arkham Intelligence, the blockchain analytics platform, revealed a brand new growth within the current Bybit hack. The agency posted a bounty for details about the incident, discovering that the Lazarus Group was accountable. As we speak it confirmed that every one the funds from the Bybit hack have been efficiently laundered.

“Lazarus has now totally laundered the proceeds of the Bybit hack. They’ve transferred 500,000 ETH primarily to native BTC. Thorchain has processed over $5.5 billion in quantity since Bybit was hacked on the twenty first of February,” Arkham claimed by way of social media.

The Bybit hack was the most important crime in crypto historical past, stealing $1.5 billion in Ethereum tokens. Two days in the past, analysts confirmed that Lazarus had already laundered 70% of the stolen Bybit funds.

Lazarus moved very quick, nonetheless. Yesterday, Bybit CEO Ben Zhou famous that 83% had been transformed to Bitcoin, and now your complete provide has been processed.

Bybit CEO Zhou additionally claimed that Lazarus laundered 72% of Bybit’s belongings by means of THORChain, a decentralized trade/blockchain community. The overwhelming majority of transactions changing ETH to BTC went by means of this trade.

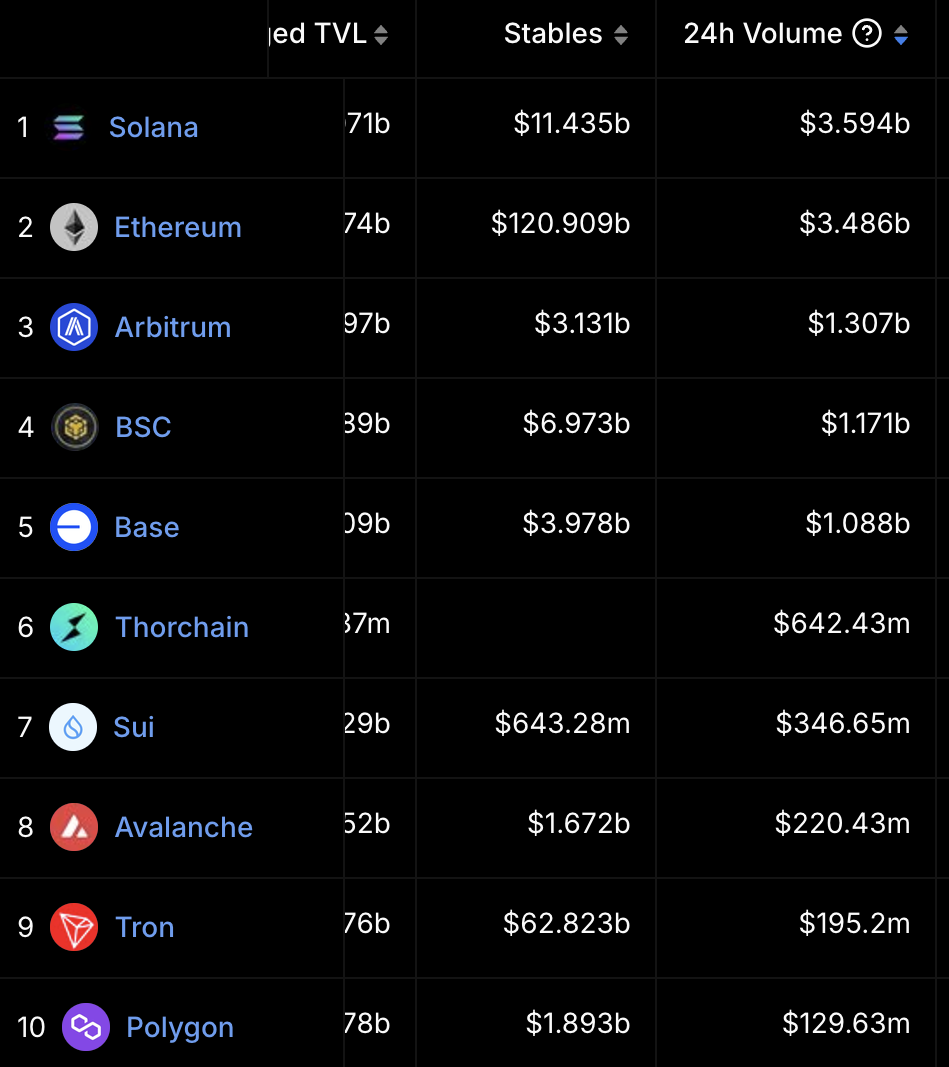

Additionally, THORChain’s 24-hour buying and selling quantity spiked as a result of sheer dimension of those transactions, surpassing a number of rather more outstanding networks.

THORChain Quantity Spikes After Bybit Laundering. Supply: DeFi Llama

THORChain Quantity Spikes After Bybit Laundering. Supply: DeFi Llama

Already, a couple of folks have begun blaming THORChain for the debacle. As one person identified, the Lazarus Group laundered big portions of Bybit’s cash, and the trade did nothing to cease them.

It really collected $3 million in charges from the affair. Nonetheless, THORChain defenders have identified that it’s open-source and decentralized, not a legislation enforcement company.

“The one motive why folks really feel that THORChain ought to censor transactions is the overall feeling that in the event that they put sufficient stress on Node Operators, they are going to buckle below stress (which actually can occur). No person is asking that from Bitcoin and Ethereum, as a result of it feels unattainable. Thorchain must win the battle of narratives,” stated Runemir, Chief Narrative Officer at Qi Capital.

Briefly, the entire affair could be very messy. Taking the pro-THORChain arguments at face worth, then decentralized establishments are structurally weak to facilitating huge finance crimes.

If Lazarus Group can efficiently use these platforms to launder billions, that’s merely the price of doing enterprise. It’s hardly an interesting image of decentralized finance as an financial mannequin.

However, the loudest criticisms additionally go away one thing to be desired. THORChain’s RUNE token briefly spiked attributable to these excessive commerce volumes, however the features have already disappeared.

The agency’s involvement with Bybit laundering will probably observe its status for years, and this received’t do it any favors. If THORChain validators have been appearing in self-interest, it was a shortsighted transfer.

In any occasion, it’s unattainable to trace down clear motivations for everybody concerned on this story. The Lazarus Group laundered an enormous quantity of funds from the Bybit hack, and there’s a number of blame to go round.