XRP is presently buying and selling between $2.42 and $2.44, with a market capitalization of $141 billion and a 24-hour commerce quantity of $4.29 billion, fluctuating inside an intraday vary of $2.42 to $2.59.

XRP

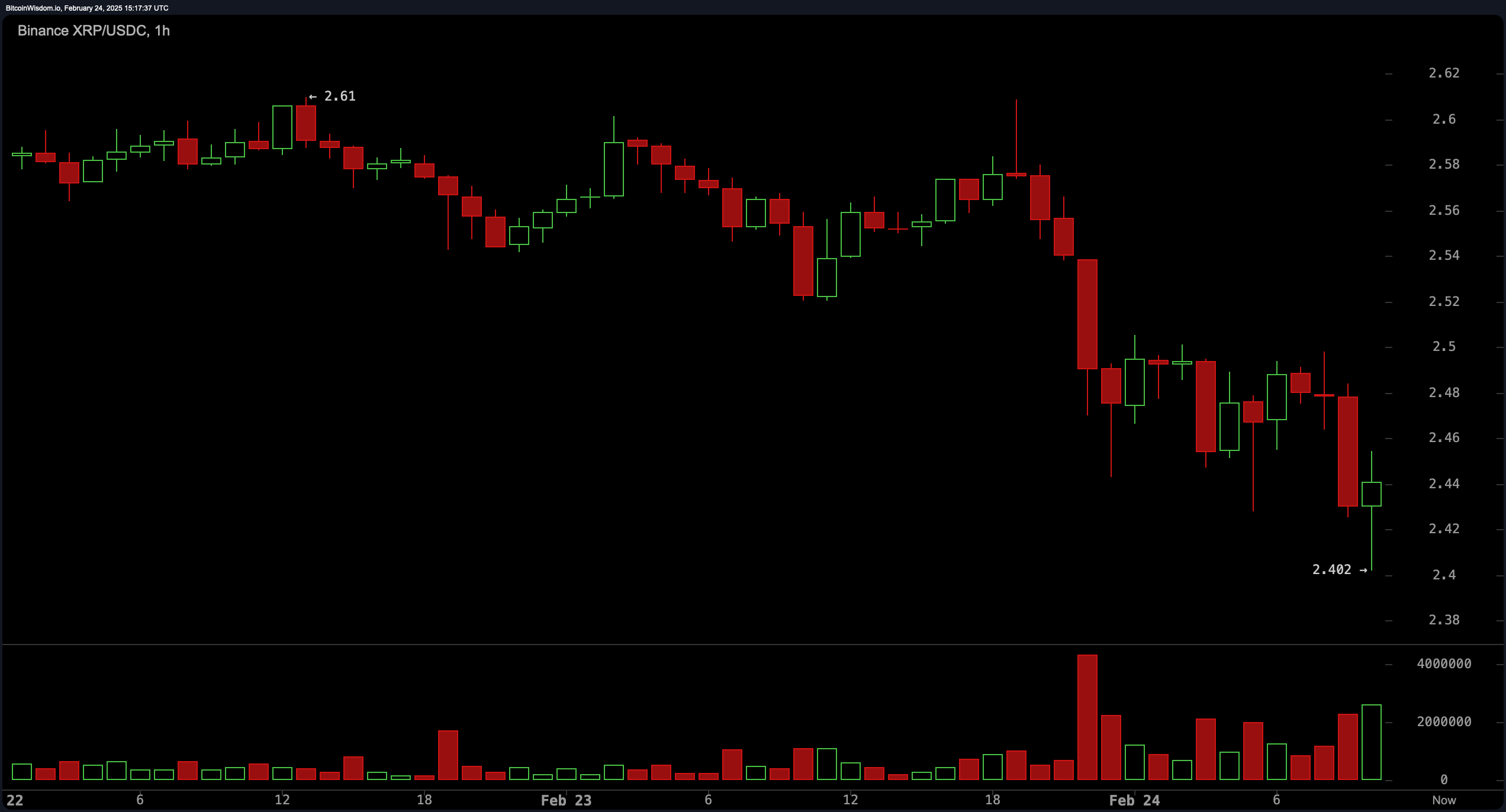

XRP’s one-hour chart displays short-term bearish momentum, with the digital asset forming decrease lows and struggling to interrupt above resistance at $2.5. The help zone between $2.4 and $2.42 has seen a number of assessments, whereas resistance at $2.5 to $2.52 stays intact. Quantity evaluation exhibits a sample of elevated promoting strain, with crimson quantity spikes outweighing shopping for makes an attempt. A rejection at $2.5 may sign additional draw back towards $2.4, whereas a profitable reclaim of $2.45 with bullish candles could drive XRP towards $2.55 to $2.6 within the quick time period.

XRP 1-hour chart on Feb. 24, 2025.

XRP 1-hour chart on Feb. 24, 2025.

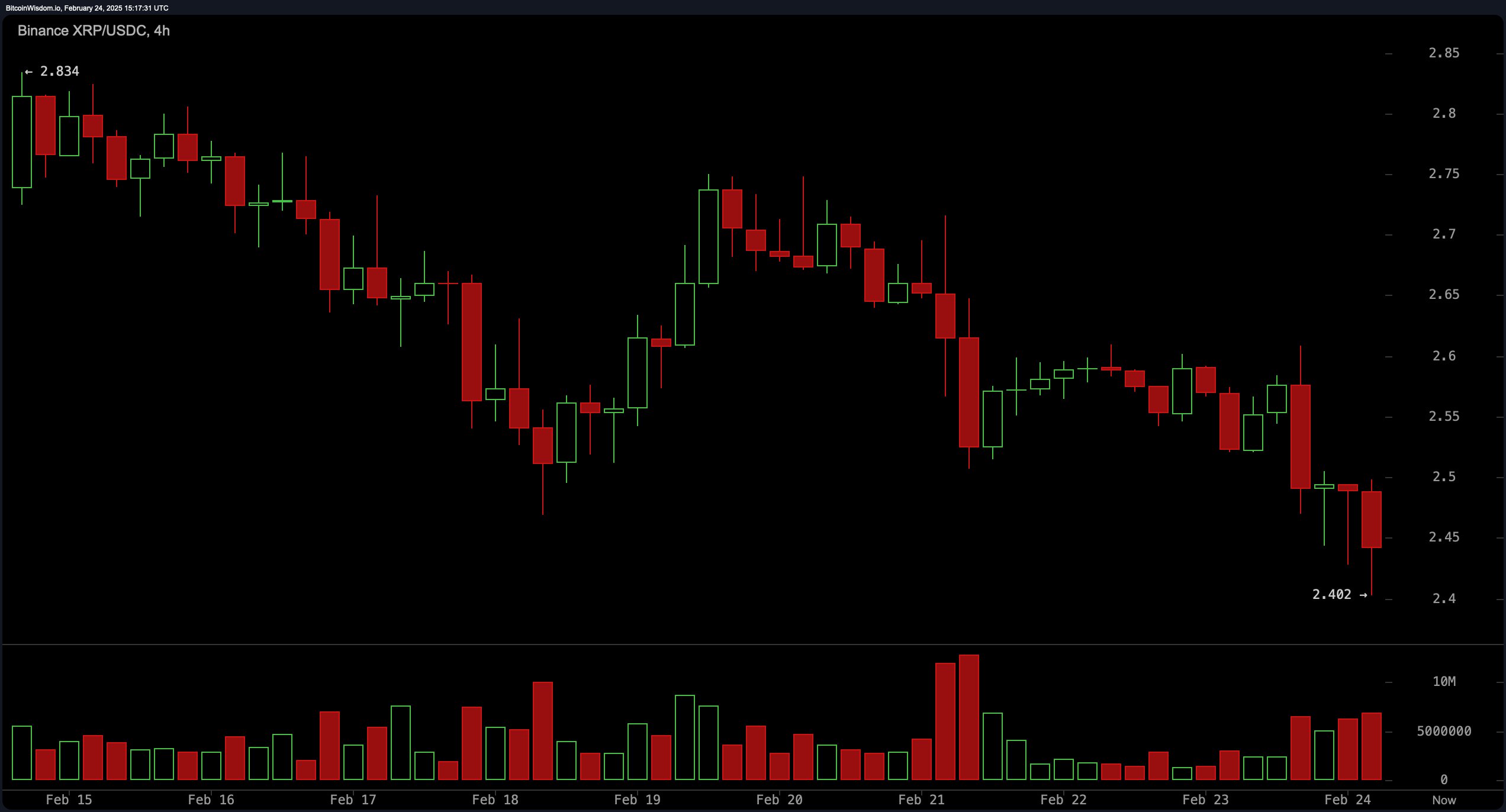

On the four-hour chart, XRP stays in a transparent downtrend, having fallen from $2.83 to its present vary. Makes an attempt to get better above $2.6 have failed, reinforcing the sample of decrease highs. Elevated crimson quantity on current declines suggests stronger sell-side dominance, whereas the $2.4 stage has held as a key help. A brief place could possibly be thought-about if XRP rejects resistance at $2.55 to $2.6, concentrating on a drop towards $2.3 to $2.4. A break above $2.6 would problem the bearish outlook, however affirmation of downward momentum stays a precedence for merchants.

XRP 4-hour chart on Feb. 24, 2025.

XRP 4-hour chart on Feb. 24, 2025.

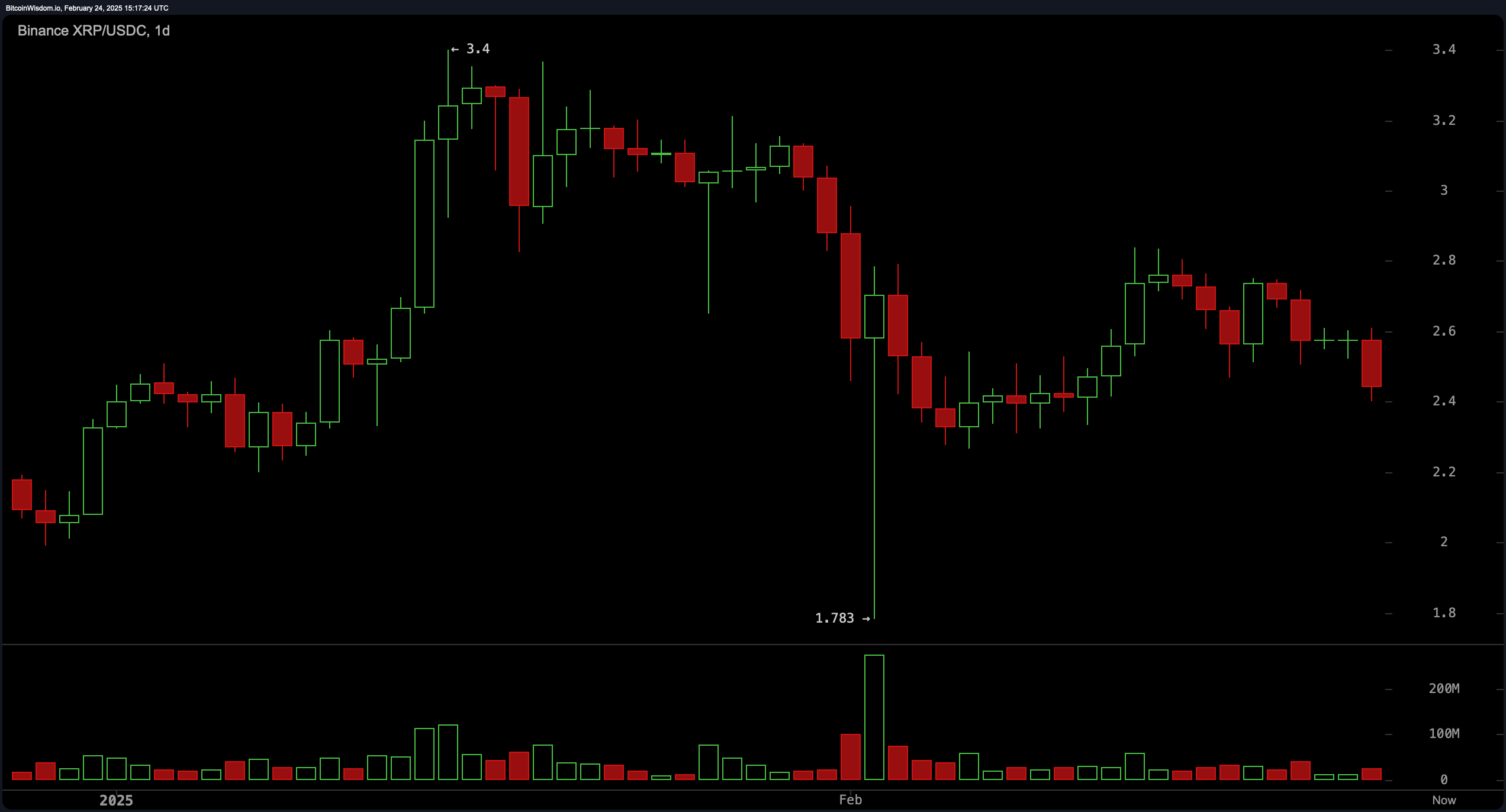

The day by day chart highlights a broader pattern of declining value motion following XRP’s rally to $3.4 and subsequent drop to $1.78. The current value construction signifies a decrease excessive formation, signaling ongoing bearish strain regardless of periodic restoration makes an attempt. The failure to carry above $2.5 will increase the chance of additional declines, with draw back targets extending towards $2.2 or decrease. Nevertheless, if XRP sustains help at $2.4, a possible transfer towards $2.8 to $3.0 stays potential, although quantity traits recommend a cautious method.

XRP 1-day chart on Feb. 24, 2025.

XRP 1-day chart on Feb. 24, 2025.

Oscillator readings replicate a largely impartial stance, with the relative power index (RSI) at 41.35, Stochastic at 41.11, the commodity channel index (CCI) at -32.28, and the common directional index (ADX) at 30.51. Nevertheless, the superior oscillator at -0.118, momentum at -0.287, and transferring common convergence divergence (MACD) at -0.037 all point out a bearish sign, reinforcing the prevailing bearish sentiment.

Transferring averages (MAs) recommend continued promoting strain, with the exponential transferring common (EMA) and easy transferring common (SMA) throughout 10, 20, 30, and 50 durations all signaling negativity. Nevertheless, longer-term help emerges with the 100-period EMA at $2.29 and the SMA at $2.40, alongside the 200-period EMA at $1.78 and SMA at $1.48, each issuing optimistic alerts. These point out that whereas short-term traits stay bearish, long-term help ranges may present potential reversal zones if promoting strain weakens.

Bull Verdict:

Regardless of short-term bearish strain, long-term transferring averages recommend that XRP may discover sturdy help at key ranges, probably paving the best way for a restoration. If patrons step in at $2.4 and XRP reclaims $2.6, momentum may shift towards an upside goal of $2.8 to $3.0, with additional beneficial properties potential if quantity helps the transfer.

Bear Verdict:

XRP stays beneath bearish management, with decrease highs and chronic promoting strain indicating additional draw back threat. Oscillator alerts and short-term transferring averages reinforce the chance of a drop towards $2.2 or decrease if $2.4 fails to carry. With no decisive break above $2.6, the downtrend stays intact, making a retest of decrease help ranges more and more probably.