Bitcoin has managed to keep up sturdy assist at $95,000 for a while. Nevertheless, this stage may face challenges because the cryptocurrency’s overvaluation might result in a correction.

If this assist is damaged, Bitcoin may expertise a drop, probably reaching as little as $92,000, which might set off additional issues for buyers.

Bitcoin Is Dealing with Hassle

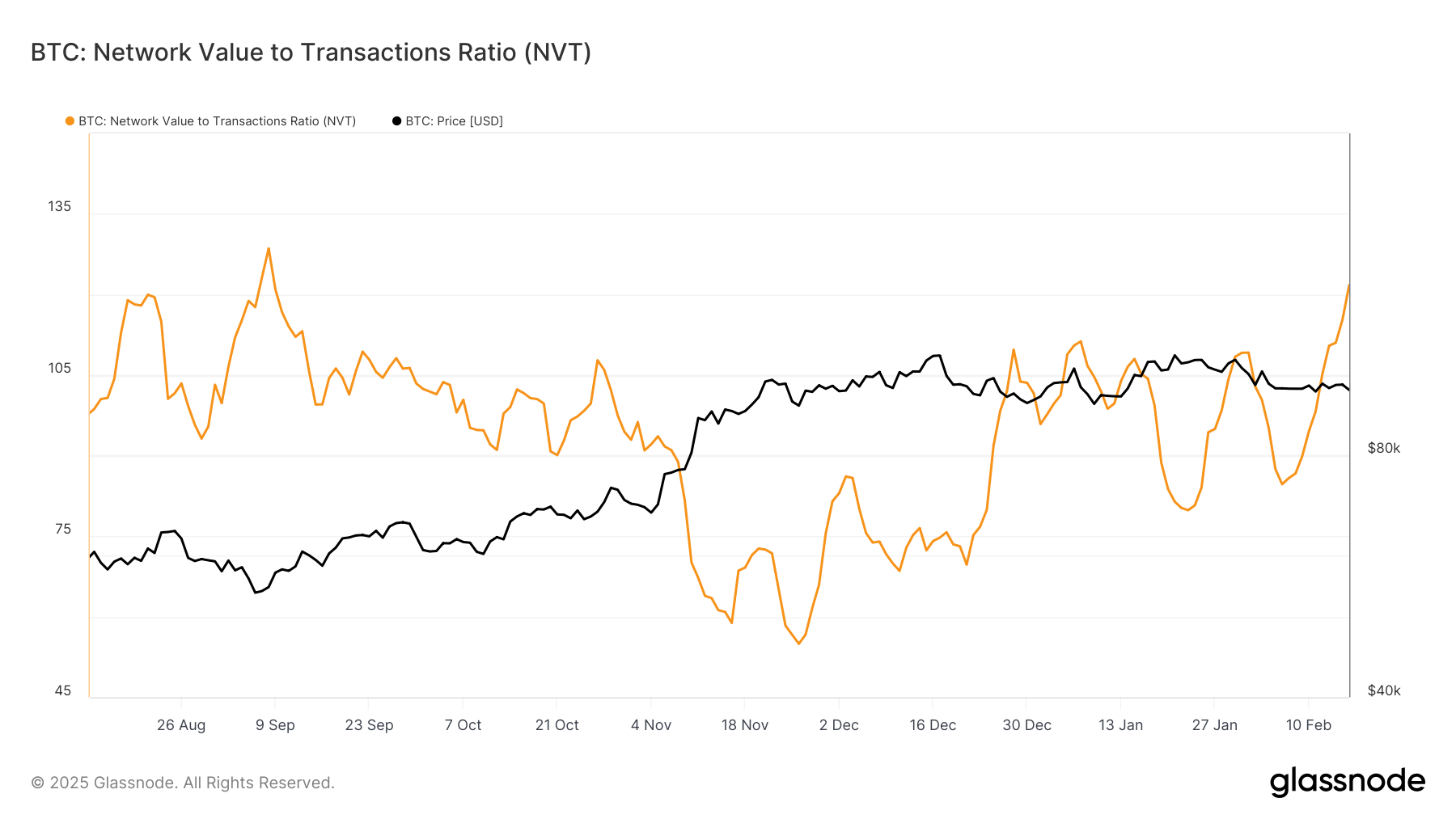

The Community Worth to Transactions (NVT) ratio is presently at a five-month excessive, a stage final seen in September 2024. The NVT ratio, which measures the connection between Bitcoin’s community worth and transaction quantity, means that community worth is much larger than precise transactions. This imbalance sometimes signifies that Bitcoin is overvalued, traditionally appearing as a set off for worth corrections.

The rising NVT ratio indicators that Bitcoin’s worth might not align with its underlying community exercise, suggesting a possible mispricing. As this imbalance continues, the possibilities of a worth correction enhance, which means Bitcoin would possibly face a drop towards decrease assist ranges except its community exercise can meet up with its valuation.

Bitcoin NVT Ratio Supply: Glassnode

Bitcoin NVT Ratio Supply: Glassnode

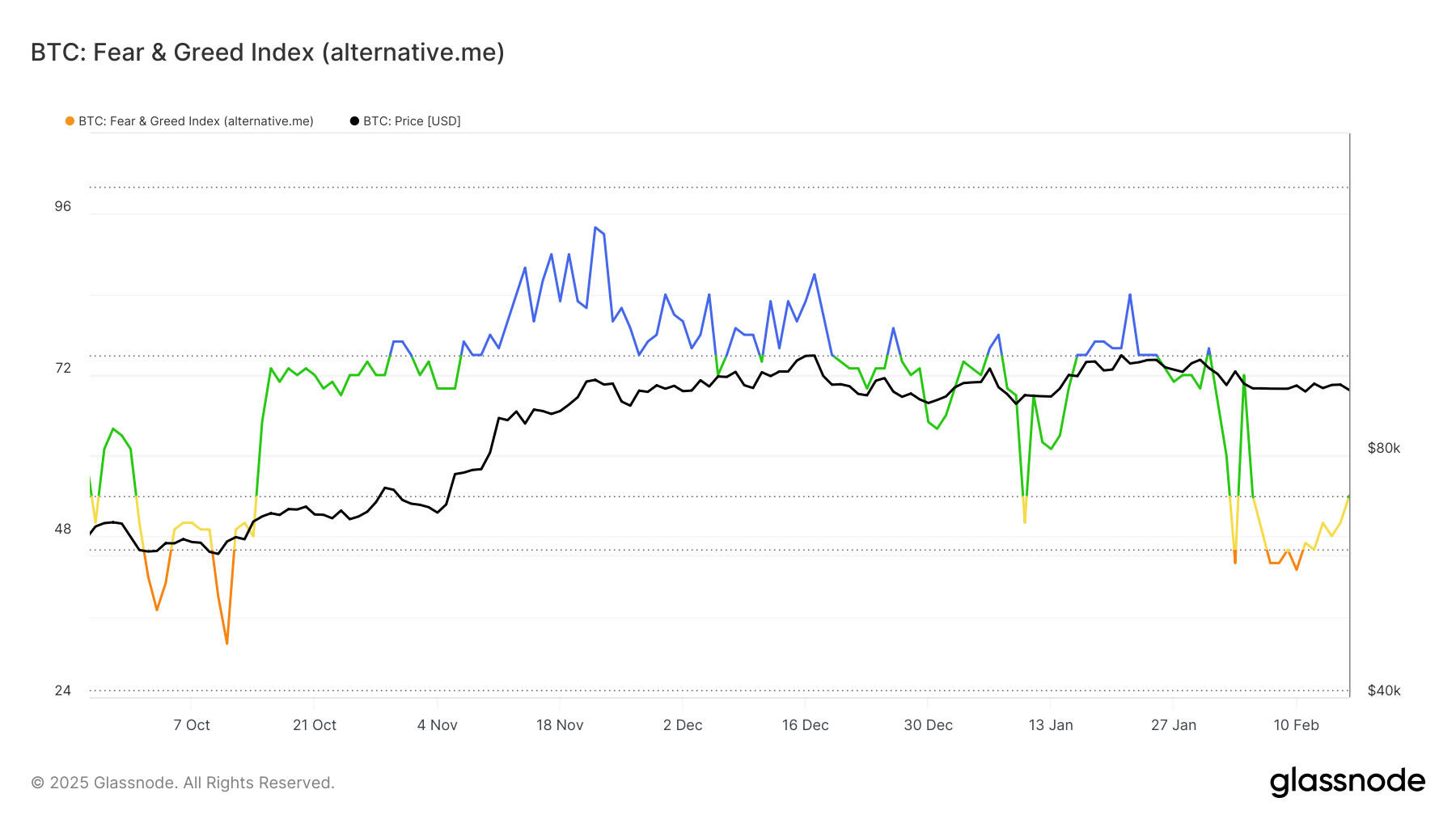

Bitcoin’s broader market momentum is exhibiting blended indicators, with the Worry and Greed index nearing the Greed zone. The index, which tracks market sentiment, is on the verge of transitioning from Impartial to Greed, usually indicating that the market could also be nearing native tops. This shift suggests Bitcoin may very well be overvalued, with the potential for a correction if the sentiment overheats.

Traditionally, when the Worry and Greed index enters the Greed zone, Bitcoin has skilled pullbacks because the overvaluation triggers profit-taking. The way forward for Bitcoin’s worth will rely on how sentiment evolves within the coming days.

Bitcoin Worry And Greed Index. Supply: Glassnode

Bitcoin Worry And Greed Index. Supply: Glassnode

BTC Value Prediction: Staying Above Help

Bitcoin is presently buying and selling at $96,273, holding above its important assist stage of $95,869. For now, Bitcoin can be staying above its uptrend assist line, which has offered a buffer in opposition to an extra worth decline. If these ranges maintain, Bitcoin may keep stability and keep away from breaking beneath key assist.

Nevertheless, if the components of overvaluation and shifting market sentiment exert strain on Bitcoin, it’s more likely to fall beneath the $95,869 assist. This might set off a decline towards $93,625, and even as little as $92,005, extending the losses for buyers who’re holding throughout this unsure section.

Bitcoin Value Evaluation. Supply: TradingView

Bitcoin Value Evaluation. Supply: TradingView

If Bitcoin can discover resilience above the $95,869 assist, it would see a bounce towards $98,212. Efficiently breaching this resistance stage may present renewed bullish momentum, invalidating the present bearish thesis. If Bitcoin pushes above $98,212, the market may see a renewed upward trajectory, restoring confidence in its future potential.