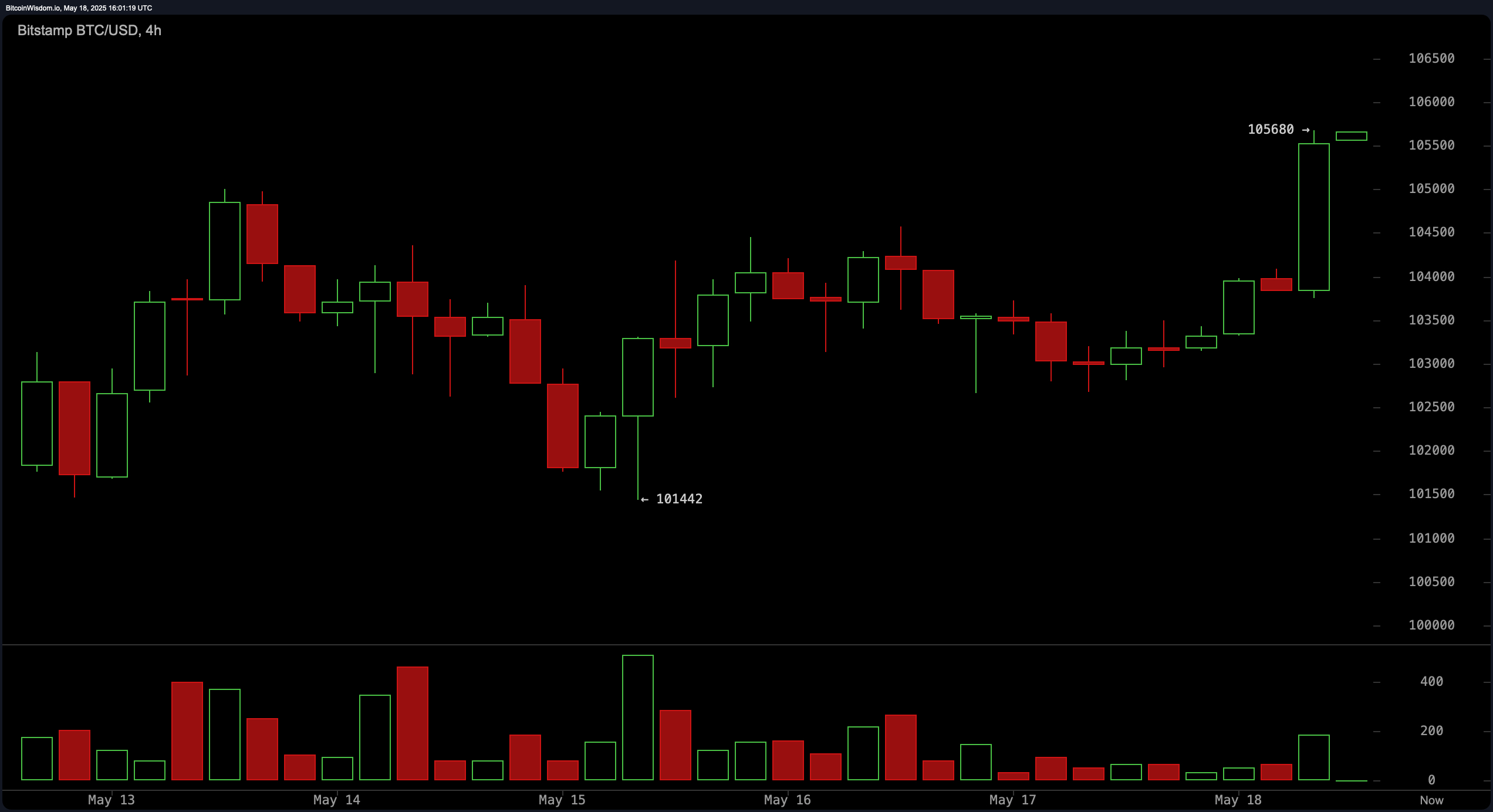

Bitcoin scaled an intraday peak of $105,680, climbing 2.5% versus the U.S. greenback, as merchants reveled in its buoyant momentum. The digital asset now orbits close to $105,385 per unit, weathering a modest 3.87% dip from its historic zenith of $109,356 achieved on Jan. 20, 2025. Present buying and selling vigor displays roughly $19 billion in BTC commerce quantity, with Binance dominating as as we speak’s most energetic change. Analyzing current volatility, Coinglass information reveals that over $27 million in bearish BTC quick bets evaporated inside a four-hour window, illuminating fleeting market dynamics. A standout casualty emerged on Binance: a single BTC/ USDT place price $3.37 million was swiftly liquidated, marking the day’s most dramatic exit.