The Trump household fund, World Liberty Monetary, is on observe to promote out the final of the WLFI tokens. The second stage of the presale has to boost solely $2M to shut, opening up the following stage of the undertaking.

World Liberty Monetary has nearly finalized the final stage of its WLFI token presale. A little bit over 40M tokens stay, with a price ticket of $0.05, awaiting inflows of simply $2M. The fundraising remained comparatively sluggish, as many of the shopping for was for retail quantities. The fund is closing its second presale, after beforehand inserting one other 25B tokens at $0.015.

For now, WLFI has not attracted different large-scale patrons, and many of the purchases are just like small donations. WLFI continues to be bought most frequently for Ethereum (ETH) or USDC. WLFI purchases vary from as little as $10 in USDC to three.1ETH for one of many current additions. The most recent stage elevated WLFI holders to 85,569 wallets.

The fund’s subsequent stage is to run its personal model of an Aave vault, offering passive revenue primarily based on crypto lending. The precise use case of the WLFI token will change into clearer sooner or later, although the asset will stay locked and non-transferable for a minimum of a yr after the presale ends.

World Liberty Fi portfolio loses $3M in a day

World Liberty Fi is greater than a fund and was used as an indicator for dependable token choice. Regardless of this, estimated losses from peak worth could also be as much as $110M. It’s laborious to estimate the precise losses, because the fund has traded and reorganized its portfolio to retain worth.

The portfolio’s aim could be to make sure collaterals for an Aave vault, which might produce passive revenue. For that cause, World Liberty Fi has transformed a few of its belongings into essentially the most extensively used collaterals on Aave.

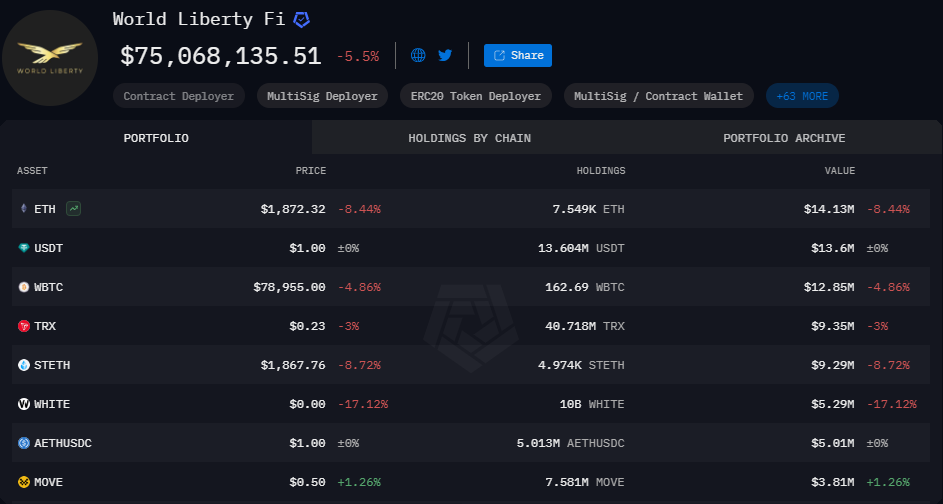

As of March 10, the fund’s portfolio primarily based on the primary public pockets fell to $75M in worth, down $3M in a number of hours. A tough estimate exhibits Ethereum (ETH) is the most important supply of losses, contributing as much as 65% for the loss on paper. The fund bets on the Ethereum ecosystem, with ETH and its wrapped variations as the most important holding.

World Liberty Fi consolidated its holdings, with ETH nonetheless holding a distinguished place. | Supply: Arkham Intelligence

World Liberty Fi consolidated its holdings, with ETH nonetheless holding a distinguished place. | Supply: Arkham Intelligence

At the moment, the fund retains 7.53K ETH, valued at over $14M. That is the fund’s greatest holding, accrued prior to now weeks from WLFI purchases and buying and selling. The fund has been identified to commerce actively and purchase the dip on ETH.

Regardless of this, World Liberty Fi misplaced 9% of the ETH worth prior to now day, because the asset sank underneath $2,000. ETH makes up over 65% of the fund’s holdings, virtually making the Trump household Ethereum maximalists. Even Eric Trump, one of many individuals closest to the fund, has been taken to activity for his suggestion to purchase ETH, simply earlier than one other vital worth drawdown.

A number of the belongings of World Liberty Fi have been moved to different wallets, although one of many public addresses stays essentially the most energetic, receiving inflows from patrons.

World Liberty Fi retains its TRON (TRX) holdings, which have additionally posted the smallest losses. The fund additionally expanded its Motion (MOVE) holdings. Total, World Liberty Fi decreased its token choice, eradicating a few of its tokens from the primary pockets.

After current token actions and shifts, the fund’s portfolio is extra restricted. World Liberty Fi has moved its Ondo (ONDO) and Chainlink (LINK) holdings whereas onboarding Whitebit (WHITE). A number of the funds had been shifted to WBTC, serving each as a DeFi-compatible asset and a tracker of the BTC market worth.