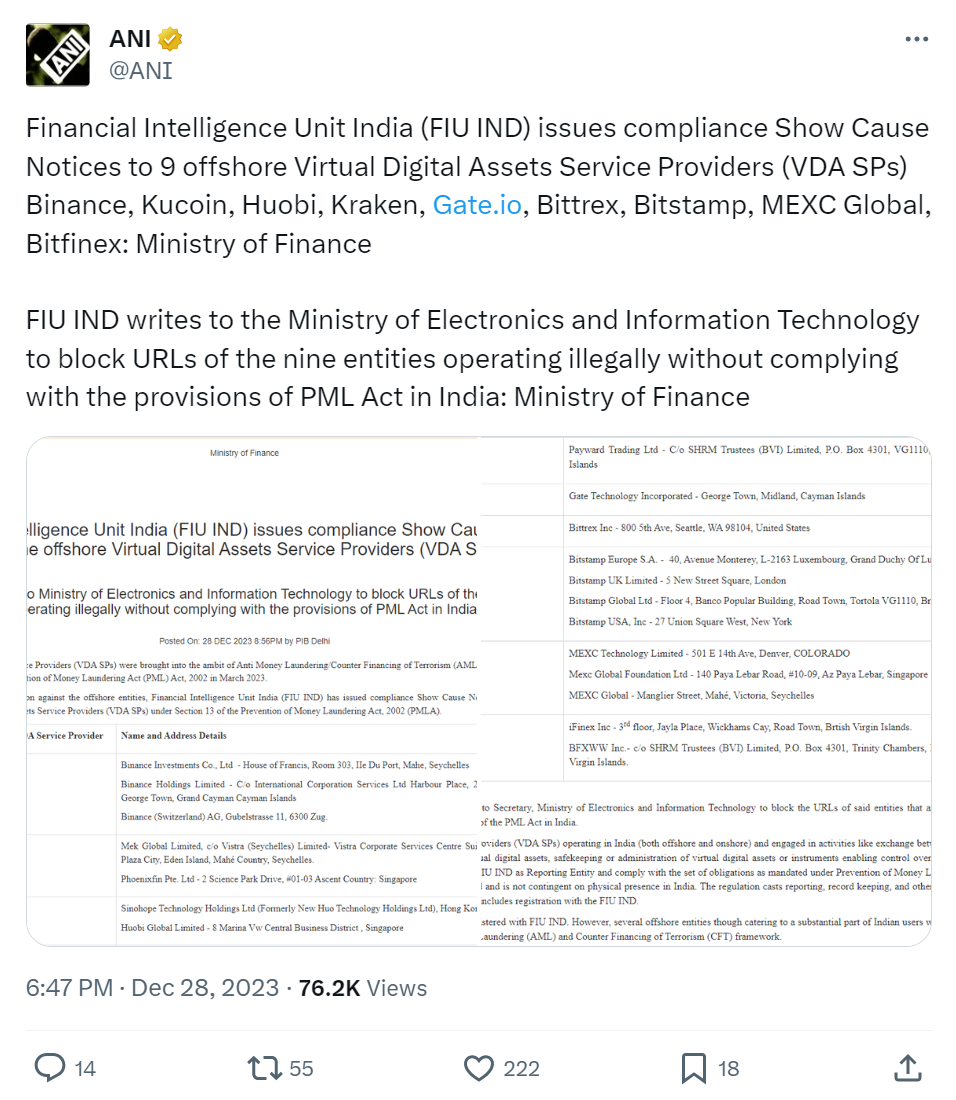

December hit hard the crypto community in India: the government has issued show-cause notices to nine leading offshore virtual digital assets service providers for alleged violations of local anti-money laundering regulations. The targeted exchanges, including major players, have had their domains blacklisted for operating unlawfully within the nation.

The government’s announcement specifically named Binance, Kucoin, Huobi, Kraken, Gate.io, Bittrex, Bitstamp, MEXC Global, and Bitfinex as cryptocurrency exchanges lacking the necessary licenses to conduct business in India. Despite being among the most active globally, these exchanges now face restrictions due to their non-compliance with India’s Prevention of Money Laundering Act.

Snap | Source: X(Formerly Twitter)

This development comes a week after reports in the local media indicated that Indian financial authorities still hold the view that there is no economic “upside” to regulating cryptocurrencies as financial instruments and have strong qualms about incorporating them into the country’s economic structure.

Why This Action Is Important?

The decision aligns with global efforts to regulate and monitor the cryptocurrency space to prevent money laundering, fraud, and other financial crimes. The request to block access to these exchanges reflects India’s commitment to maintaining the integrity of its financial system and ensuring compliance with international standards for combating financial crimes.

The Indian government’s action comes amid a broader global trend of increased scrutiny and regulation of the cryptocurrency market. Countries worldwide are grappling with the challenge of balancing the benefits of decentralized digital currencies with the risks they pose to financial stability and security. India’s move also aligns with efforts to address offshore entities operating in the crypto space, showcasing a proactive approach to safeguarding the country’s financial ecosystem.

While cryptocurrency exchanges are legal in India, they operate under strict anti-money laundering rules that impose significant limitations. Local exchanges must withhold a portion as tax for each transaction, with a fixed 30% tax on cryptocurrency profits. The FIU emphasizes that the responsibility is activity-based, requiring reporting, record-keeping, and registration with the FIU IND under the Prevention of Money Laundering Act.

Crypto Community’s View on the Matter

In response to the government’s crackdown, Mr Edul Patel, CEO and co-founder of Mudrex, expressed concerns about the impact on innovation within the crypto sector. Patel emphasized that the Indian government has historically supported responsible development in the industry through measures such as taxation and inclusion in anti-money laundering frameworks.

Mr. Edul Patel suggested that Indian investors opt for FIU-compliant businesses like Mudrex for a secure and localized experience. Patel highlighted Mudrex’s efforts to simplify processes for customers, including instant Know Your Customer (KYC) authentication, support for crypto deposits, and direct withdrawals to bank accounts. Patel encouraged investors to move their assets from non-compliant overseas exchanges to firms in India adhering to FIU regulations, fostering a thriving digital asset ecosystem.

Additionally, according to Nischal, WazirX’s founder, 2024 is expected to witness a surge in such regulatory moves by different world governments. He anticipates a drastic change in the landscape for centralized crypto operations and regulatory arbitrage that existed before will disappear over time.

According to him, these are signs of a maturing regulatory ecosystem for crypto, and he believes learning to navigate this in 2024 will be crucial for all startups.

Snap | Source: X(Formerly Twitter)

What’s In Store for India’s 2024?

The government’s approach to the crypto sector remains cautious, as evidenced by the developing regulatory framework and a prevailing sense of suspicion towards the industry. This cautious stance aims to curb potential risks, particularly in light of the increased prevalence of scams in crypto.

According to local reports, one of the significant expectations for 2024 is formulating and implementing a robust set of regulatory guidelines for the cryptocurrency market in India. This anticipation is widespread within the crypto community, as a well-defined regulatory framework can bring clarity and stability to the industry. The absence of such guidelines has been a point of contention, leading to uncertainty among investors and enthusiasts alike. The hope is that regulatory measures will address fraud, money laundering, and investor protection concerns, fostering a more secure and transparent crypto environment.

Despite the cautious approach, there may not be significant optimism for a reduction in taxation policies related to cryptocurrencies in 2024. Taxation has been a contentious issue within the crypto community globally, and India is no exception.

While regulatory clarity is sought, the government’s fiscal policies on cryptocurrencies might not witness a substantial shift. This aspect underscores the broader challenge of balancing embracing the potential benefits of decentralized digital currencies and safeguarding the financial system from potential risks.