Cardano’s (ADA) price is far from breaking out of its bullish pattern, and this could be further delayed owing to the current market conditions.

In addition to being overvalued, the altcoin’s key investors, the crypto whales, are showing no bullishness either.

Cardano Needs Some Time After Hard Fork

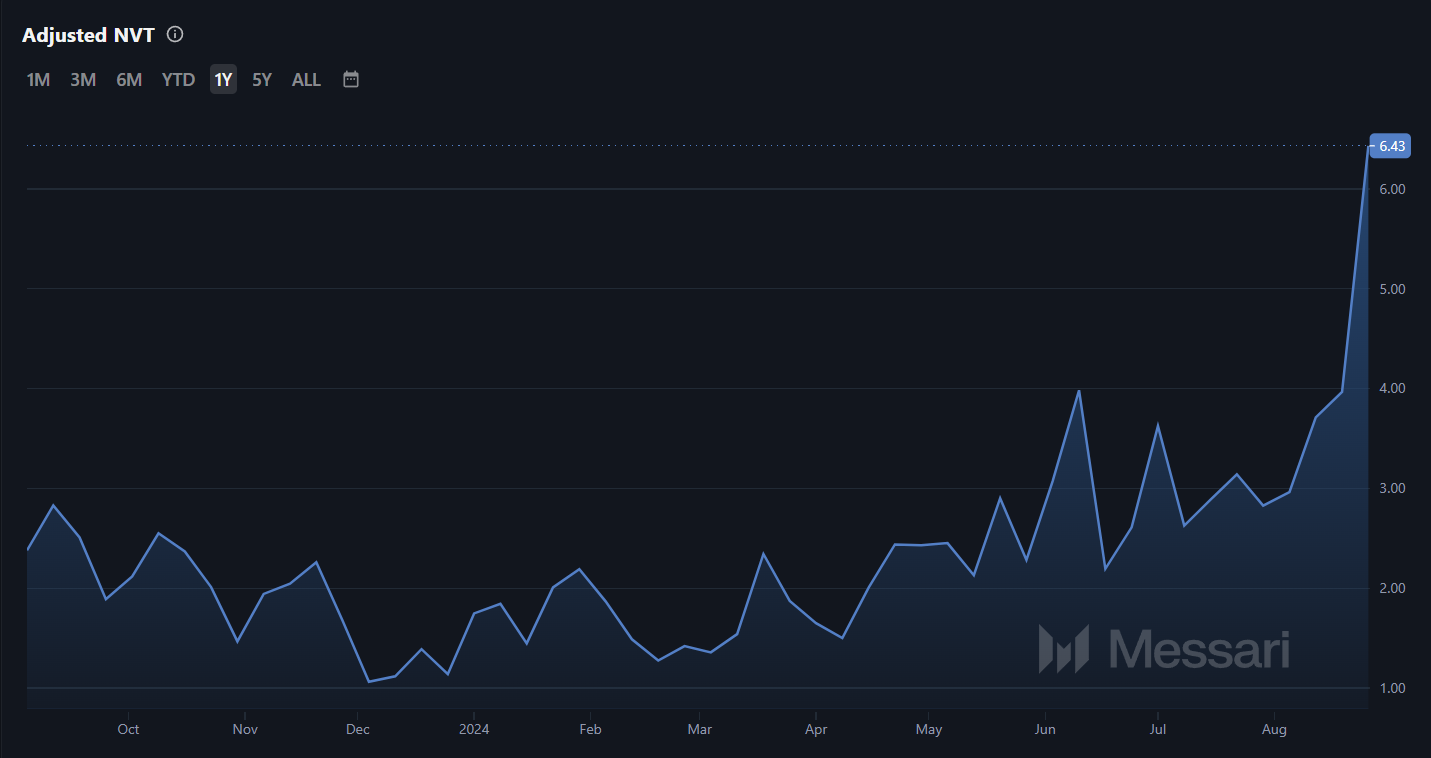

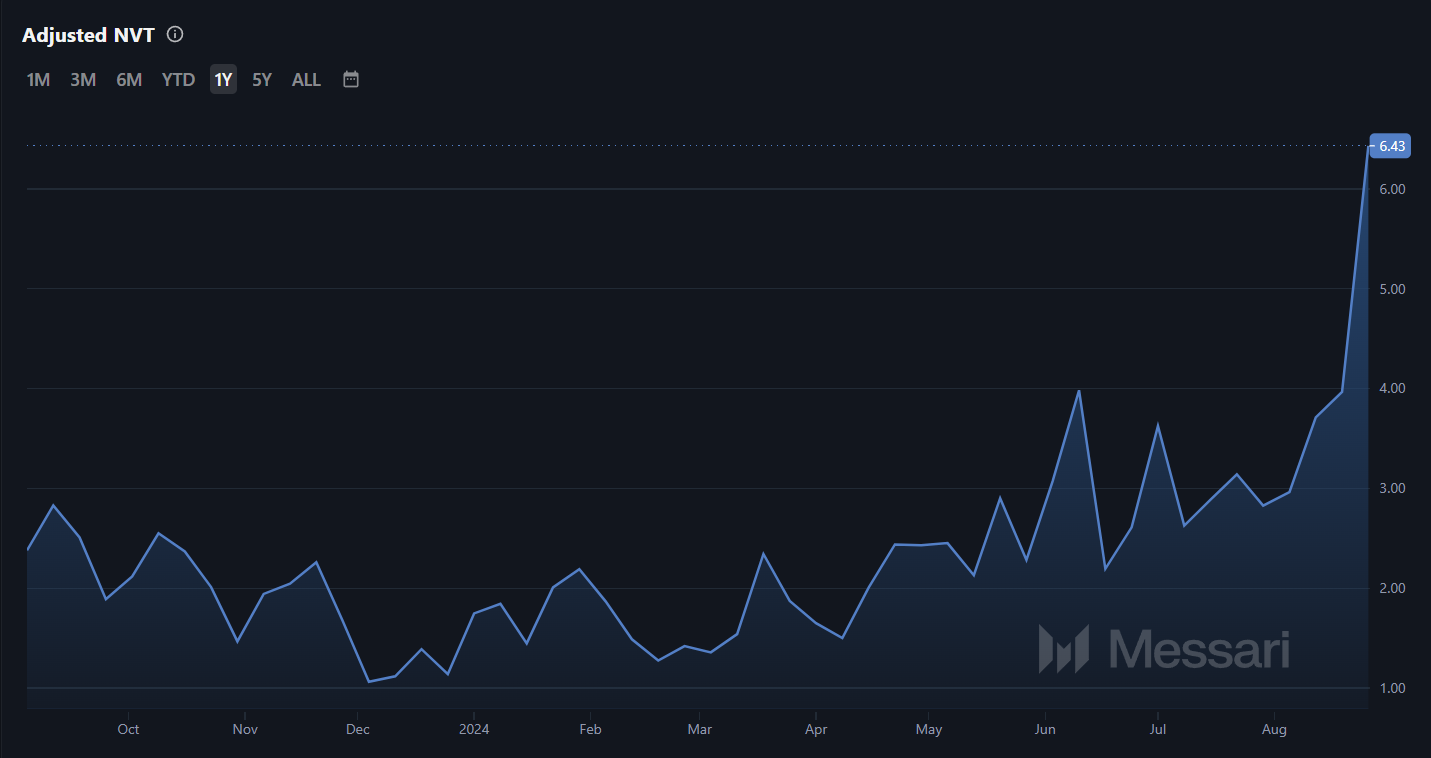

Considering the network’s condition, the recovery in Cardano’s price is slightly skeptical at the moment. The Network Value to Transaction (NVT) ratio shows that ADA is overvalued.

The NVT ratio measures the relationship between a cryptocurrency’s market capitalization and its transaction volume. It’s often used to assess whether a digital asset is overvalued or undervalued. This indicator is currently at a yearly high of 6.43.

Read More: How To Buy Cardano (ADA) and Everything You Need To Know

Cardano NVT ratio. Source: Messari

Cardano NVT ratio. Source: Messari

Overvaluation is a bearish sign for any asset since it generally leads to corrections or delays in rallies.

Beyond the technical indicators, support from investors is also missing. The large wallet holders, also known as crypto whales, are one of the most important cohorts. Their accumulation drives rallies, and selling leads to price declines.

In the case of ADA, it is the latter. Addresses holding between $100,000 and $1 million worth of ADA moved to sell their supply over the last ten days. During this time, they dumped over $326 million worth of tokens, representing about 15% of their entire holdings.

Following the recent Chang hard fork event, these crypto whales have initiated their sell-offs, anticipating potential market corrections. This behavior aligns with the ‘sell-the-news’ phenomenon, where traders often capitalize on the hype leading up to significant developments.

Typically, such strategic moves by large-scale holders can precipitate a market correction, as the initial excitement surrounding big events tends to wane, resulting in decreased token prices.

Since then, the accumulation of these investors has also been insignificant, making it difficult for Cardano’s price to register growth.

Cardano Whale Holding. Source: IntoTheBlock

Cardano Whale Holding. Source: IntoTheBlock

ADA Price Prediction: Holding Back

While recovery for Cardano’s price may not be imminent, it is coming soon. Since the altcoin has spent over four months within the descending wedge that began in mid-April, it will breakout eventually.

However, for now, Cardano’s price will likely note a drawdown to the support of $0.31. This level has served as a crucial support floor, and recovery from this point could help ADA break out. The pattern suggests a 47% rise after breaching the descending wedge, placing the target at $0.53.

Read More: Cardano (ADA) Price Prediction 2024/2025/2030

Cardano Price Analysis. Source: TradingView

Cardano Price Analysis. Source: TradingView

On the other hand, if the network and investors’ conditions do not improve, further drawdown is possible. This would invalidate the bullish-neutral thesis, extending the breakout delay.