Ethereum (ETH) is up almost 9% over the previous seven days, displaying indicators of power, but the worth continues to battle across the $2,000 mark. Regardless of this upward motion, key indicators recommend the market continues to be missing decisive momentum.

From development power to whale exercise and assist/resistance ranges, a number of metrics level to a market caught in consolidation. Whether or not Ethereum breaks out or breaks down from right here could rely on the way it reacts to each technical ranges and shifting investor habits within the days forward.

Ethereum BBTrend Is Optimistic

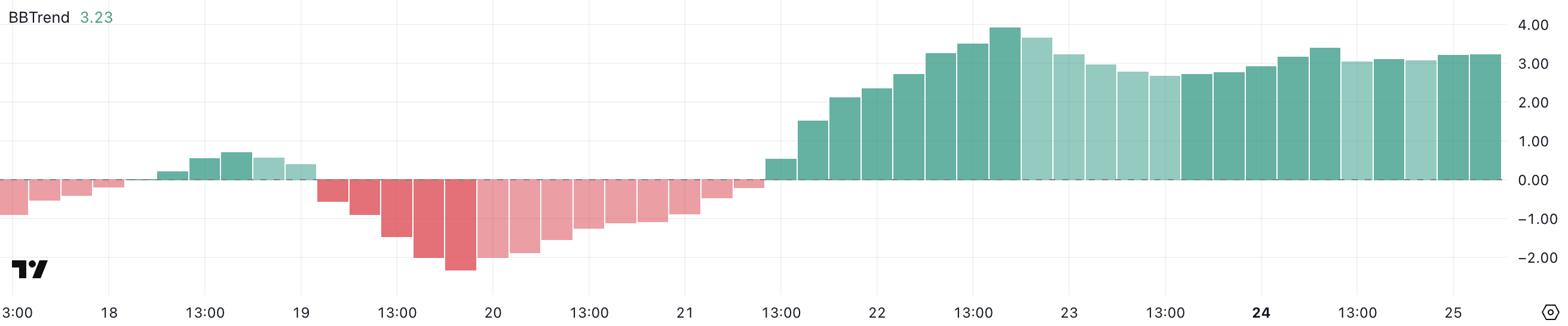

Ethereum’s BBTrend is at the moment sitting at 3.23 and has remained in constructive territory for the previous three consecutive days. The indicator not too long ago peaked at 3.93 on March 22, signaling a strengthening development over the brief time period.

This sustained constructive studying means that Ethereum could also be gaining momentum once more, although not aggressively.

Notably, the final time BBTrend reached above 5—a stage usually related to robust trending situations—was on February 26, almost a month in the past. Since then, the indicator has proven reasonable power however has but to interrupt into the high-momentum zone once more.

ETH BBTrend. Supply: TradingView.

ETH BBTrend. Supply: TradingView.

BBTrend, brief for Bollinger Band Development, is a technical indicator used to measure the power of worth tendencies. It quantifies how far the worth deviates from its imply, usually utilizing Bollinger Bands as a baseline.

Values under 0.5 typically sign an absence of development or uneven situations, whereas readings above 1.0 point out rising development power. A worth above 3 is taken into account an indication of a strong development, and something over 5 usually factors to a robust directional transfer, both bullish or bearish.

Ethereum’s BBTrend hovering at 3.23 suggests some directional conviction, however the absence of readings above 5 previously month could indicate that whereas ETH is trending, it’s not but in a breakout or high-momentum section.

Whales Are Reaching A Month-Low

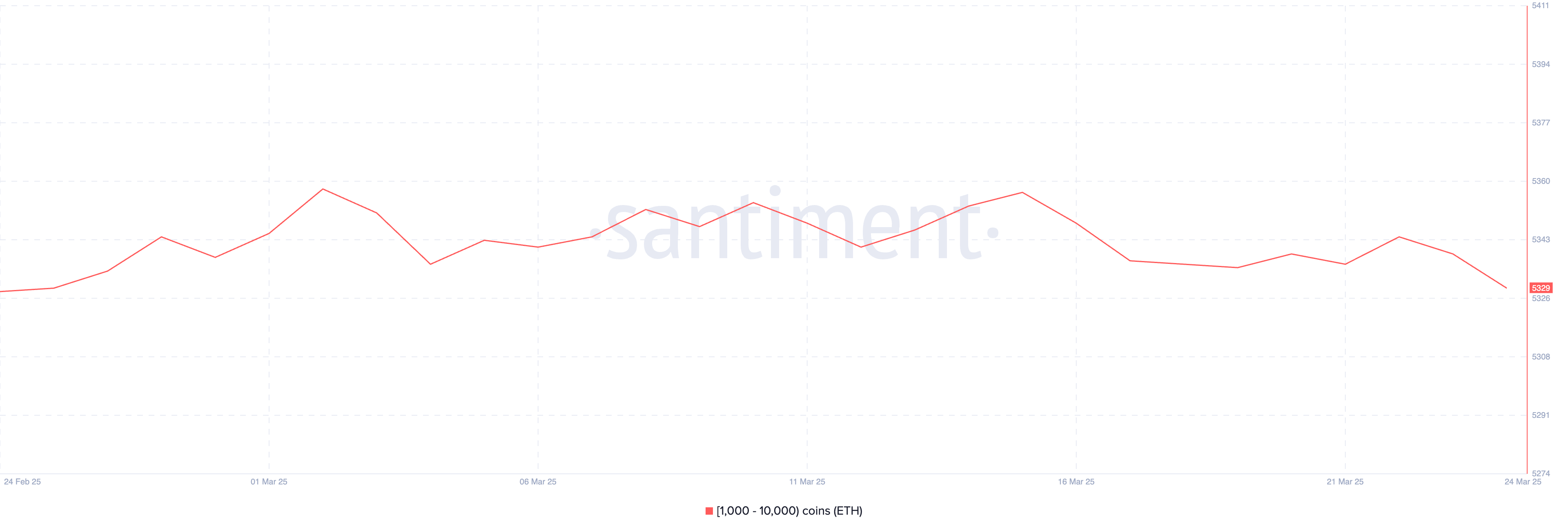

The variety of Ethereum whales—wallets holding between 1,000 and 10,000 ETH—has dropped to five,329, down from 5,344 simply three days in the past.

This slight however notable decline suggests a gradual discount in large-holder confidence or positioning. What’s significantly necessary is that that is the bottom whale depend noticed since February 25, marking a one-month low.

Whereas the change could seem small, even marginal actions in whale habits can ripple via the broader market, particularly when Ethereum’s development indicators are displaying solely reasonable power.

Ethereum Whales. Supply: Santiment.

Ethereum Whales. Supply: Santiment.

Monitoring Ethereum whale wallets is essential as a result of these massive holders have the ability to affect worth via vital shopping for or promoting exercise.

Whales typically act as good cash, and adjustments of their accumulation or distribution patterns can function early indicators of broader market shifts. A declining whale depend could indicate that some high-capacity buyers are taking income, repositioning, or adopting a extra cautious stance.

The truth that the variety of whale wallets is now at a month-to-month low may recommend rising hesitation at increased worth ranges, probably capping upside momentum for ETH within the close to time period until new inflows or investor confidence returns.

Will Ethereum Fall Beneath $2,000 Once more?

Ethereum’s EMA strains at the moment recommend a section of consolidation, with worth motion persevering with to battle across the $2,000 mark. The dearth of clear route displays indecision available in the market, as ETH trades inside a narrowing vary.

On the draw back, if Ethereum worth exams the important thing assist stage at $1,938 and fails to carry it, the following decrease targets lie at $1,867 and probably so far as $1,759.

ETH Worth Evaluation. Supply: TradingView.

ETH Worth Evaluation. Supply: TradingView.

On the flip facet, if Ethereum manages to collect bullish momentum and construct a sustained uptrend, the primary main resistance to observe is at $2,320.

A profitable breakout above this stage may set off a run towards $2,546 and, if the momentum accelerates, even attain as excessive as $2,855.