- Kryll (KRL) fashioned a hidden bull divergence, which is a possible pattern reversal.

- Quantity spikes affirm key worth strikes, however declining curiosity suggests market consolidation.

- KRL’s worth motion aligns with basic cycles, indicating a markdown part earlier than potential restoration.

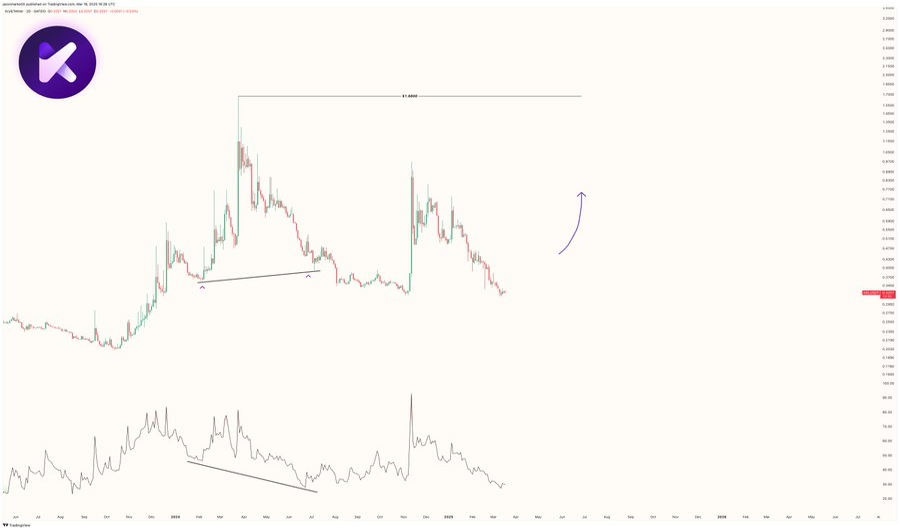

Costs pulled again additional as Kryll (KRL) fashioned a textbook Hidden Bull Divergence sample. This setup has traditionally led to main rallies, with projected targets ranging between $1.10 and $1.50 within the coming periods.

Market Construction and Momentum Tendencies

Kryll’s worth historical past shows a excessive of $4.40 earlier than a steep drop, which indicators a change in market sentiment. Throughout its preliminary levels, the asset remained comparatively steady with low volatility adopted by a gradual pattern upwards. With the value rising, reducing shopping for strain was seen because the momentum indicator moved downwards.

KRL broke out, then skilled a sudden enhance within the worth, which resulted in a parabolic rally. The transfer was accompanied by a sudden surge within the momentum, exhibiting heightened market exercise and participation.

Having reached its peak, KRL entered its corrective part, resulting in a pointy decline. Restoration makes an attempt weren’t capable of reclaim previous highs, resulting in extended bearish tendencies that pushed the value down.

Hidden Bullish Divergence and Future Outlook

A market analyst, Javon Marks, analyzed the hidden bullish divergence in KRL, noting that the asset not too long ago fashioned greater lows whereas the momentum indicator printed decrease lows. He emphasised that this divergence is a key technical sign that usually precedes potential reversals or pattern continuations. Presently, KRL stays in a downtrend with diminished volatility, forming a possible base for restoration.

Supply: Javon Marks

Quantity exercise has proven notable spikes throughout main worth actions, confirming elevated participation in key phases of the cycle. Javon Marks highlighted that current quantity patterns point out declining market curiosity, suggesting a interval of consolidation. The general worth construction aligns with basic market cycles, suggesting that KRL is presently in a markdown part after its earlier important rally.

In keeping with Javon Marks, KRL’s subsequent transfer is dependent upon demand ranges on the present worth vary. If shopping for strain will increase, a possible rebound towards resistance zones might materialize. Nevertheless, if demand stays weak, the downtrend might persist till a robust assist stage is established, confirming whether or not accumulation is happening.