Bitcoin, Ethereum and XRP acquire barely on Wednesday as merchants gear for the U.S. FOMC charge resolution at 2 PM ET. Not like earlier bear markets, merchants are seeing shorter bear cycles adopted by sharp worth rallies.

The upcoming FOMC assembly might usher increased volatility within the costs of prime three cryptocurrencies and current purchase the dip alternatives or supply alternatives for merchants to take income, amidst the extended bear market.

Desk of Contents

- Bitcoin, Ethereum and XRP dealer sentiment flip risk-off

- BTC, ETH, XRP on-chain evaluation

- Trump push and FOMC charge resolution

- Bitcoin eyes return to $87,000, Ethereum might climb to $2,100

- XRP worth forecast

Bitcoin, Ethereum and XRP dealer sentiment flip risk-off

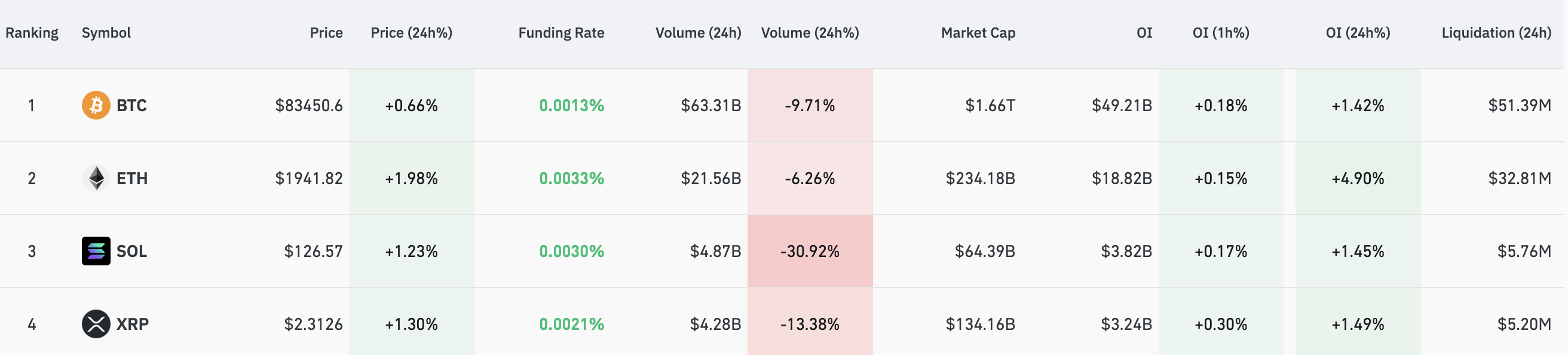

Bitcoin (BTC), Ethereum (ETH) and XRP (XRP) merchants have decreased their exercise within the derivatives market previously 24 hours. Derivatives knowledge from Coinglass exhibits a decline in commerce quantity, BTC and ETH commerce quantity declined practically 11% and seven%. XRP famous an almost 14% decline in commerce quantity in the identical timeframe.

Coinglass exhibits that merchants have turned risk-averse following practically $89 million in liquidations previously 24 hours within the prime three cryptocurrencies.

Bitcoin, Ethereum and XRP derivatives knowledge | Supply: Coinglass

Bitcoin, Ethereum and XRP derivatives knowledge | Supply: Coinglass

Open Curiosity, one other key derivatives metric, the mixed worth of all open contracts in a given token climbed by 1.42%, 4.90% and 1.49% respectively for the highest three cryptos BTC, ETH and XRP.

BTC, ETH, XRP on-chain evaluation

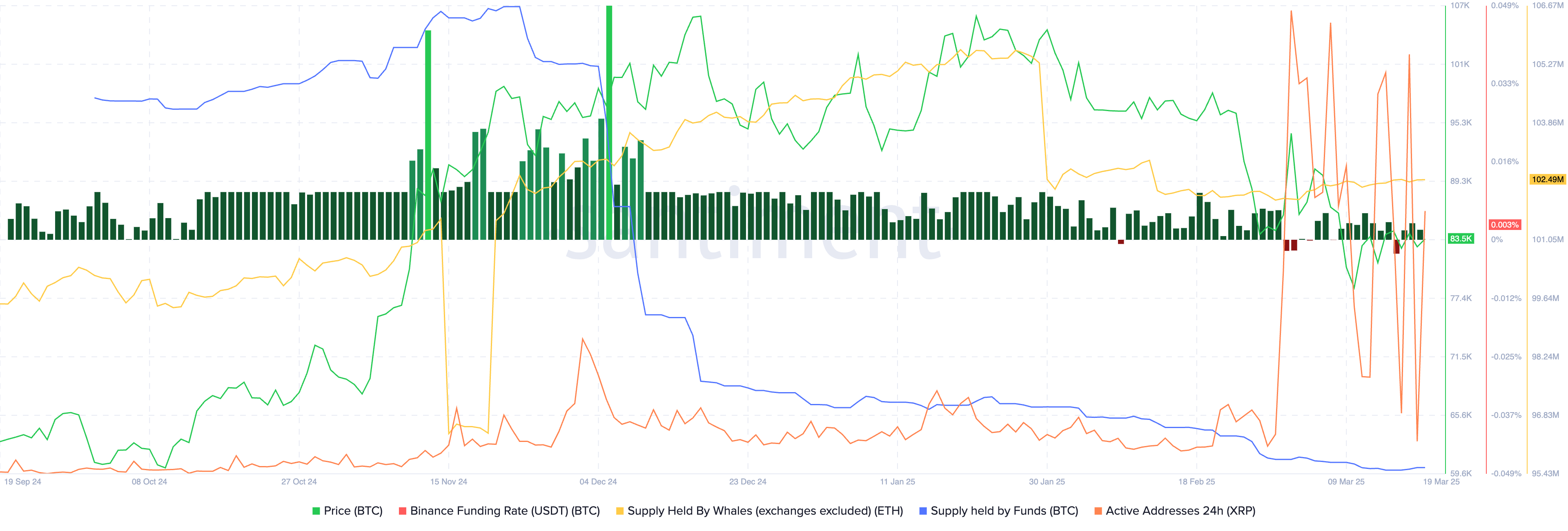

On-chain evaluation for the highest three cryptocurrencies on Santiment exhibits that Binance funding charge for Bitcoin has been optimistic for 3 consecutive days in a row. Which means Bitcoin derivatives merchants anticipate worth to understand, whilst they scale back their exercise within the token, as gathered by Coinglass knowledge.

Ethereum provide held by whales, excluding exchanges, sees no important change, whereas Bitcoin provide held by funds has decreased constantly. The energetic addresses in XRP, on the every day timeframe have climbed on Wednesday, after a damaging spike on Tuesday, as famous by Santiment.

The blended on-chain knowledge suggests a barely bullish outlook for Bitcoin and XRP and Ethereum worth might stay steady or unchanged within the face of upcoming volatility within the costs of the highest three cryptocurrencies with the looming FOMC rate of interest resolution.

Bitcoin, Ethereum and XRP on-chain evaluation | Supply: Santiment

Bitcoin, Ethereum and XRP on-chain evaluation | Supply: Santiment

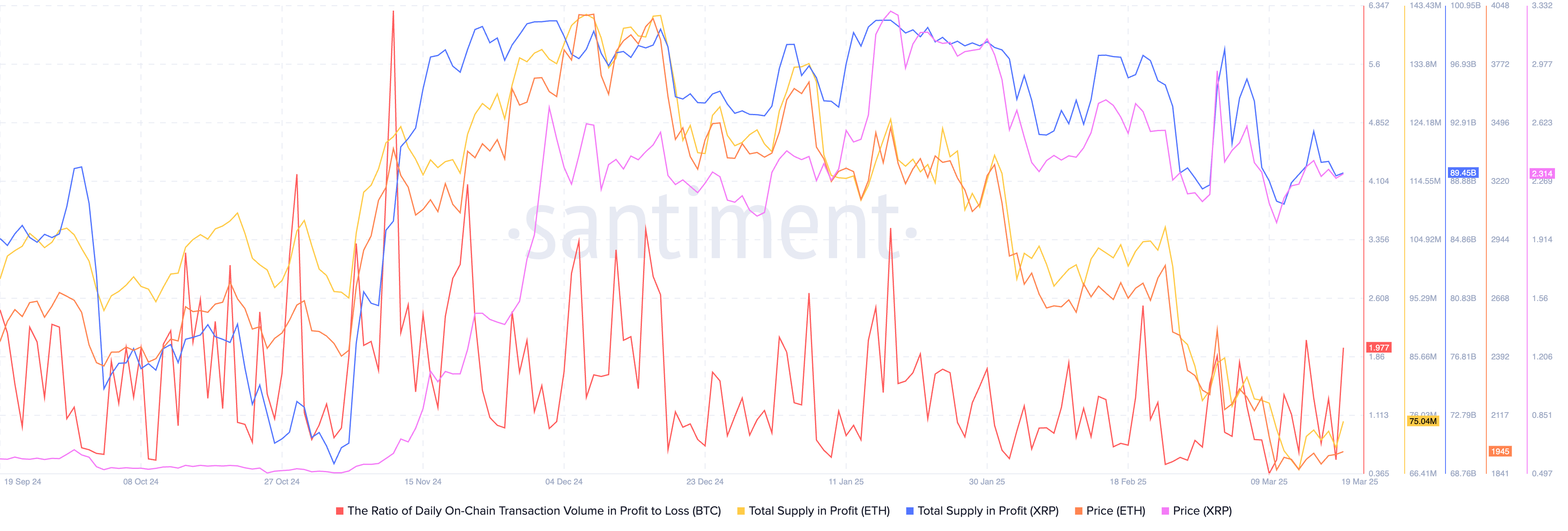

On the Bitcoin blockchain, the ratio of every day on-chain transactions in income is almost double that of transactions in losses, there’s scope for profit-taking by merchants who purchased the token decrease. Within the case of Ethereum, there’s a slight uptick within the provide in revenue and the identical has been noticed in XRP.

Ethereum and XRP each supply restricted profit-taking alternatives for merchants, as seen within the chart beneath.

Bitcoin, Ethereum and XRP on-chain evaluation | Supply: Santiment You may additionally like: Why did South Korea reject a Bitcoin reserve? How do different nations clarify the reluctance to undertake the BTC reserve?

Bitcoin, Ethereum and XRP on-chain evaluation | Supply: Santiment You may additionally like: Why did South Korea reject a Bitcoin reserve? How do different nations clarify the reluctance to undertake the BTC reserve?

Trump push and FOMC charge resolution

Bitget CEO Gracy Chen instructed Crypto.information that Trump’s pro-crypto stance has left many merchants puzzled. The thought of a U.S. strategic Bitcoin reserve is gaining traction and whereas the federal government is just not shopping for Bitcoin but, it might quickly change.

“The Stablecoin invoice is transferring by Congress, signaling a significant shift towards a blockchain-based monetary system. Some huge names, Elon Musk included, are exploring their very own stablecoins, and Trump’s staff sees stablecoins as a solution to shield the greenback’s world reserve standing.

Then there’s the economic system. Scott Bessent’s speak of a “detox interval” suggests a managed downturn may be forward. If that’s the case, Trump’s playbook appears clear: blame the recession on Biden, use tariffs and crypto narratives to handle prices, and push for decrease rates of interest to gasoline tech and AI progress. Brief-term ache, long-term acquire — that’s the technique.”

Chen maintains an optimistic outlook on Bitcoin and predicts no fall beneath $70,000.

“Bitcoin worth drop to probably 73-78k [is likely], which is a strong time to enter for any patrons on the fence. Within the subsequent 1-2 years, BTC at 200k isn’t as far-fetched as most would suppose.”

The FOMC rate of interest resolution is looming, with the chance of upper volatility and worth swings as merchants react to the information.

Ryan Lee, Chief Analyst at Bitget Analysis instructed Crypto.information in a written word:

“The FOMC assembly on March 19, 2025, is anticipated to keep up the federal funds charge at 4.25%-4.50%, with the Fed taking a cautious,>

“The crypto market might proceed displaying growing independence from Fed selections. Submit-FOMC, Bitcoin is anticipated to commerce inside $80,000–$86,000 with 80% confidence, whereas Ethereum is projected to maneuver between $1,800–$2,100 beneath the identical confidence stage. These ranges mirror potential fluctuations tied to macroeconomic alerts, investor sentiment, and broader monetary situations.”

You may additionally like: Nansen: Whales quietly purchase Ethereum as costs stagnate

Bitcoin eyes return to $87,000, Ethereum might climb to $2,100

Bitcoin might return to the $87,000 stage as BTC exhibits indicators of restoration on Wednesday. On the time of writing, Bitcoin trades at $83,517, and technical indicators on the every day timeframe present chance of beneficial properties within the token.

Bitcoin’s Relative Energy Index (RSI) reads 44 and is sloping upwards, supporting a thesis of optimistic momentum underlying the token’s worth development. MACD is flashing inexperienced histogram bars, the fourth consecutive day within the row, supporting beneficial properties in Bitcoin.

BTC/USDT every day worth chart | Supply: Crypto.information

BTC/USDT every day worth chart | Supply: Crypto.information

Ethereum gained 2.39% on the day, eyeing a retest of the psychologically essential $2,000 stage earlier than trying to climb to help at $2,100. This marks a acquire of practically 7% in Ethereum worth.

Two key momentum indicators on the Ethereum worth chart, RSI and MACD help ETH worth restoration on the every day timeframe.

A Bitcoin flashcrash might push Ethereum right down to the current low of $1,754.

ETH/USDT every day worth chart | Supply: Crypto.information

ETH/USDT every day worth chart | Supply: Crypto.information

XRP worth forecast

XRP might rally practically 7% and take a look at key resistance on the higher boundary of a Truthful Worth Hole on the every day timeframe at $0.2707. RSI is sloping upwards and reads 47, headed in direction of impartial at 50.

MACD signifies an underlying bullish momentum within the XRP worth development.

XRP/USDT every day worth chart | Supply: Crypto.information

XRP/USDT every day worth chart | Supply: Crypto.information

XRP merchants are awaiting the following growth within the US monetary regulator’s lawsuit towards Ripple. One other key market mover is XRP’s inclusion within the Strategic Reserve, in response to President Trump’s government order signed on March 6.

The outcomes of those occasions might affect XRP worth within the short-term, along with the volatility induced by the FOMC charge resolution.

Disclosure: This text doesn’t signify funding recommendation. The content material and supplies featured on this web page are for academic functions solely.