Bitcoin is struggling to push increased, exhibiting indicators of weak demand and potential rejection. If promoting strain will increase, the $80K assist stage might be the following goal within the coming days.

Technical Evaluation

By Shayan

The Every day Chart

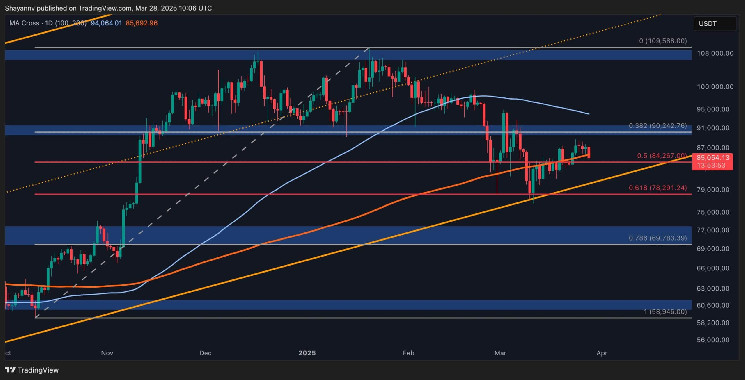

BTC’s latest bullish retracement has misplaced momentum after briefly surpassing the 200-day transferring common at $85K, resulting in a minor rejection. This value motion suggests a possible false breakout and a bull lure, highlighting the presence of sellers.

The present retracement seems to be corrective, and if promoting strain intensifies, a drop towards the important $80K assist stage might unfold within the quick time period. Nevertheless, if sudden shopping for strain emerges, a breakout above this stage might set off a brief squeeze, pushing Bitcoin to new highs.

The 4-Hour Chart

On the decrease timeframe, Bitcoin continues its downtrend inside a descending value channel, characterised by decrease highs and decrease lows, reinforcing a bearish market construction. Though BTC not too long ago tried a bullish retracement, momentum light upon reaching the channel’s higher boundary at $88K, confirming robust resistance.

The rejection at this stage has triggered renewed bearish strain, rising the probability of continued consolidation throughout the channel. Within the quick time period, the $80K assist, aligned with the channel’s mid-boundary, stays the first draw back goal.

On-chain Evaluation

By Shayan

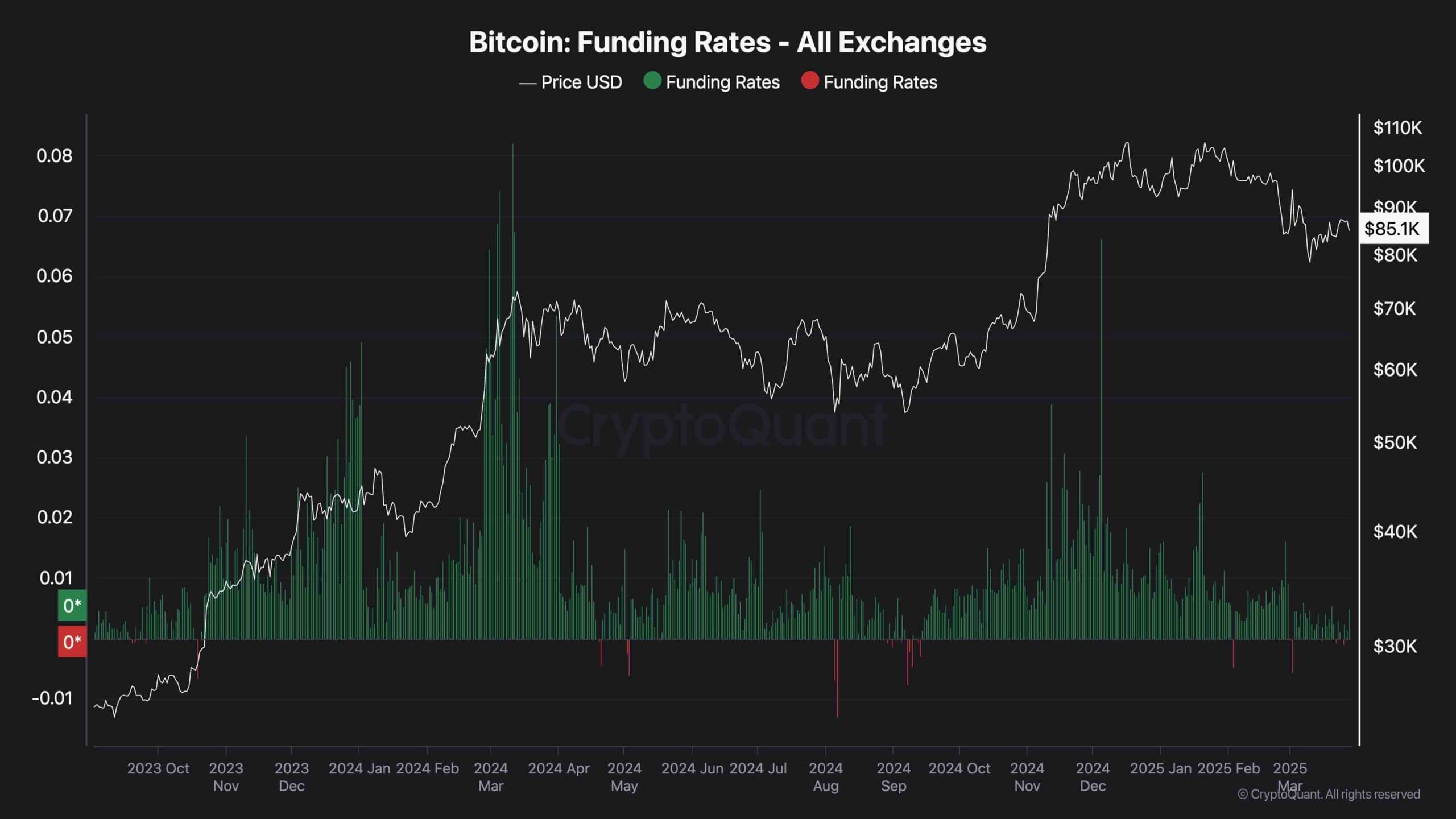

Futures market sentiment has persistently supplied worthwhile insights into Bitcoin’s value traits, with funding charges serving as a key indicator of market dominance. Current information reveals a decline in funding charges, nearing zero, signaling a shift towards vendor dominance.

Whereas this might sound bearish at first, it mirrors the market conduct seen in the summertime of 2024, when Bitcoin underwent a chronic correction earlier than rallying strongly. This sample means that BTC could have entered a deep consolidation part, doubtlessly lasting by means of the mid-to-long time period earlier than resuming its upward trajectory.