Some crypto merchants may see Ethereum’s worth decline as a nasty signal for his or her investments and could possibly be pondering if they need to offload their holdings.

In the meantime, whales view the altcoin’s worth dip as a possibility that they have to seize by rising their holdings whereas the worth is down, resulting in massive traders shopping for an enormous quantity of Ethereum within the final three days.

ETH Buying and selling Under $2,000

Analysts stated that Ethereum’s worth continues to fall because the broader cryptocurrency market is at the moment experiencing a difficult scenario.

Knowledge confirmed that the world’s largest altcoin struggles to achieve an upward momentum and proceed to stumble under $2,000.

As of writing, Ethereum is traded at $1,988 per coin, with a market cap of practically $240 billion.

In response to CoinGecko, since ETH hit $3,640 per coin on January 6, the crypto has been steadily reducing in worth with its first main dip occurring on January 14, after hitting $3,007.

On February 3, the coin slid additional reaching $2,460 and dropped to $2,100 on February 28. Ethereum hit under $2,000 for the primary time on March 11. Since then, ETH has been having bother holding itself above $2,000.

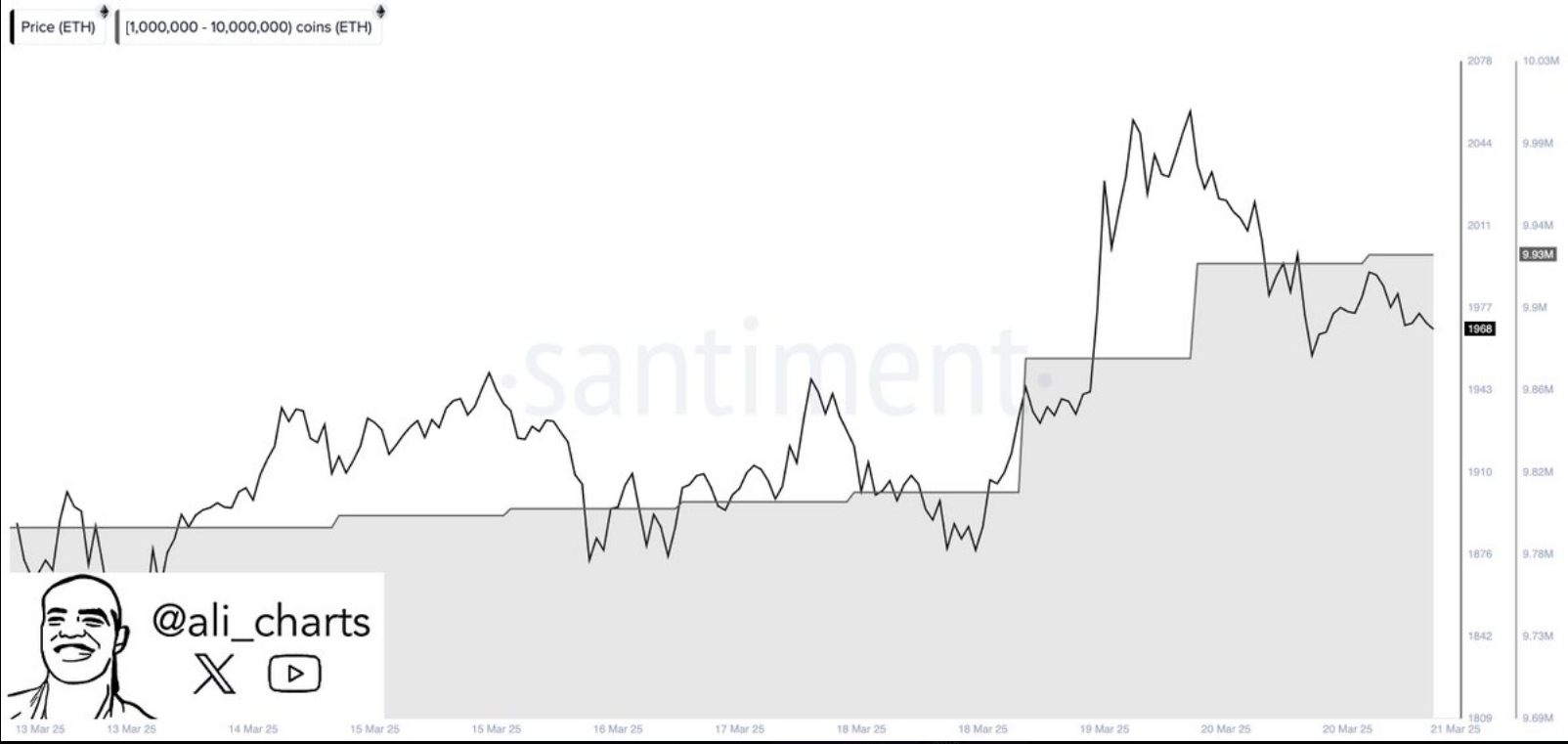

Whales purchased over 120,000 #Ethereum $ETH within the final 72 hours! pic.twitter.com/kuZY6u9drS

— Ali (@ali_charts) March 21, 2025

An Alternative In The Dip?

Ethereum struggling to keep up itself on the $2,000 stage may fear many crypto merchants, however large-scale traders noticed a possibility within the worth dip. Whales used this example to purchase extra ETH and additional enhance their holdings.

Crypto analyst Ali Martinez commented in a publish that ETH worth decline attracted massive traders to extend their shopping for exercise. “Whales purchased over 120,000 #Ethereum $ETH within the final 72 hours,” Martinez stated.

The analyst introduced a chart that confirmed a spike within the whale ETH accumulation coinciding with the coin’s worth decline, including that Ethereum’s retreat allowed whales to accumulate greater than 120,000 ETH tokens with a price of about $236 million and so they solely did that in three days.

“That’s a big transfer by the whales! Their accumulation usually signifies confidence out there. It’s fascinating to see how these massive gamers can affect worth trajectories,’ Agent Snek commented on Martinez’s publish.

Whale Buys Over 7,000 ETH

In the meantime, information analytics platform Lookonchain tracked a whale who added practically $14 million price of ETH.

“A whale purchased 7,074 $ETH($13.8M) in the present day! The whale withdrew 4,511 $ETH($8.81M) from #OKX 3 hours in the past and deposited it into #Aave,” Lookonchain stated in a publish.

The analyst added that the whale didn’t cease depositing in Aave, a decentralized finance platform. The massive investor borrowed 5 million USDT from Aave and put it into OKX to buy a further 2,563 ETH tokens price $5 million.

Featured picture from Pexels, chart from TradingView