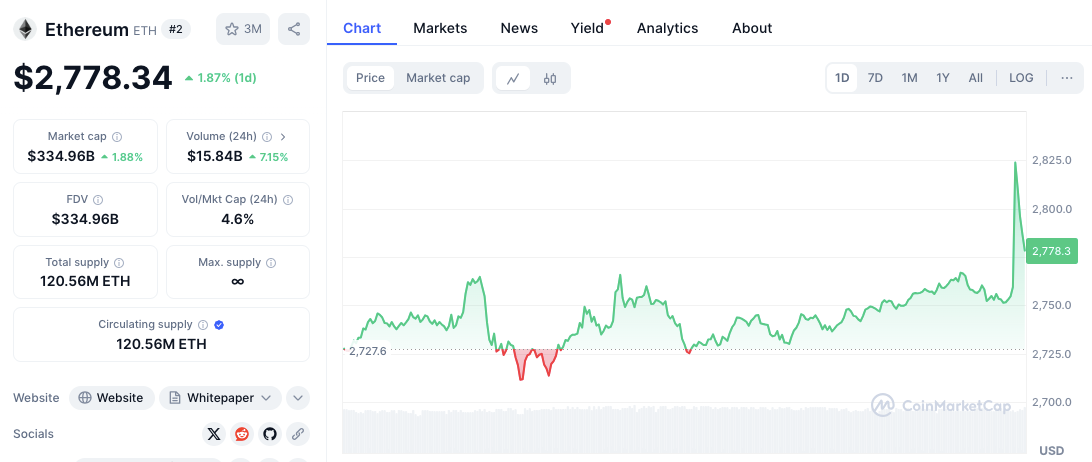

Ethereum (ETH) continues to point out bullish momentum, with the value at present at $2,759.09—a 0.99% acquire over the previous 24 hours. The cryptocurrency’s market cap rises to $332.64 billion, and its 24-hour quantity jumps 7.89% to $15.28 billion.

These actions level to rising shopping for curiosity because the market eyes resistance on February 22 and the potential to interrupt via $2,800.

Ethereum’s Present Value Pattern

The latest worth motion exhibits volatility together with an uptrend, marked by larger highs and better lows—an indication of sustained bullishness.

Rising buying and selling quantity helps the potential of additional positive factors, and if ETH holds above $2,750, it may transfer towards key resistance ranges.

Associated: Vitalik Buterin Praises Household’s Function in Ethereum’s Genesis

Key Assist and Resistance Ranges

Ethereum finds key help at $2,730, the place a number of bounces sign robust shopping for strain. Beneath this, $2,700 acts as a essential psychological degree, whereas $2,660 marks the bottom level within the present timeframe.

Supply: CoinMarketCap

Supply: CoinMarketCap

On the resistance facet, ETH approaches $2,780—a degree the place worth has confronted rejection earlier than.

If the value breaks previous this barrier, the subsequent essential resistance is at $2,800, a psychological degree that might sign additional positive factors. Ought to ETH efficiently breach this mark, the $2,850 degree turns into the subsequent key goal, representing the higher restrict of the present worth vary.

Technical Indicators Sign Potential Upside

ETH/USD day by day worth chart, Supply: TradingView

ETH/USD day by day worth chart, Supply: TradingView

Ethereum’s technical indicators counsel a possible shift in momentum. The Relative Power Index (RSI) at present stands at 48.19, indicating neutrality. Though it stays under the 50 threshold, indicators of restoration counsel that purchasing strain could also be constructing. A transfer above 50 would strengthen the bullish case.

The Shifting Common Convergence Divergence (MACD) indicator presents a possible bullish crossover. The MACD line sits at 32.90, whereas the sign line stays at -97.18. The histogram’s worth of -130.08 signifies diminishing bearish momentum. If the MACD crosses above the sign line, Ethereum may acquire further upward traction.

Ethereum Derivatives Information Displays Market Exercise

Coinglass market sentiment stays optimistic, as Ethereum derivatives information highlights elevated buying and selling exercise. Derivatives quantity surged by 10.53% to succeed in $25.58 billion, whereas open curiosity rose by 4.11% to $25.66 billion.

Associated: Evaluation: Is Coinbase’s Shady Staking Affecting Ethereum’s Value?

In the meantime, choices quantity grew by 2.44% to $653.94 million. Nonetheless, choices open curiosity declined by 6.54% to $6.59 billion, suggesting some merchants could also be securing earnings.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t answerable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.