As of January 2, 2024, BlackRock, the world’s largest asset supervisor, has revealed a heavy focus in Bitcoin (BTC) and Ethereum (ETH), deeming them the one cryptocurrencies value investing in.

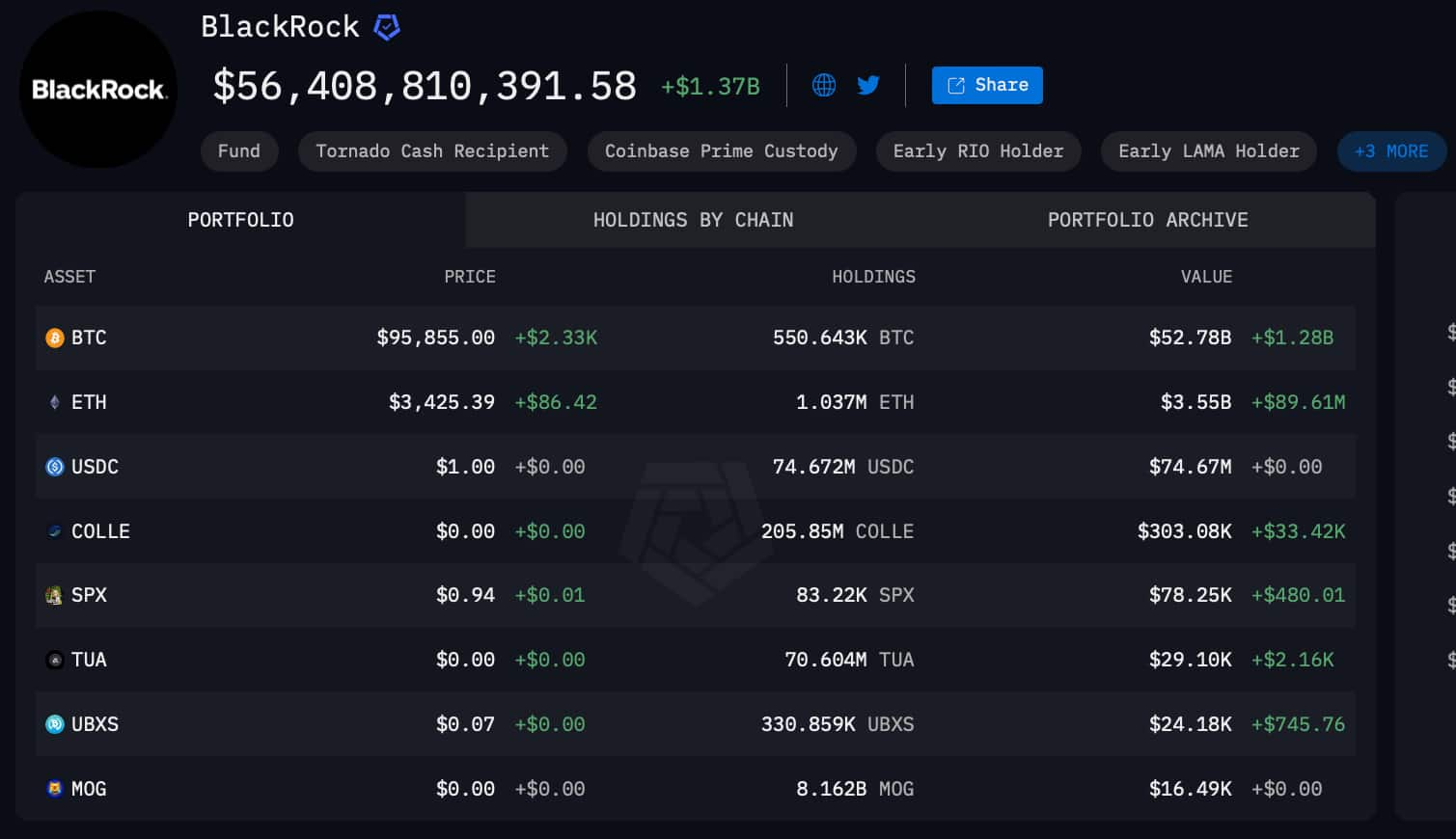

With a staggering $56.41 billion allotted to its cryptocurrency portfolio, Bitcoin and Ethereum dominate, accounting for over 99% of the portfolio’s worth.

Dominance of Bitcoin and Ethereum in BlackRock’s technique

Bitcoin leads the pack with 550,643 BTC holdings, valued at $52.78 billion at a present value of $95,855 per coin, representing a achieve of $1.28 billion (+2.48%), as per information retrieved by Finbold from Arkham Intel.

Ethereum follows with 1.037 million ETH value $3.55 billion, priced at $3,425 per token, and a rise of $89.61 million (+2.59%). These two belongings type the bedrock of BlackRock’s cryptocurrency method, reflecting the corporate’s religion of their long-term potential.

The remainder of BlackRock’s portfolio contains smaller exploratory holdings in stablecoin USDC, valued at $74.67 million, and various tokens akin to COLLE ($303,080), SPX ($78,250), TUA ($29,100), UBXS ($24,180), and MOG ($16,490).

BlackRock’s shift in stance and the success of Bitcoin ETF

BlackRock’s transition from skepticism to adoption within the cryptocurrency house has been transformative. Initially hesitant, the agency launched its Bitcoin ETF after receiving SEC approval, following Grayscale’s authorized battle with the SEC over the same product.

BlackRock’s Bitcoin fund grew to become a historic success, surpassing $50 billion in belongings underneath administration (AUM) inside simply 11 months—a feat Bloomberg has credited with driving Bitcoin’s value above $100,000 earlier this yr.

The fund’s unparalleled efficiency has sparked hypothesis that its AUM may surpass gold ETFs within the coming years, signaling a seismic shift in institutional curiosity from conventional to digital belongings.

Nate Geraci, CEO of ETF Retailer, predicted that except Bitcoin’s value plummets in 2025, BlackRock’s Bitcoin ETF (IBIT) may overtake SPDR Gold Shares, the world’s largest gold ETF.

Restricted Curiosity past Bitcoin and Ethereum

Earlier this yr, Robert Mitchnick of BlackRock famous that there’s “little or no curiosity” in different cryptocurrencies amongst their buyers, indicating that the expansion potential for altcoins might stay constrained.

Whereas Bitcoin and Ethereum dominate BlackRock’s crypto technique, the broader market is evolving. Corporations like Franklin Templeton and VanEck discover blockchain tasks like Solana (SOL), there may be optimism that altcoins may achieve traction by future ETF approvals.

Franklin Templeton has been vocal in its help for Solana, calling it one of the vital promising blockchain tasks. In the meantime, ETF filings for XRP by WisdomTree, Bitwise, and Canary Capital spotlight rising institutional curiosity in increasing crypto choices past the 2 heavyweights.

Solana’s futures-based ETF purposes and the rising curiosity in XRP ETFs counsel a diversification pattern within the institutional panorama. Analysts like Eric Balchunas of Bloomberg imagine that the approval of futures-based ETFs may pave the way in which for spot ETFs, offering altcoins like Solana and XRP with institutional publicity.

Featured picture by way of Shutterstock