Bitcoin is buying and selling at $95,700 with an general market capitalization of $1.89 trillion, a 24-hour buying and selling quantity of $13.51 billion, and an intraday value vary between $94,805 and $96,684, reflecting a consolidation section amid blended technical indicators.

Bitcoin

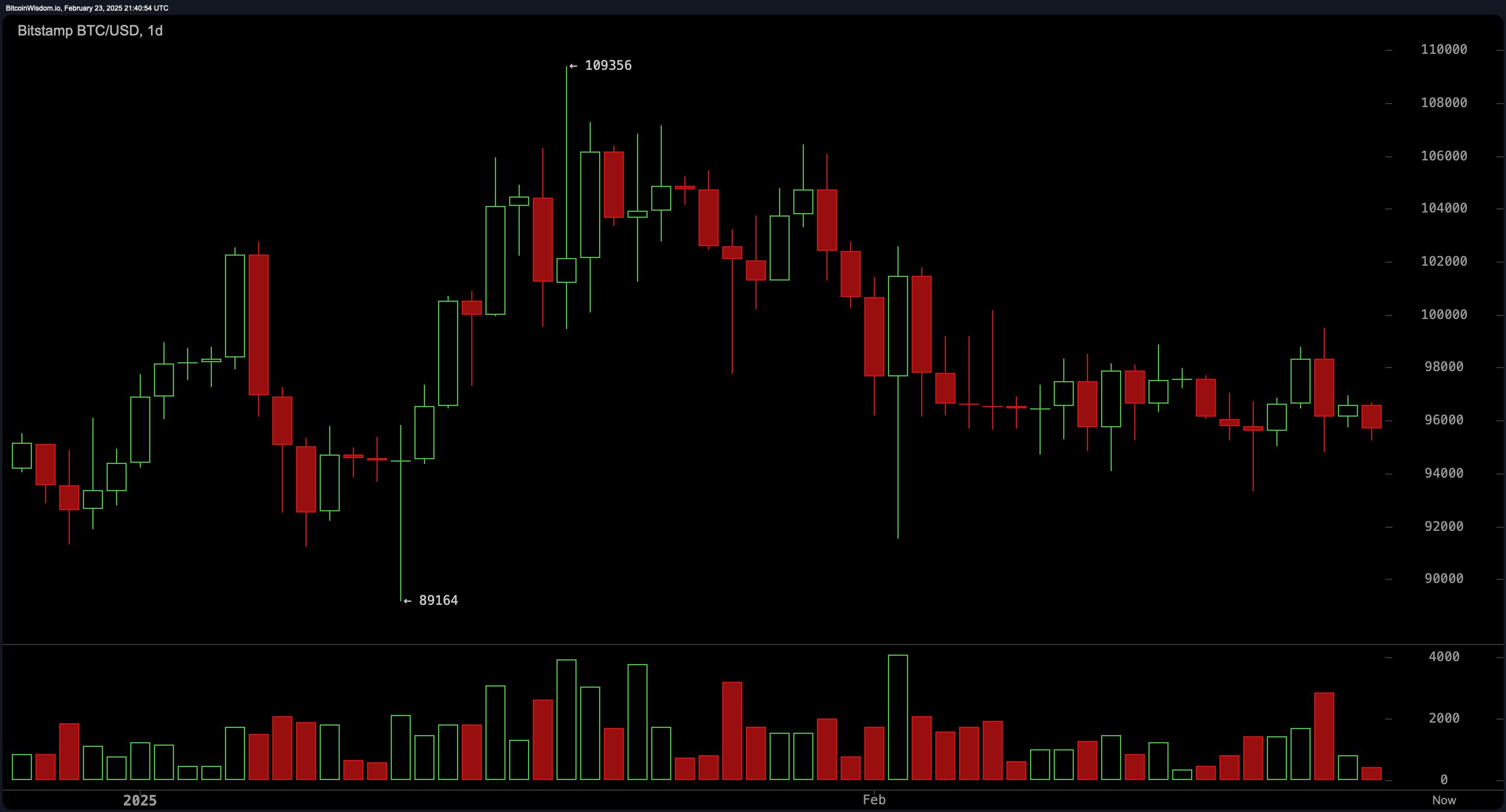

Bitcoin’s day by day chart exhibits BTC beforehand peaked close to $109,356 earlier than experiencing a pullback to roughly $89,164, adopted by consolidation across the $96,000 degree. The $89,000 to $91,000 vary serves as a key help zone, whereas resistance stays sturdy close to $109,000. A declining quantity development on the pullback signifies potential exhaustion of promoting stress. If bitcoin reclaims $98,500 with sturdy quantity, an upside transfer towards the $104,000 to $109,000 vary is feasible. Nevertheless, failure to carry above present ranges may push costs decrease towards the $89,000 area.

BTC/USD through Bitstamp on Feb. 23, 2025, 1D chart.

BTC/USD through Bitstamp on Feb. 23, 2025, 1D chart.

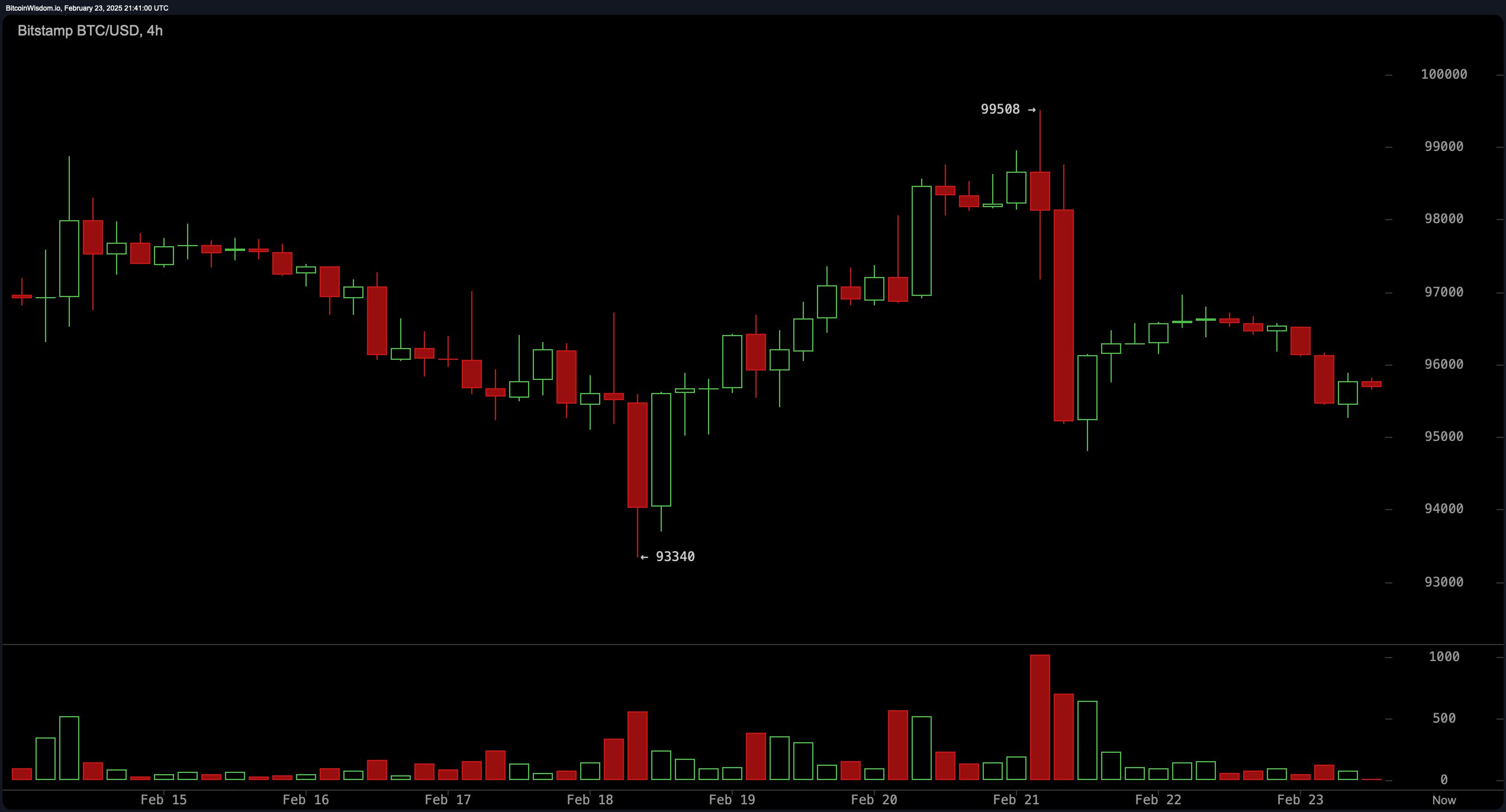

On the BTC/USD four-hour chart through Bitstamp, bitcoin tried a restoration after a drop to $93,340, rallying to $99,508 earlier than failing to maintain momentum and retreating towards $96,000. Resistance stays agency at $98,000 and $99,500, whereas help is seen close to $93,000 and $94,000. A retest of the $94,000 to $95,000 zone might present a protracted alternative focusing on $98,000. Conversely, a value breakdown under $93,000 per BTC may open the door for additional draw back towards $90,000 to $91,000.

BTC/USD through Bitstamp on Feb. 23, 2025, 4H chart.

BTC/USD through Bitstamp on Feb. 23, 2025, 4H chart.

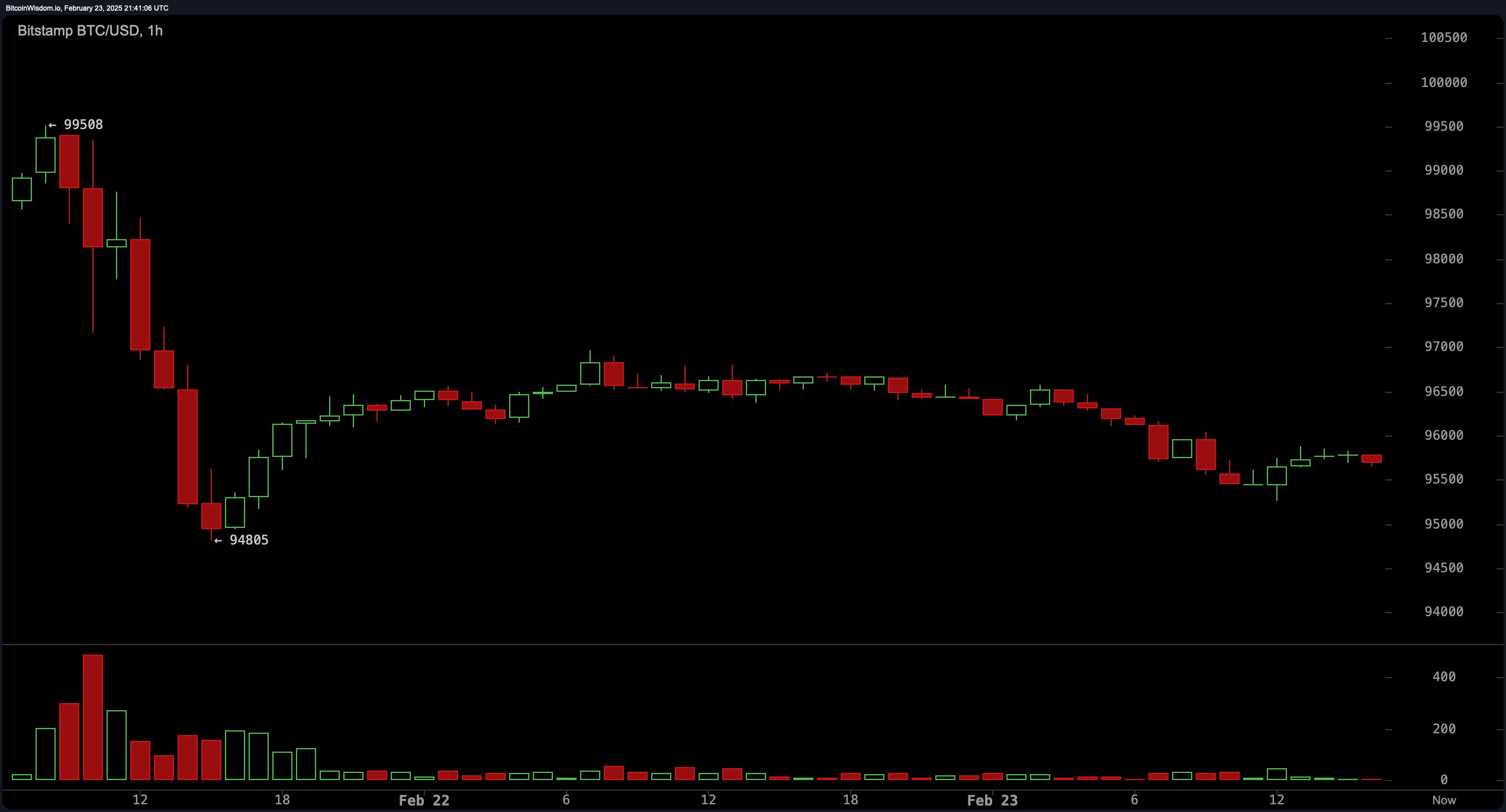

The one-hour chart highlights short-term weak point as bitcoin fell sharply from $99,508 to $94,805 earlier than stabilizing. Resistance is kind of evident at $96,500 and $98,000, whereas quick help lies between $94,000 and $95,000. Merchants might search for dip-buying alternatives round $94,500 to $95,000 with tight stop-loss ranges. A failure to reclaim $96,500 may result in renewed promoting stress, focusing on the $94,500 area.

BTC/USD through Bitstamp on Feb. 23, 2025, 1H chart.

BTC/USD through Bitstamp on Feb. 23, 2025, 1H chart.

The day by day chart’s oscillators present impartial to blended indicators, with the relative power index (RSI) at 44, Stochastic at 45, and the commodity channel index (CCI) at -100, all within the impartial territory. The momentum indicator at -932 and the shifting common convergence divergence (MACD) degree at -848 each sign upbeat situations.

Shifting averages (MAs) point out a bearish development on decrease timeframes, with the 10-period exponential shifting common (EMA) at $96,599 and the straightforward shifting common (SMA) at $96,601 each signaling gloomy situations. The 20-period and 30-period shifting averages additionally stay in depressed territory, whereas the 100-period and 200-period MAs recommend longer-term bullish potential.

Bitcoin’s quick value trajectory is determined by whether or not it might probably reclaim resistance ranges or if promoting stress resumes. A decisive break above $98,500 may pave the best way for a transfer towards $100,000 to $104,000, whereas a drop under $94,000 might improve draw back dangers towards $89,000. Merchants ought to watch quantity ranges carefully to verify the subsequent vital transfer.

Bull Verdict:

Regardless of short-term resistance, bitcoin’s capacity to carry above key help ranges, mixed with purchase indicators from the shifting common convergence divergence (MACD) and momentum indicators, suggests a possible breakout. If bitcoin reclaims $98,500 with sturdy quantity, it may set off a rally towards $104,000 to $109,000, reinforcing a bullish outlook.

Bear Verdict:

The dominance of promote indicators throughout a number of shifting averages, coupled with bitcoin’s failure to maintain larger ranges, factors to continued draw back stress. If bitcoin drops under $94,000 and breaks key help at $93,000, it may speed up losses towards $89,000, confirming a bearish continuation.