Bitcoin is buying and selling below $90,000, marking its lowest level in a month. The cryptocurrency has fallen over 7% this week, presently hovering round $88,948. Nonetheless, in line with PlanB, the creator of the Bitcoin Inventory-to-Circulate (S2F) mannequin, these worth corrections are regular in Bitcoin’s development cycles.

In a put up on X (previously Twitter), PlanB identified that again within the 2016-2017 bull market (which the present market cycle is copying), Bitcoin had a number of worth drops of greater than 30% earlier than reaching new all-time highs. The analyst backed up his claims by posting a worth chart of BTC throughout that point.

Blockchain intelligence agency Arkham reported that BlackRock lately moved $150 million value of Bitcoin to Coinbase Prime. These strikes are outflows from the IBIT Bitcoin ETF, which suggests institutional buyers is likely to be taking income. These giant transactions can add to promoting stress.

ALERT: BLACKROCK SELLING $BTC

BlackRock has transferred $150M BTC to Coinbase Prime. These are outflows from the IBIT Bitcoin ETF. pic.twitter.com/GoruDylqdk— Arkham (@arkham) February 25, 2025

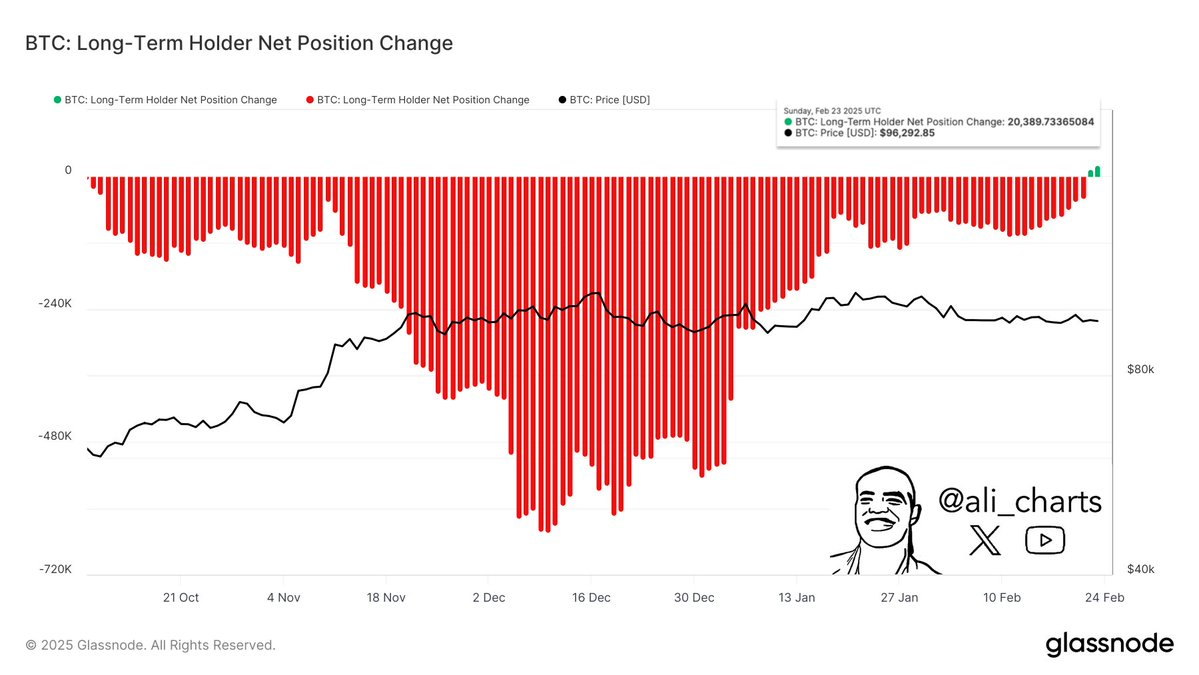

Lengthy-Time period Holders Purchase the Dip, Exhibiting Bitcoin Confidence

However, there was constructive information as effectively. Though there was a pointy worth correction, on-chain information reveals that long-term holders are shopping for extra Bitcoin throughout this dip. Analyst Ali Martinez confirmed that long-term holders have added almost 20,400 BTC. This indicators confidence in Bitcoin’s long-term worth.

Associated: Damaging Crypto Sentiment: Bitcoin’s Booster?

As well as, BitMEX founder Arthur Hayes shared his ideas on the macroeconomic and political elements affecting Bitcoin’s worth.

He means that if United States president Donald Trump fails to go his price range and debt ceiling will increase stall, we might see Bitcoin retest pre-election victory ranges between $75,000 and $70,000. He suggested buyers to attend earlier than placing their cash in crypto.

Bitcoin Value Evaluation: Technical Indicators Blended

The Relative Power Index (RSI) for Bitcoin is at 30.84, getting near oversold territory. A worth rebound would possibly occur quickly if patrons step in, but it surely’s clear that market circumstances are presently influenced by political occasions and macroeconomic circumstances.

Associated: Bitcoin Cracks Under $90,000: Market Tremors and Dealer Losses Mount

Transferring Common Convergence Divergence (MACD) indicator confirmed a bearish divergence in Bitcoin’s worth motion. The sign line (purple) crossed above the MACD line (blue), and the MACD histogram has turned purple.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be chargeable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.