Ethereum confronted steep losses Friday after a safety breach at Bybit drained an estimated $1.4 billion from the change.

Ethereum Faces 2.6K Low Following the Hack—Can Restoration Maintain?

Bybit’s CEO confirmed on Feb. 21, 2025, that the platform misplaced a big portion of its crypto reserves within the assault, which focused ETH, mETH and stETH holdings. The incident despatched Ethereum’s worth tumbling, with costs dropping sharply in its wake.

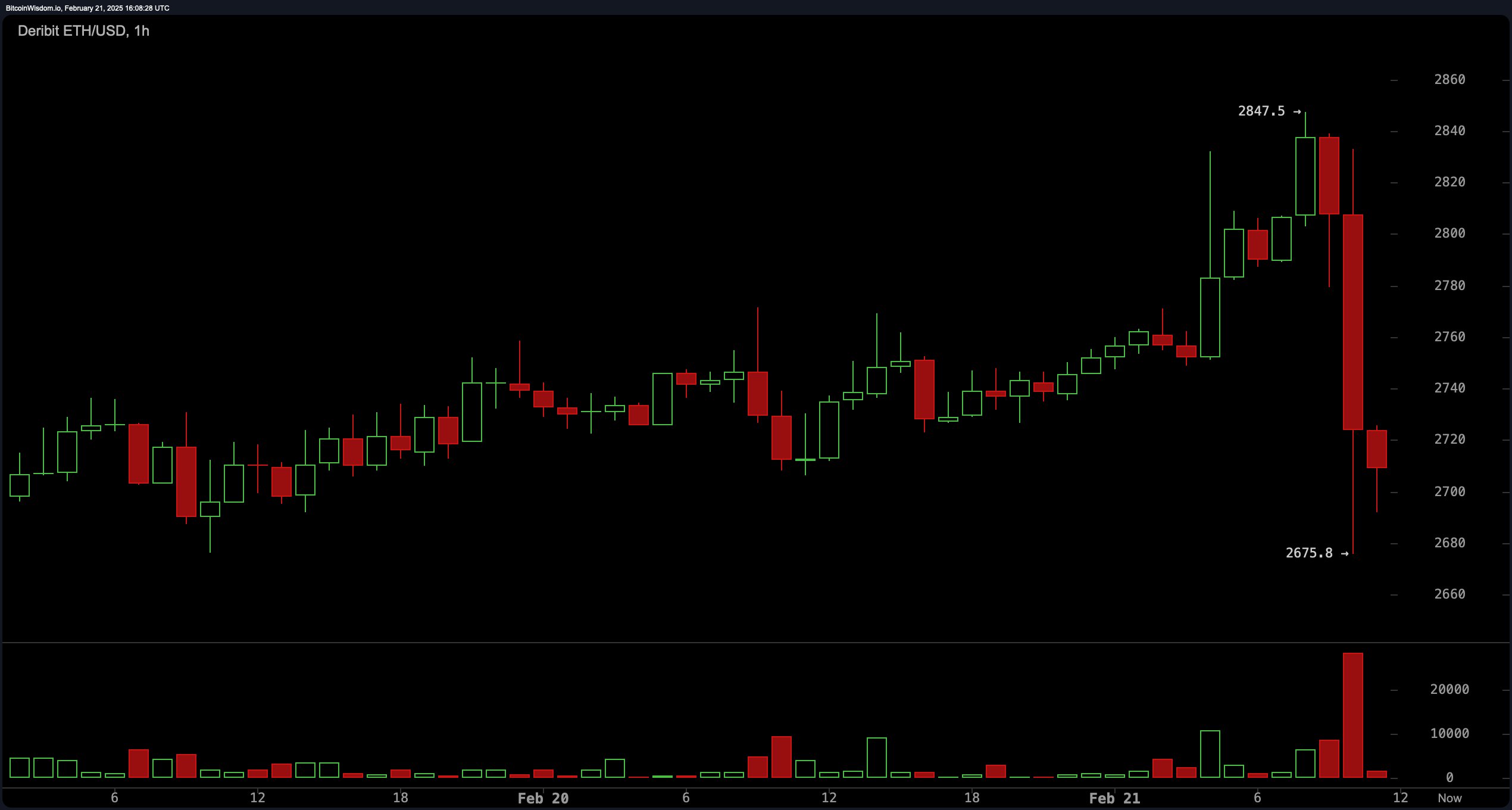

Ether (ETH) plunged to $2,675 instantly after the breach however later rebounded to $2,763. Earlier than the hack was disclosed, ETH had traded at $2,837. Derivatives markets mirrored the chaos: Inside one hour, $48 million in ETH-linked positions had been liquidated, together with greater than $25 million from brief contracts.

A further $109 million in ETH derivatives positions evaporated over the following 24 hours. The fallout rippled past Ethereum, hitting belongings like bitcoin and solana. On HTX’s BTC derivatives platform, a single dealer absorbed a $45.8 million loss. Markets now seem to stabilize as buyers digest information of the breach.

The breach at Bybit highlights persistent vulnerabilities in centralized exchanges, reviving considerations over custodial dangers. Although markets present early indicators of stabilization, the spillover into main belongings illustrates the crypto sector’s interconnected publicity.