Donald Trump clinched the presidential nomination in November, making a frenzy of bitcoin value predictions that vary from a modest $130,000 to a mind-bending $49 million per coin.

High Minds Predict Bitcoin’s Worth Trajectory

A black swan occasion is an incidence so uncommon and unpredictable that nobody sees it coming, but its influence is far-reaching and profound.

The election of a pro-bitcoin U.S. president – a person who simply three years in the past known as the dominant cryptocurrency a “rip-off” – would match neatly into the black swan class.

Add to that scene the historic January spot bitcoin exchange-traded fund (ETF) approvals and the April halving occasion, and the consequence is an ideal storm that offers rise to one of many strongest crypto bull markets, with bitcoin (BTC) topping $108,135 on December 17, in keeping with information from Coingecko.

Donald Trump’s landslide victory on November 5 particularly, has spawned all method of bitcoin (BTC) value predictions for numerous causes, leading to 2025 value forecasts as little as $130,000 all the way in which to $49 million per bitcoin by 2045.

The Pragmatists

Bitcoin peaked at roughly $44,000 in 2023 earlier than skyrocketing to only over $108,000 earlier this month – a 145% enhance in value.

If 2025 produces related returns, we should always anticipate a value of roughly $265,000. Thus, predictions decrease than that benchmark could possibly be seen as extra conservative estimates.

Bitwise: Digital asset supervisor Bitwise, predicted that BTC will commerce “above $200,000” in 2025, and 4 years later in 2029, it “will overtake the $18 trillion gold market and commerce above $1 million per bitcoin.”

Nevertheless, the agency added a caveat that might push the 2025 prediction all the way in which previous half one million.

“If the U.S. authorities follows by on proposals to ascertain a a million bitcoin strategic reserve, $200,000 turns into $500,000 or extra,” Bitwise acknowledged.

The corporate defined that file ETF inflows, the bitcoin halving (which decreased provide), and elevated institutional and authorities demand had been the first components behind its predictions.

Vaneck: Fellow asset supervisor Vaneck supplied a extra modest prediction, capping its estimate at $180,000 throughout the first quarter of 2025, coupled with a $54,000 dip afterward.

“On the cycle’s apex, we challenge bitcoin to be valued at round $180,000,” the agency stated. “Following this primary peak, we anticipate a 30% retracement in BTC,” the corporate added.

Very similar to Bitwise, Matthew Sigel, Vaneck’s head of digital property analysis, identified that his crew has a mannequin that comes with a strategic bitcoin reserve situation and generates a a lot larger value because of this – $3 million by 2050.

“Now we have a mannequin that assumes that by 2050…bitcoin turns into a reserve asset that’s utilized in international commerce and held by international central banks at a really modest 2% weight,” Sigel stated. “In that mannequin, we arrive at a $3 million value goal for bitcoin.”

Bernstein: Gautam Chhugani, a senior analyst at brokerage agency Bernstein, predicted a $200,000 bitcoin value in June, and doubled down on that prediction in November.

“We’re getting into a stage, the place we anticipate intrigue will flip to ache for the bitcoin bears,” Chhugani and his crew wrote in a notice to shoppers. “Bitcoin to $100,000 appears across the nook and our $200,000 bitcoin goal [by the end of] 2025 now appears not as delusional,” the crew stated.

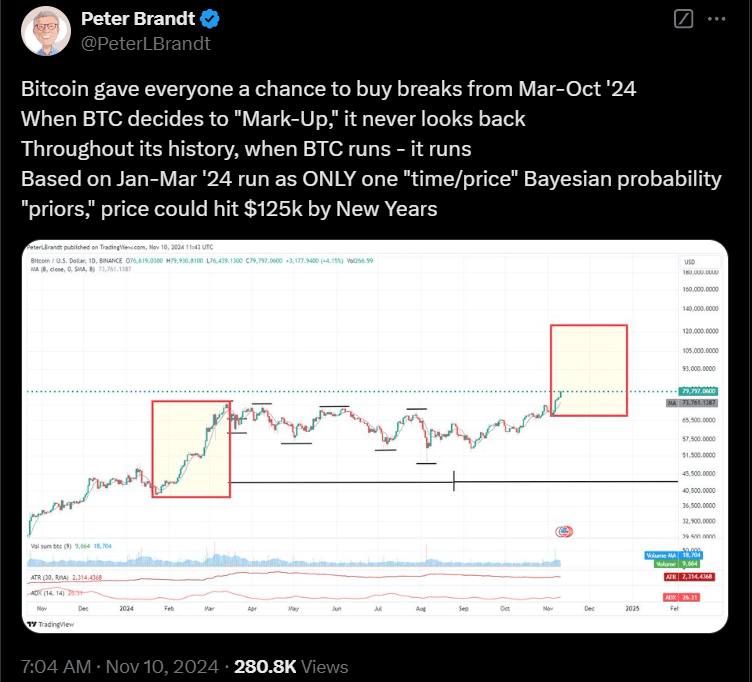

Peter Brandt: Again in February, ever-popular chart dealer Peter Brandt, whose X account has effectively over 750,000 followers, predicted a $200,000 bitcoin value by August or September 2025.

Brandt primarily depends on charting and technical evaluation for his predictions – scouring market information to suss out tendencies and patterns.

Quickly after the U.S. presidential election, Brandt downgraded that estimate to “between $130,000 and $150,000” for the August to September 2025 interval, but additionally projected a $125,000 bitcoin by January 1, 2025.

(Bitcoin value technical evaluation/Peter Brandt)

(Bitcoin value technical evaluation/Peter Brandt)

“Based mostly on January to March 2024 run, as just one ‘time/value’ Bayesian likelihood ‘priors,’ value may hit $125,000 by New Yr’s,” Brandt posted on Twitter.

In different phrases, he primarily based his 2025 New Yr’s projection on bitcoin’s prior rally within the spring.

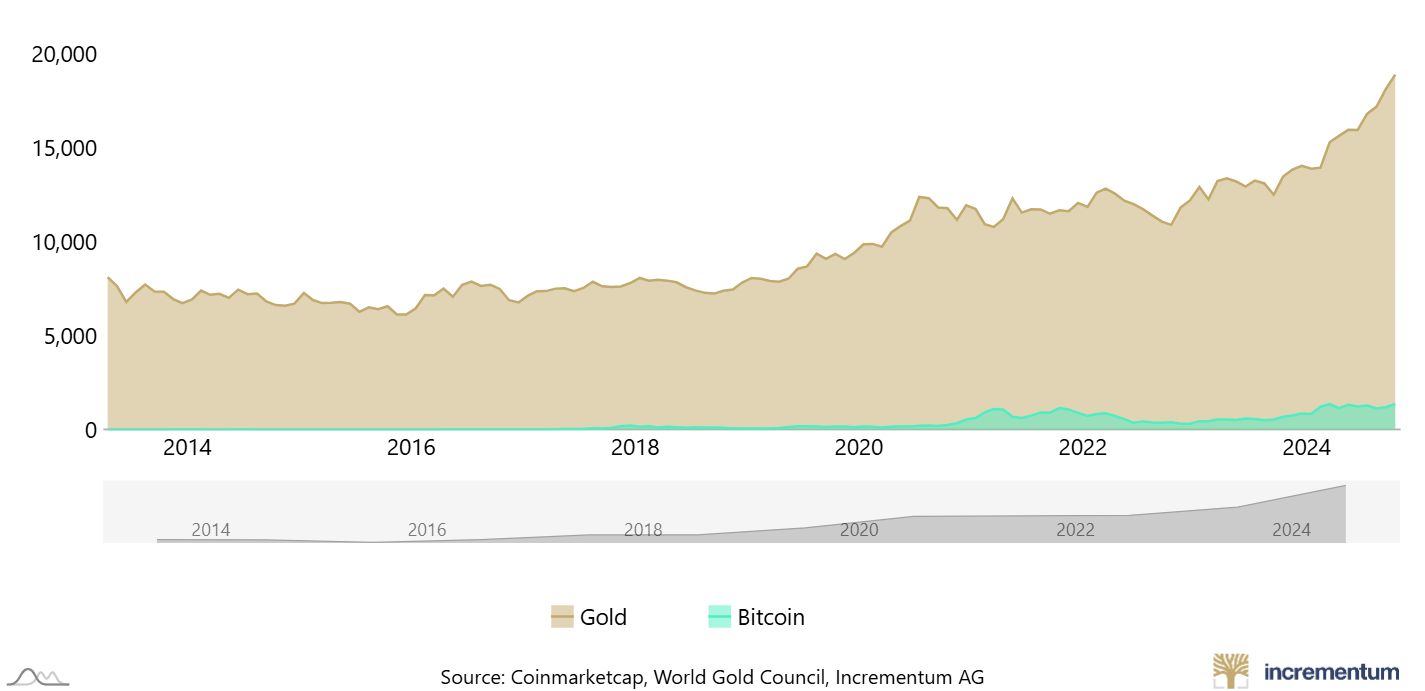

Nic Carter: Throughout a Bloomberg Crypto interview, Fortress Island Ventures Normal Associate Nic Carter declined to present a short-term BTC value goal however projected a long-term value of $900,000 assuming bitcoin matches the market capitalization of gold.

(Gold vs bitcoin market capitalization/Incrementum)

(Gold vs bitcoin market capitalization/Incrementum)

Bitcoin and gold had market capitalizations of roughly $2 trillion and $18 trillion respectively on the time of reporting.

“Lengthy-term, I’m searching for bitcoin to match the market cap for gold, which might value bitcoin at $900,000 a coin,” Carter stated.

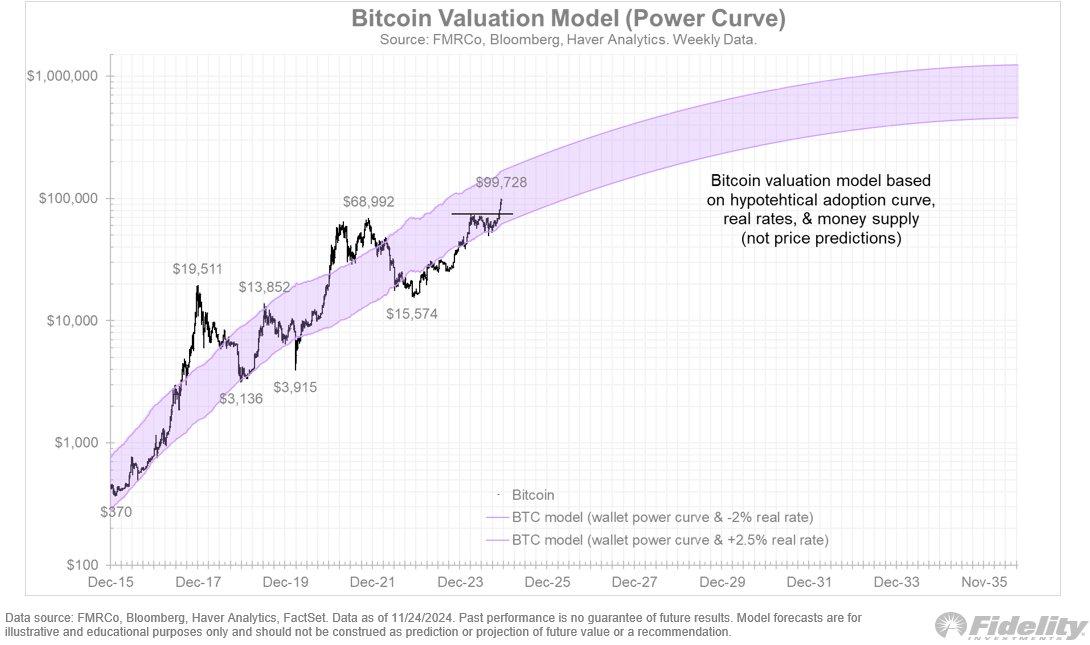

Constancy Investments: Like Carter, Jurrien Timmer, Constancy Investments’ international head of macro, didn’t publicly share a value prediction, however posted an attention-grabbing chart on X, displaying a bitcoin energy regulation curve that seems to counsel a $1 million BTC value by 2035. An influence regulation is a particular kind of relationship between two variables.

(Bitcoin energy regulation curve/Jurrien Timmer)

(Bitcoin energy regulation curve/Jurrien Timmer)

“If the facility regulation of bitcoin’s increasing community (amplified by actual charges and the cash provide) is one of the best ways to worth this most intriguing asset, then bitcoin sits squarely in its honest worth vary,” Timmer stated.

Timmer was as soon as mistakenly quoted as having predicted a $1 billion bitcoin value by 2038.

Tommy Lee: Co-founder of funding analysis agency Fundstrat, Tommy Lee, had beforehand predicted a $150,000 BTC value for 2025. Lee just lately upped that projection to $250,000 throughout a podcast episode with Anthony Scaramucci, founding father of asset administration agency Skybridge Capital.

“Over the subsequent 12 months, I consider one thing within the vary of $250,000 is feasible, maybe even extremely possible, primarily based on the present value cycle,” Lee stated.

He defined that his estimate was primarily based on the Bitcoin halving in April, however now with a pro-crypto administration ready within the wings, that quantity may go even larger.

“As a result of the brand new administration has run on a pro-bitcoin platform, I feel that the opportunity of the U.S. not solely legitimizing bitcoin however making it a strategic reserve asset raises…the attainable value situations for bitcoin,” Lee defined.

The Moonshots

Futurist Peter Diamandis – who sarcastically simply predicted a $300,000 BTC value – defines a moonshot as “going 10x greater or higher when everybody else is pursuing incremental change.”

Moonshot predictions are extra bullish estimates that exceed the beforehand referenced $265,000 threshold.

Michael Saylor: Beloved Bitcoin proponent Michael Saylor, chairman of Microstrategy, the world’s largest company holder of bitcoin, predicted a $13 million BTC value by 2045 throughout his keynote speech on the July Bitcoin Convention in Nashville, Tennessee.

Saylor just lately defined his rationale for that long-term estimate on the favored Influence Principle podcast.

“I gave that forecast in Nashville in July of this yr and it’s primarily based upon the Bitcoin 24 mannequin,” Saylor stated. “The Bitcoin 24 mannequin is an open-source macro mannequin of Bitcoin adoption and macroeconomic improvement over the subsequent 21 years.”

In a nutshell, the mannequin assumes a 60% progress charge in value with a 20% deceleration throughout 21 years, yielding a median annual charge of return (ARR) of 29%, which over 21 years ends in a value of roughly $13 million per coin.

To be clear, the $13 million price ticket is a base case situation. A extra conservative bear market situation ends in a a lot decrease $3 million estimate, whereas a bull market situation would challenge a staggering $49 million BTC value.

(Bitcoin 24 Mannequin/Michael Saylor)

(Bitcoin 24 Mannequin/Michael Saylor)

The 59-year-old billionaire stated the mannequin is accessible on Github and could be downloaded and manipulated by anybody.

Robert Kiyosaki: Wealthy Dad Poor Dad creator and businessman Robert Kiyosaki endorsed Saylor’s $13 million projection and has thrown out predictions of his personal, citing the opportunity of AI to decimate fiat forex programs, as signaled by lawyer Jim Rickard in his e book “Cash GPT.”

“It’s horrifying as a result of AI goes to shake up the world of cash,” Kiyosaki posted on X in September. “The excellent news is, Jim Rickard’s prediction means bitcoin might quickly high $500,000 in 2025 and $1 Million by 2030.”

He repeated that very same prediction in late November after Trump’s election.

Samson Mow: CEO of JAN3, Samson Mow, isn’t any stranger to seven-figure bitcoin value predictions. His agency focuses on nation-state bitcoin adoption, an exercise that probably shapes his grander estimates.

Mow predicted a $1 million bitcoin value goal earlier than and after the U.S. presidential election, most just lately throughout a November podcast episode.

“That is the premise behind the $1 million bitcoin name,” Mow stated. “It’s not going to be a gradual gradual enhance to $1 million a coin, however reasonably, a really brief and violent upheaval that sends us there in a matter of weeks to months.”

Like Kiyosaki, Mow cites the eventual failure of fiat programs as the ultimate catalyst for a meteoric rise within the value of bitcoin.

“In the event you take a look at the failure of fiat currencies, they don’t progressively fail, they fail spectacularly,” Mow stated.

He has beforehand described an idea known as “dollar-sat parity” the place one satoshi or “sat” – 100 millionth of a bitcoin and the smallest unit of the cryptocurrency – will likely be price one greenback, which means a single bitcoin will likely be price $100 million.

“Let’s simply say now we have dollar-sat parity,” Mow stated on one other podcast. “Then the market cap of Bitcoin will likely be $2.1 quadrillion {dollars}.”

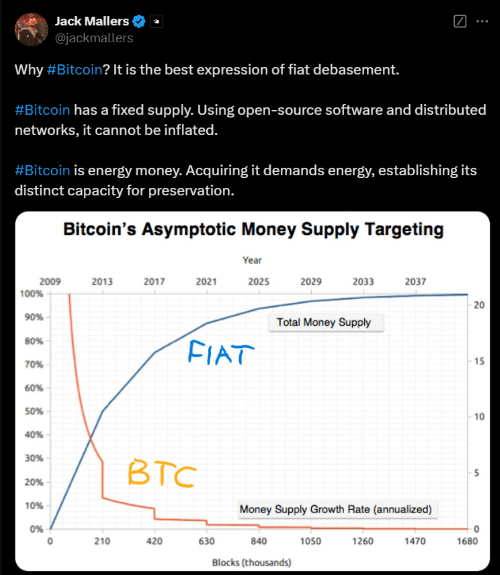

Jack Mallers: Strike CEO Jack Mallers reiterated his “$250,000 to $1 million” 2026 bitcoin value prediction throughout a podcast interview with Anthony Scaramucci.

“I feel we’re going to see one of many biggest asset bubbles in human historical past,” Mallers stated. “Home debt-to-GDP near 130%, international debt-to-GDP effectively over 300%, and so there’s a loss that must be realized and the query is the place are we going to appreciate that loss.”

In the end, Mallers believes governments will merely print more cash to repay their money owed, triggering inflation and forex debasement. Bitcoin not like fiat would be the solely international forex that may retain its worth.

(BTC vs fiat debasement/Jack Mallers)

(BTC vs fiat debasement/Jack Mallers)

“If America comes out and buys 4 million bitcoin, I feel bitcoin ticks one million simply,” Mallers stated. “If not…effectively then $250,000 appears decently cheap.”

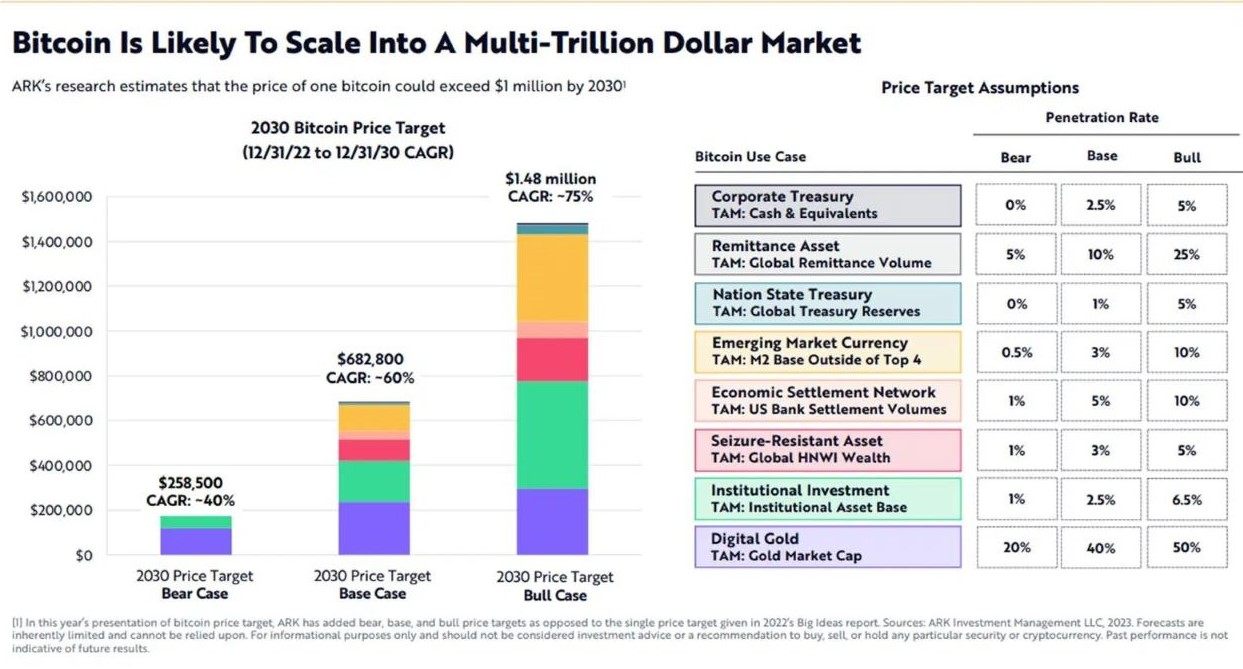

Cathy Wooden: The CEO of tech funding agency Ark Funding Administration, Catherine Wooden, just lately gave CNBC a base and bull case for the agency’s value predictions.

“Now we have a 2030 goal, in our base case it’s round $650,000, in our bull case, it’s between $1 million and $1.5 million,” Wooden defined. Like many others, she attributed the projections to heightened curiosity from Wall Avenue and a extra favorable regulatory surroundings as soon as Trump takes workplace.

A 2022 chart by Ark reveals figures much like Wooden’s latest projections, however with a breakdown of bitcoin penetration charges throughout eight particular use circumstances that Ark used to reach at its estimates. A few of these use circumstances embody BTC’s position as digital gold, a strategic reserve asset, and an rising market forex.

(Bitcoin value goal 2022/ARK Funding Administration)

(Bitcoin value goal 2022/ARK Funding Administration)

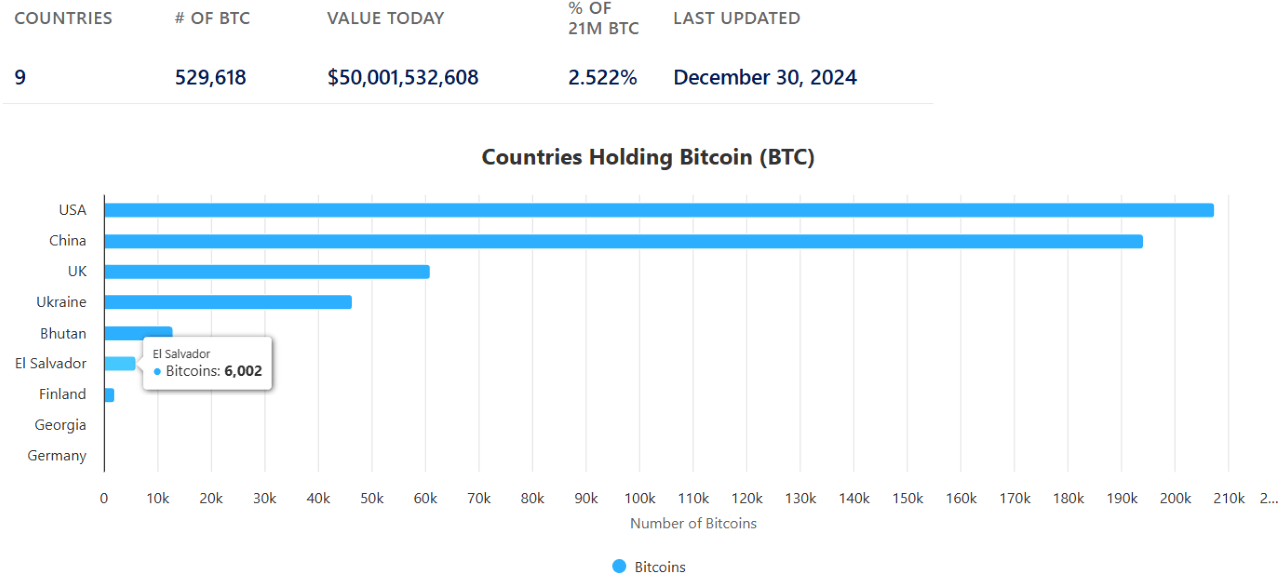

Max Keiser: Colourful bitcoin proponent Max Keiser, who additionally serves as an advisor to El Salvador President Nayib Bukele, just lately upped his value projection from $220,000 to $2.2 million per coin, citing elevated uptake of the cryptocurrency by nation-states and noting like Mallers, inevitable fiat forex debasement.

“With bitcoin, you’re assured a rise of buying energy over time whereas with fiat cash just like the U.S. greenback for instance, you’re assured a lack of buying energy over time,” Keiser stated in an interview, explaining how central banks trigger inflation by rising the cash provide.

“The provision of fiat cash is rising [annually] by 15% on common globally,” he added.

El Salvador, the place Keiser now resides, has amassed 6,002 BTC price practically $600,000,000 at present costs.

(El Salvador’s BTC treasury as of 12-30-2024/Bitcoin Treasuries by BitBo)

(El Salvador’s BTC treasury as of 12-30-2024/Bitcoin Treasuries by BitBo)