$XRP's $XRP$1.8872 price has fallen about 4% this month, starting the new year on a negative note. Yet on-chain data shows a positive trend underneath.

The number of "millionaire" wallets, or those holding at least 1 million $XRP, has increased for the first time since September 2025, according to data source Santiment.

Their number rose by 42 this month to 2,016, ending four months of declines. $XRP is the payments-focused cryptocurrency used by fintech company Ripple to facilitate cross-border transactions.

"A net of +42 wallets with at least 1M $XRP have returned to the ledger, an encouraging sign for the long-term," Santiment said on X.

The good news for the $XRP bulls doesn't end there. The U.S.-listed spot exchange-traded funds (ETFs) tied to $XRP have registered a net inflow of $91.72 million this month. These funds amassed $666 million and $499 million in investor money in November and December, respectively, according to data source SoSoValue.

This trend starkly contrasts the decline in demand for bitcoin BTC$88,196.51 ETFs, which have processed redemptions worth $278 million this month, following over $4 billion in outflows in final two months of 2025.

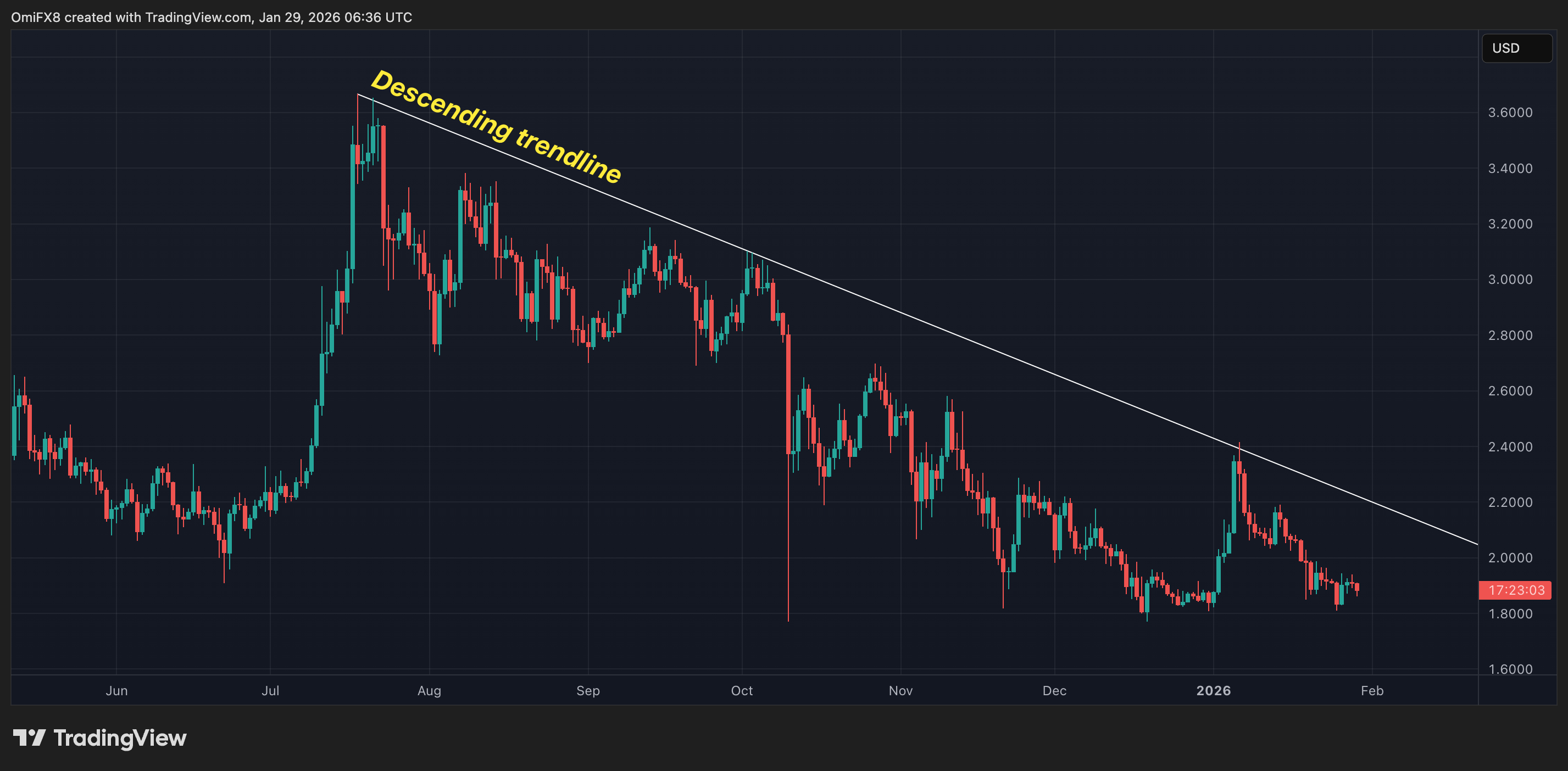

Still, $XRP's price remains in a broad downtrend, as seen in the chart below. The cryptocurrency last traded at $1.88, down 1.7% on a 24-hour basis.

$XRP's daily price chart. (TradingView)

$XRP's daily price chart. (TradingView)

The token has failed to reclaim its 50-day moving average this month, with rallies repeatedly fading near the $2 handle. That suggests larger holders may be positioning for a longer-term thesis rather than chasing near-term momentum.

That divergence — rising large-holder balances and steady ETF inflows alongside weak price action — hints at quiet accumulation rather than speculative froth. Historically, similar setups in $XRP have preceded periods of consolidation before sharper moves, though timing has varied widely.

For now, $XRP appears caught between longer-term positioning and short-term risk aversion. Without a broader pickup in crypto market momentum, particularly in bitcoin and ether, the token may struggle to convert improving fundamentals into sustained upside.