The cryptocurrency market has suffered a significant downturn, wiping out $325 billion in market capitalization since February 21, with $150 billion liquidated in simply the previous 24 hours in accordance with CoinGlass information.

The sell-off has despatched shockwaves throughout the sector, dragging down main digital belongings and severely impacting liquidity within the once-booming memecoin market.

Donald Trump’s renewed tariff threats are creating uncertainty throughout the sector, whereas a $1.4 billion safety breach at Bybit provides one other layer of instability.

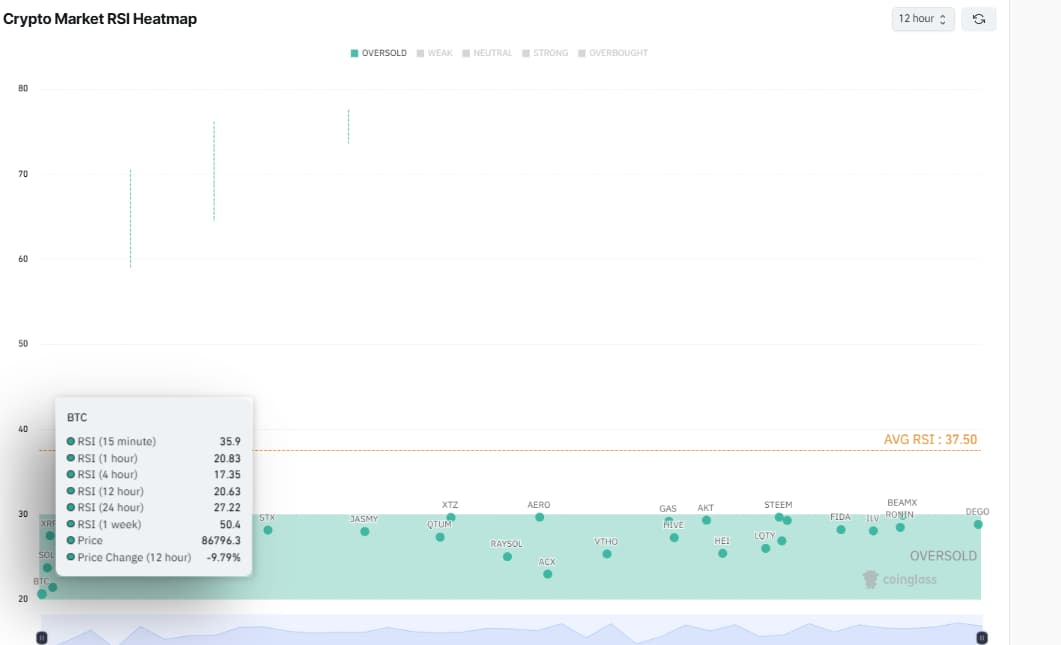

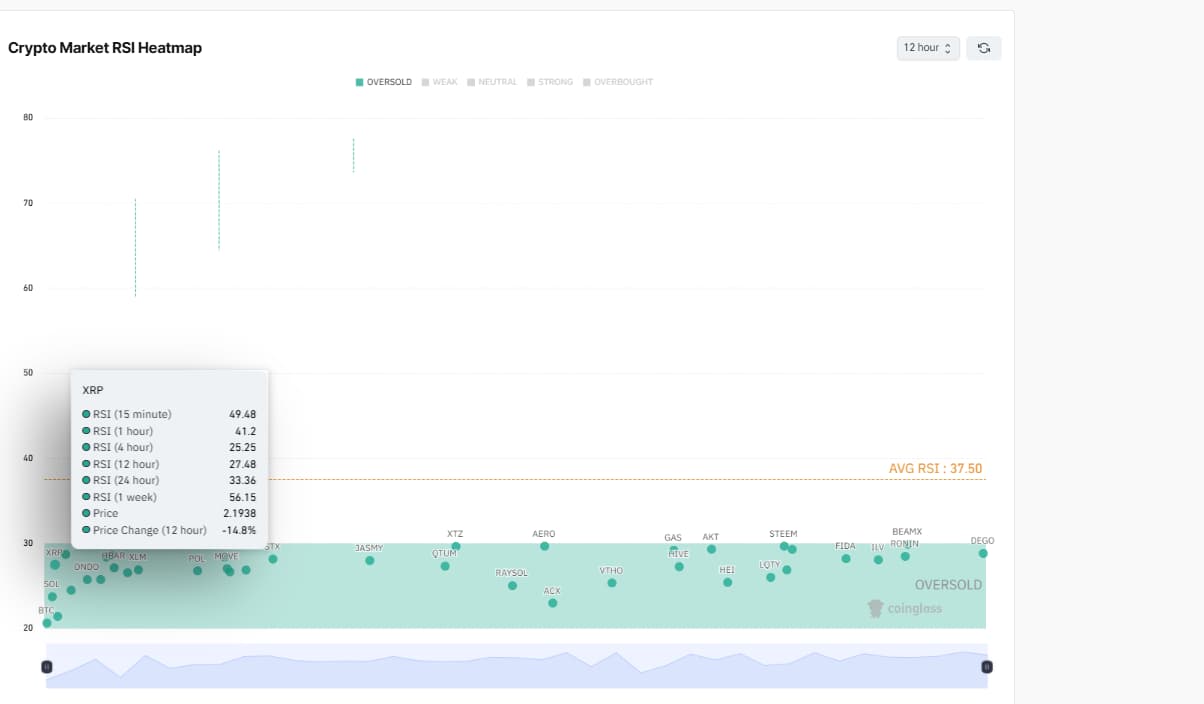

Amid this backdrop, Finbold analyzed the Relative Power Index (RSI) heatmap from CoinGlass on February 25. With a mean 12-hour RSI of 37.50, Finbold recognized potential purchase alternatives at the same time as volatility continues to problem market stability.

Bitcoin (BTC)

Bitcoin (BTC) is flashing a possible shopping for alternative as excessive oversold situations counsel a short-term rebound. The four-hour RSI has dropped to 17.35, whereas the 12-hour RSI sits at 20.63, each indicating vital promoting strain that seems to be waning.

In the meantime, the 24-hour RSI of 27.22 confirms extended weak point, a sign that has traditionally preceded corrective bounces. BTC has plunged 9.79% within the final 12 hours, marking a possible native backside the place accumulation usually begins.

The technical evaluation additional helps this outlook, with analysts suggesting that BTC is experiencing a typical bull cycle pullback, a section the place sharp dips create alternatives earlier than the subsequent leg greater. Historic traits point out that BTC may quickly stage a robust restoration, making this a compelling entry level for consumers.

XRP

XRP is displaying related indicators of a possible backside, with its 12-hour RSI at 27.48 and 4-hour RSI at 25.25, each effectively under the oversold threshold of 30.

XRP has plunged 14.8% within the final 12 hours, making a setup the place consumers could quickly regain management. Its 24-hour RSI at 33.36, although barely above the oversold threshold, reveals undervaluation aligning intently with broader market situations.

Supporting these RSI-based alerts, weekly technical indicators additionally lean bullish, with transferring averages flashing a robust purchase sign regardless of some blended alerts.

The Exponential and Easy Shifting Averages throughout a number of timeframes stay in purchase territory, additional strengthening the long-term bullish outlook. Whereas short-term momentum indicators like MACD stay bearish, the broader pattern favors accumulation earlier than a possible restoration.

Whereas RSI factors to a possible rebound for BTC and XRP, counting on a single indicator comes with dangers. Market situations stay risky, and broader components like quantity, and basic developments play an important function in shaping worth motion.

Featured picture by way of Shutterstock