Ondo Finance (ONDO) worth has been in a consolidation section over the previous few days, nevertheless it stays up 20% within the final 30 days, solidifying its place as one of the vital related RWA (Actual-World Property) tokens available in the market. Regardless of its current lack of momentum, ONDO continues to carry a $4.2 billion market cap.

Key indicators counsel uncertainty, with development energy weakening and shopping for stress fading. Whether or not ONDO breaks out of its vary or continues consolidating will rely on its skill to regain momentum within the coming periods.

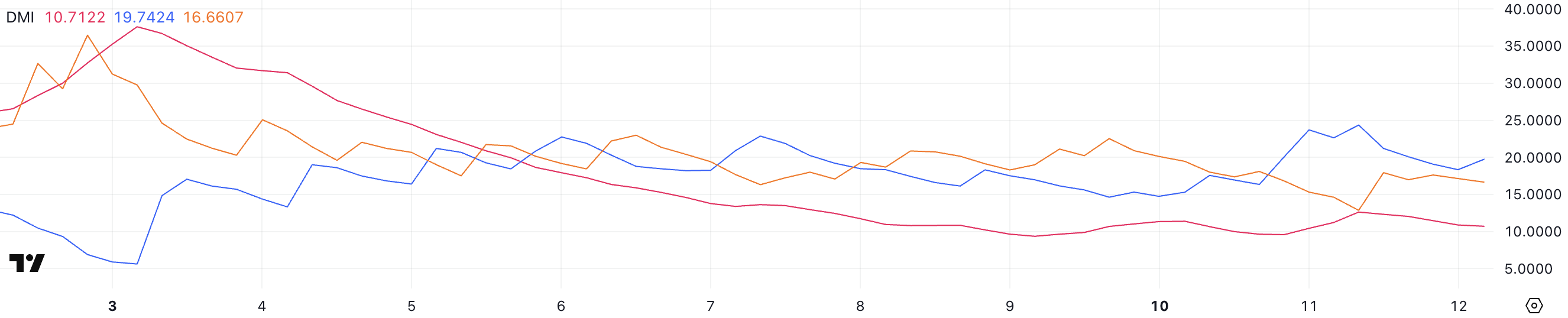

ONDO DMI Reveals Lack of a Clear Development

ONDO DMI chart reveals an ADX of 10.7, remaining beneath 15 for 5 consecutive days, signaling extraordinarily weak development energy. The ADX (Common Directional Index) measures development energy reasonably than course, with values beneath 20 sometimes indicating an absence of a robust development and above 25 suggesting a extra established motion.

Since ONDO’s ADX has stayed low for a number of days, it confirms the market is in consolidation, with no clear bullish or bearish momentum.

ONDO DMI. Supply: TradingView.

ONDO DMI. Supply: TradingView.

In the meantime, the +DI has dropped from 24.2 to 19.7, whereas the -DI has risen from 12.8 to 16.6, displaying a slight shift in directional energy however no decisive breakout. Though these actions counsel some shifts in shopping for and promoting stress, each indicators look like stabilizing.

This aligns with ONDO present sideways worth motion, the place neither patrons nor sellers have full management. Till ADX rises above 20, a robust development is unlikely, and ONDO could proceed consolidating within the brief time period.

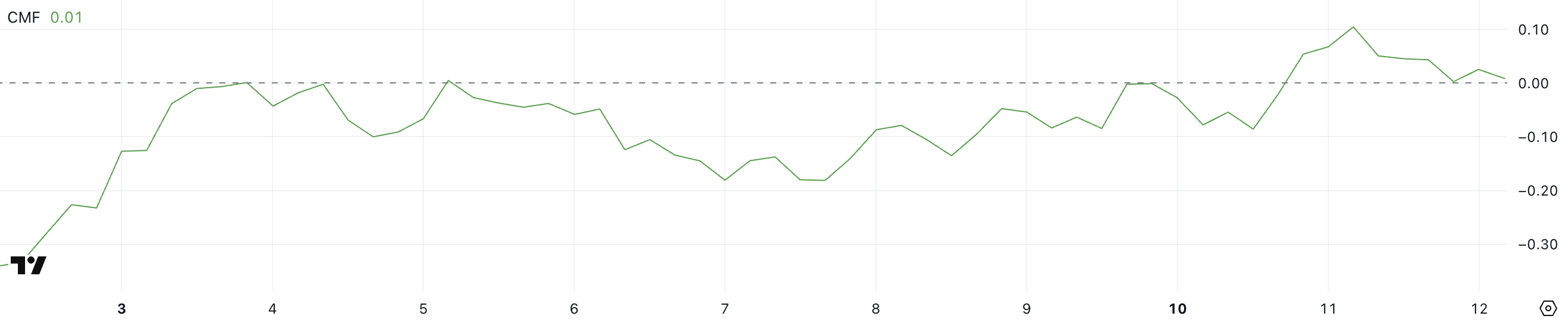

ONDO CMF Struggles to Keep Constructive

ONDO CMF is presently at 0.01, dropping from 0.1 up to now day after spending almost two weeks in unfavourable territory between January 31 and February 10.

The Chaikin Cash Movement (CMF) measures shopping for and promoting stress based mostly on quantity and worth motion. Values above zero point out accumulation and values beneath zero sign distribution.

A rising CMF suggests stronger shopping for curiosity, whereas a declining or unfavourable CMF signifies promoting stress dominating the market.

ONDO CMF. Supply: TradingView.

ONDO CMF. Supply: TradingView.

ONDO failing to maintain above 0.1 and now trending decrease suggests a weakening bullish momentum.

With CMF barely holding above zero, shopping for stress is fading, growing the chance of a return to unfavourable values. If it dips beneath zero once more, it may point out renewed promoting stress, probably resulting in an additional worth decline or prolonged consolidation.

ONDO Value Prediction: Will the Consolidation Proceed?

ONDO worth has been buying and selling inside a decent vary between $1.38 and $1.31 in the previous few days, even after it introduced its personal Layer-1. Its EMA traces are intently aligned, signaling an absence of clear momentum.

Regardless of its sharp correction from $1.60 to $1.13 between January 30 and February 2, it stays one of many largest RWA tokens, sustaining a $4.2 billion market cap. The present sideways motion suggests the market is indecisive, ready for a breakout in both course.

ONDO Value Evaluation. Supply: TradingView.

ONDO Value Evaluation. Supply: TradingView.

As one of the vital fascinating RWA cash for February, if ONDO establishes an uptrend, it may first take a look at resistance at $1.49. If that stage is damaged, an additional push towards $1.66 may comply with.

Nonetheless, if bearish stress will increase and the $1.28 help fails, the value may prolong its decline towards $1.00.