SafeMoon’s value has climbed over 25% previously week amid the broader market volatility. This double-digit value achieve has been fueled by the uptick within the token’s demand following the undertaking’s migration from BNB Chain to Solana.

Nevertheless, profit-taking and elevated promoting strain are actually threatening to erase a few of SFM’s latest good points. This evaluation offers the main points.

SafeMoon Battles Rising Promote-Offs

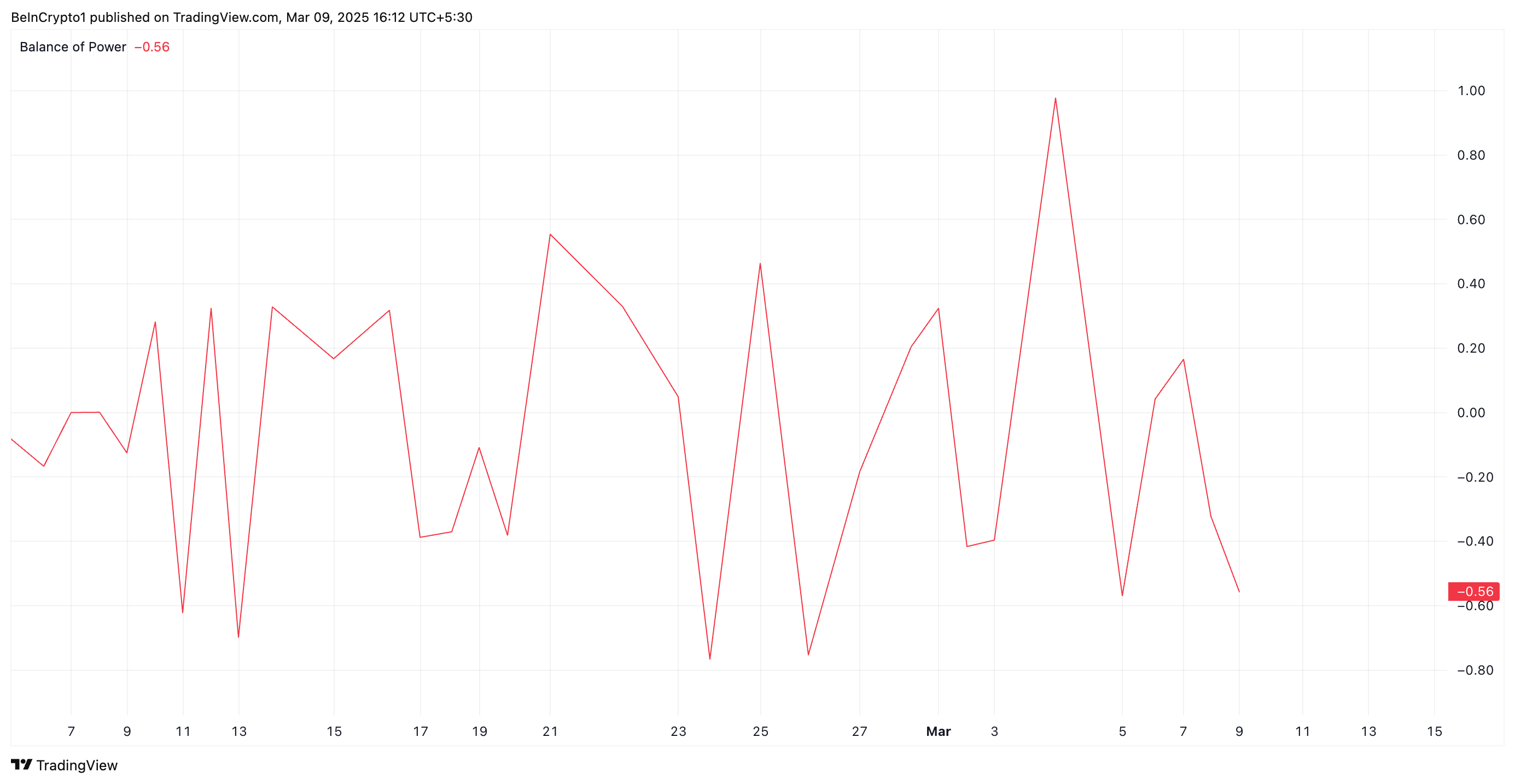

An evaluation of the SFM/USD one-day chart highlights the rising promoting strain inside SFM’s spot markets. A notable indicator of this development is the token’s damaging Steadiness of Energy (BoP), which is at -0.96 at press time.

SFM BoP. Supply: TradingView

SFM BoP. Supply: TradingView

An asset’s BoP indicator compares patrons’ and sellers’ strengths by analyzing value actions inside a given interval. When its worth is damaging like this, it signifies that sellers have extra management, that means downward strain is stronger, and the asset is probably going experiencing a bearish development.

This means weakening bullish momentum amongst SFM holders and hints at declines if promoting strain continues.

Moreover, SFM’s value has dropped 8% over the previous 24 hours, inflicting the altcoin to commerce close to its 20-day exponential shifting common (EMA).

This shifting common measures an asset’s common value over the previous 20 buying and selling days, giving extra weight to latest costs to determine short-term tendencies.

SFM 20-Day EMA. Supply: TradingView

SFM 20-Day EMA. Supply: TradingView

As with SFM, when an asset’s value is poised to interrupt under the 20-day EMA, it alerts elevated promoting strain. It’s a signal of weakening bullish momentum and a shift towards a bearish development.

SFM Finds Key Assist at $0.000061

A profitable breach of the dynamic assist supplied by SafeMoon’s 20-day EMA at $0.000061 would strengthen the bearish development. On this situation, the altcoin’s value may plummet additional to $0.000047.

SFM Worth Evaluation. Supply: TradingView

Nevertheless, a spike in new demand would invalidate this bearish outlook. If spot inflows rally, it may drive SFM’s value above the resistance at $0.000068 towards its multi-year excessive at $0.000011.