Toncoin (TON), the native token powering the Telegram Open Community, has lately made headlines with a pointy value rebound. After weeks of consolidation and downward strain, TON has surged previous key ranges, reigniting optimism amongst merchants and traders. With its rising ecosystem and deep integration with Telegram, Toncoin is more and more being seen as a robust contender within the layer-1 blockchain race.

At present priced round $3.60, the large query is whether or not this bullish momentum can maintain—and extra importantly, can TON value realistically attain the $20 mark in 2025? On this evaluation, we dive into the technical indicators, chart construction, and key value ranges to find out Toncoin’s path ahead.

Toncoin Value Prediction: Is Toncoin’s Momentum Signaling a Main Upswing?

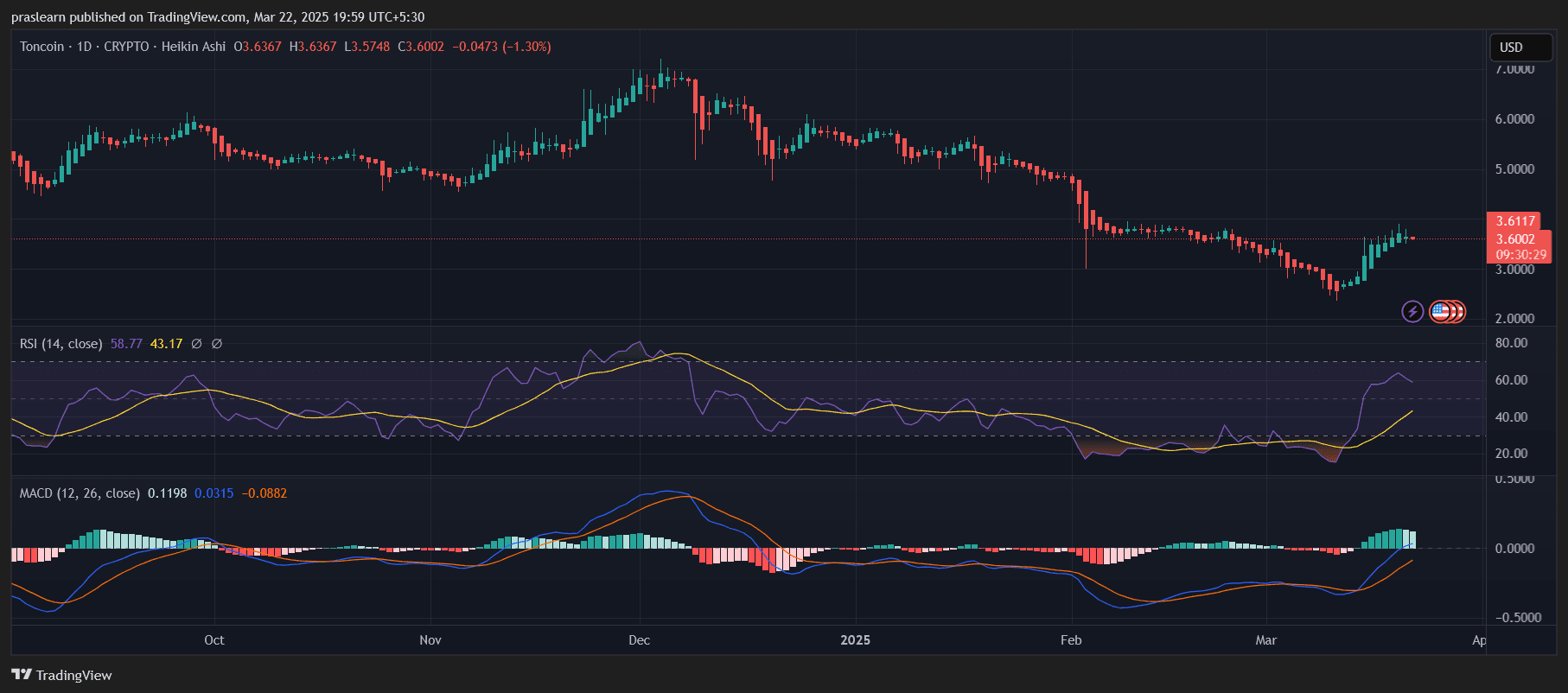

TON/USD Each day Chart- TradingView

TON/USD Each day Chart- TradingView

Toncoin value has lately caught the eye of merchants and traders with a pointy rebound from its March lows. After consolidating beneath the $3 mark, TON has damaged out with notable bullish power, at present buying and selling round $3.60. This latest value motion has sparked hypothesis: is that this only a aid rally, or the start of a long-term uptrend aiming for a large $20 goal?

The present bullish momentum is clear within the robust upward construction of Heikin Ashi candles, indicating pattern continuity. Over the previous a number of periods, TON has fashioned larger highs and better lows—a key attribute of a constructing rally. With rising quantity and revived curiosity in layer-1 tasks, the Toncoin ecosystem might be setting the stage for a broader breakout.

What Are Technical Indicators Telling Us About TON’s Trajectory?

A more in-depth have a look at the RSI (Relative Power Index) reveals bullish momentum. At 58.77, the RSI has emerged from oversold territory and is now approaching the overbought zone. This means sustained shopping for curiosity, although it additionally warrants warning for potential short-term consolidation or profit-taking if the RSI crosses 70. The RSI’s latest breakout above its midline is a constructive sign for continued bullish strain.

In the meantime, the MACD (Transferring Common Convergence Divergence) has turned bullish. The MACD line is now above the sign line, and histogram bars have flipped inexperienced, indicating rising constructive momentum. The MACD crossover occurred after a protracted downtrend, which will increase its weight as a reversal sign. This convergence of MACD and RSI traits usually marks the early section of a stronger value motion.

The place Are Key Resistance and Help Ranges for TON?

Toncoin faces quick resistance close to $3.80–$4.00, a zone the place sellers beforehand took management throughout its final rally. A profitable breakout above this vary would open the door to the $5.00 psychological resistance, which can also be a earlier native excessive. If TON can flip that stage into assist, it will solidify the uptrend and strengthen the case for a parabolic transfer towards larger targets.

On the draw back, $3.30 is a key assist to look at. This stage held agency throughout latest dips and is prone to act as a buffer zone if costs right barely. A breakdown beneath this could invite a retest of the $3.00 assist, which should maintain for bulls to stay answerable for the pattern.

Toncoin Value Prediction: Can TON value Realistically Attain $20 in 2025?

A transfer to $20 from the present $3.60 value would suggest an virtually 5.5x return, which is definitely bold however not not possible in a crypto bull cycle. For such a parabolic rally to materialize, a number of catalysts would want to align:

- Large ecosystem development: The Telegram-integrated Toncoin community should increase its utility and person base.

- Strategic partnerships or institutional adoption: A serious announcement or integration may gasoline explosive demand.

- Wider altcoin bull run: If Bitcoin breaks all-time highs and altcoins comply with, TON may experience the wave of capital rotation.

- Market narrative shift: A renewed give attention to decentralized messaging and social platforms may spotlight TON’s distinctive worth proposition.

Whereas $20 is much from present ranges, it turns into extra attainable if TON breaks above $5 and sustains above earlier long-term resistance zones. The journey received’t be linear—retracements will happen—however the path is technically doable with robust macro assist and momentum.

Is Toncoin a Sensible Purchase Proper Now?

Toncoin has proven outstanding power over the previous two weeks, breaking out from bearish consolidation and turning technical indicators bullish. The RSI is rising, MACD has flipped constructive, and the candlestick construction helps upward continuation. If TON reclaims and holds the $4–$5 zone, the chance of a long-term rally will increase dramatically.

For now, Toncoin is a robust candidate for mid-term bullish momentum performs, and if the broader market aligns, $20 would possibly simply be greater than a dream—it may turn into a vacation spot.