Ethereum value has seen a major downturn, plunging to an eight-week low of $2,600. The sharp decline has resulted in heavy losses for ETH holders.

Nonetheless, institutional buyers view this as a shopping for alternative, capitalizing on decrease costs in anticipation of a possible market restoration.

Ethereum Losses Momentum

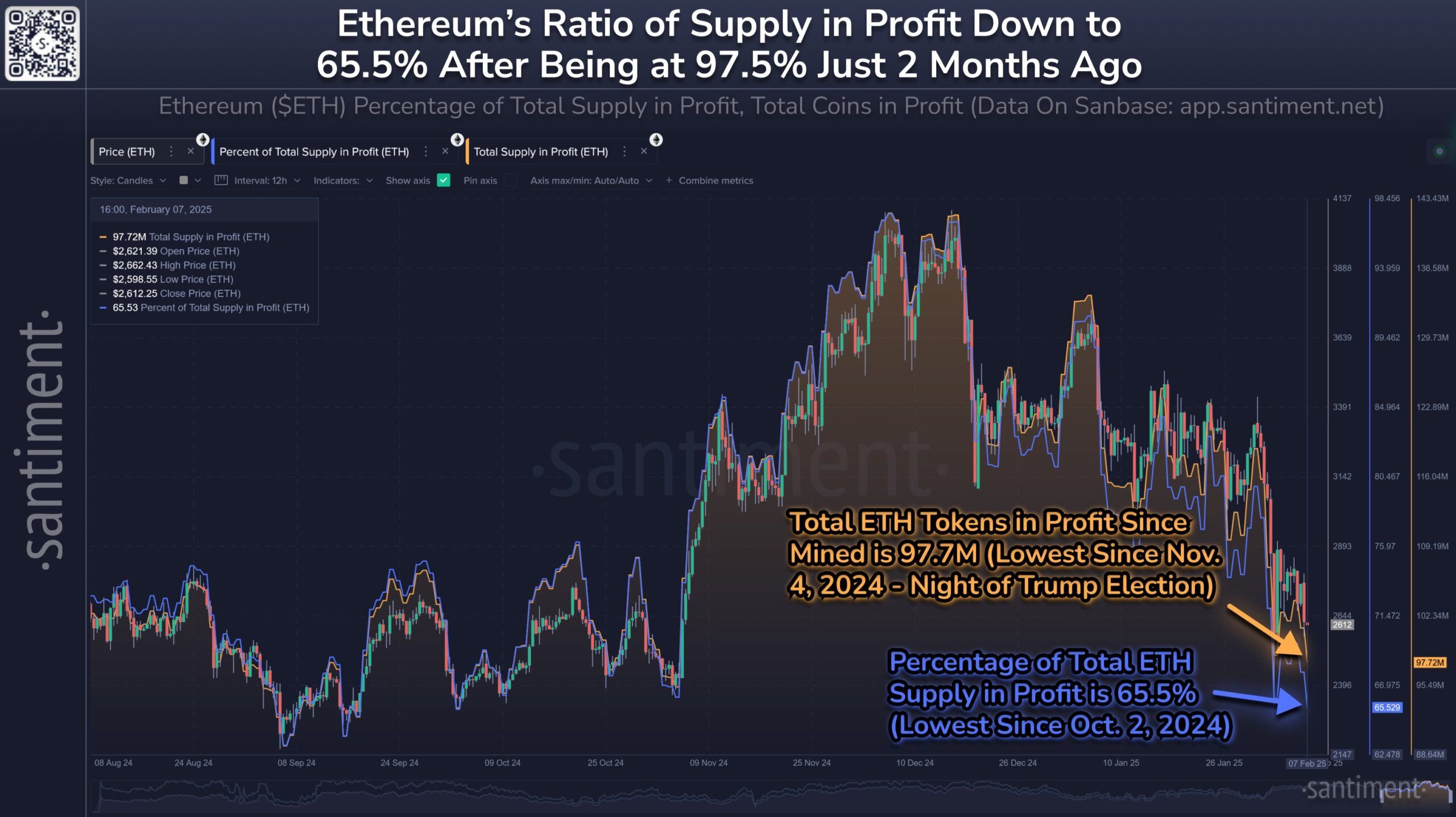

Ethereum’s provide in revenue has dropped sharply, declining by 32% over the previous two months. Beforehand, 97% of ETH holders had been in revenue, however this determine has now fallen to simply 65%.

The decline has fueled a destructive sentiment amongst merchants, with Ethereum underperforming in comparison with different large-cap cryptocurrencies.

Worry, uncertainty, and doubt (FUD) have led to retail buyers promoting their holdings, contributing to additional draw back strain. Nonetheless, market cycles usually result in sudden reversals. If the broader crypto market stabilizes, ETH may see shock bounces as long-term buyers reap the benefits of discounted costs.

Ethereum Provide In Revenue. Supply: Santiment

Ethereum Provide In Revenue. Supply: Santiment

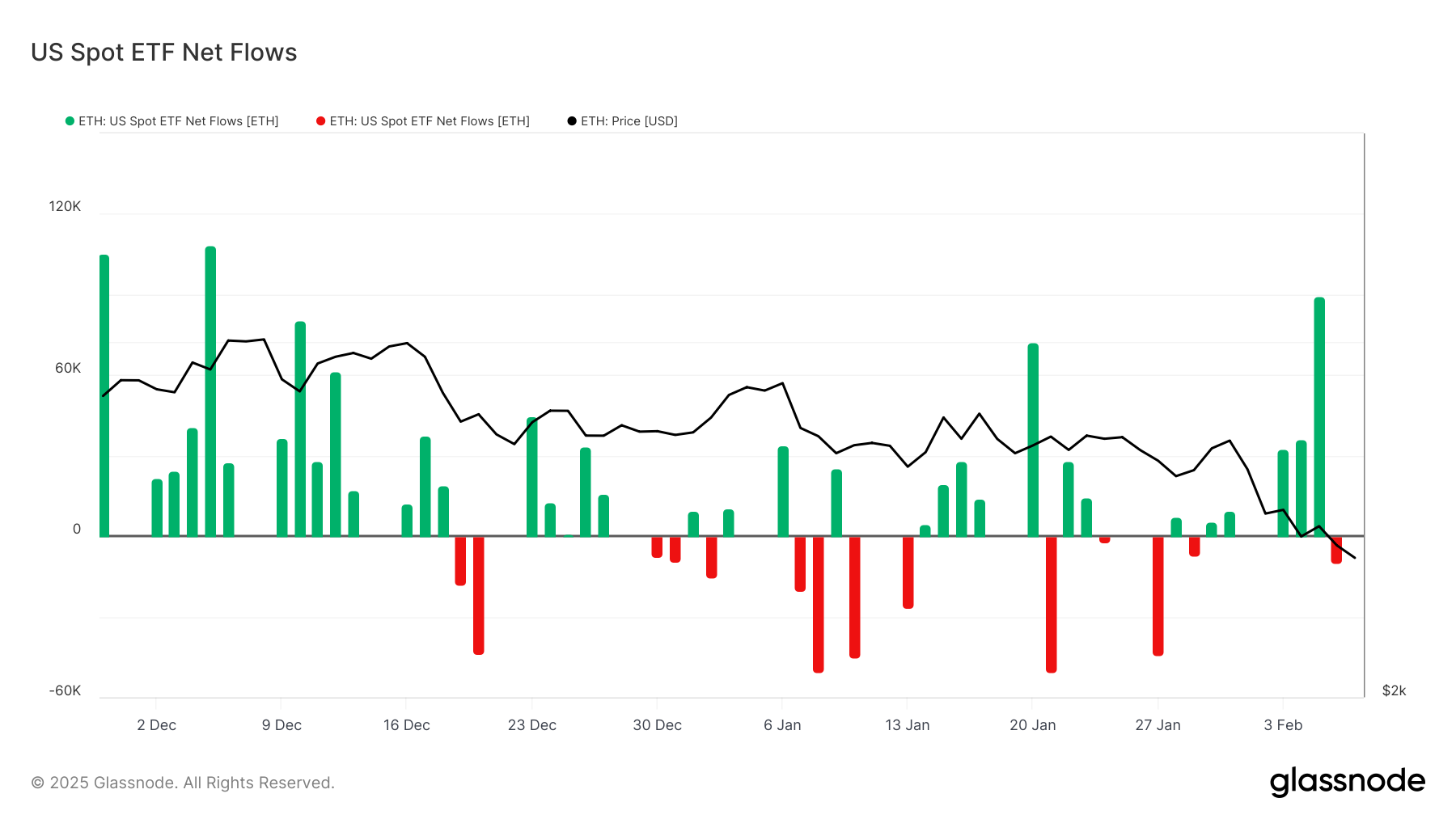

Regardless of Ethereum’s value decline, institutional buyers look like accumulating the asset. The US spot Ethereum ETF market recorded its highest single-day influx in two months, with 89,290 ETH value roughly $236 million getting into funds earlier this week.

This means that institutional buyers see Ethereum’s present value as a pretty entry level.

Giant-scale accumulation at decrease ranges signifies that long-term buyers stay assured within the altcoin. Whereas short-term value actions stay risky, sustained institutional inflows may present help for ETH. It may assist stabilize Ethereum value within the coming weeks.

Ethereum Spot ETF Inflows. Supply: Glassnode

Ethereum Spot ETF Inflows. Supply: Glassnode

ETH Worth Prediction: Reclaiming Help And Recovering

Ethereum’s value has dropped by 20% over the previous week, at present buying and selling at $2,608. The cryptocurrency is holding above the vital help stage of $2,546 after dropping the $2,698 help. This decline has left ETH in a weak place, with buyers intently monitoring value motion for additional indicators of motion.

The present market circumstances current combined alerts, making Ethereum prone to extended consolidation beneath $3,000. A possible restoration may start if ETH reclaims the $2,698 help.

Till then, value motion could stay range-bound as merchants assess the market’s path.

Ethereum Worth Evaluation. Supply: TradingView

Ethereum Worth Evaluation. Supply: TradingView

Nonetheless, if Ethereum fails to carry the $2,546 help stage, the downtrend may deepen. An extra decline may ship ETH to $2,344, invalidating the bullish-neutral outlook and lengthening investor losses.

This is able to reinforce bearish sentiment, doubtlessly delaying any vital restoration within the close to time period.