Bitcoin (BTC) has gone by way of three earlier halving cycles with a comparatively clear worth sample. The availability decreased, demand surged, and Bitcoin’s worth skyrocketed afterward. Nevertheless, within the fourth halving cycle, there’s a deviation.

Information means that Bitcoin’s development trajectory now not follows the historic vary set by earlier cycles. Many trade consultants imagine Bitcoin has entered a very completely different part in comparison with earlier than.

What’s Totally different About Bitcoin’s Fourth Halving Cycle?

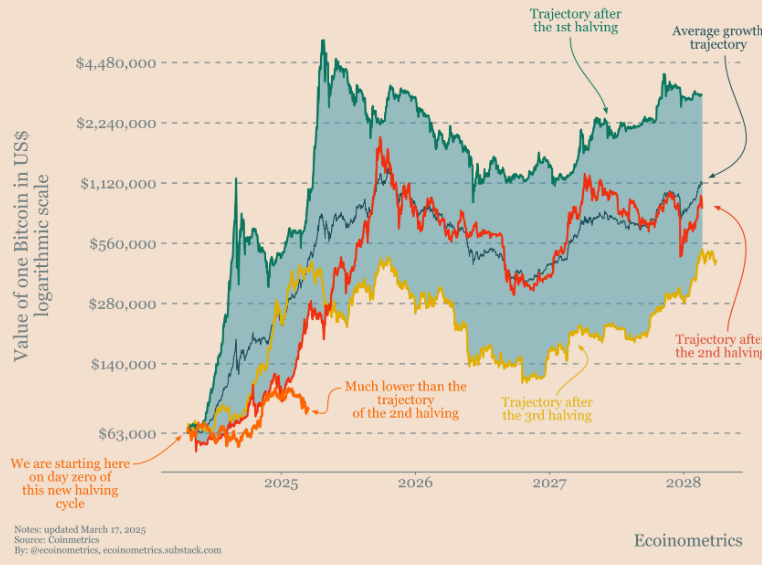

Observations from Ecoinometrics present that Bitcoin’s development fee on this cycle is considerably decrease than in earlier ones. This means that the halving occasion now not performs a central function in driving Bitcoin’s worth because it did earlier than.

If Bitcoin had been to develop equally to earlier cycles, its worth may vary from $140,000 to $4,500,000, ranging from $63,000. Nevertheless, Bitcoin is presently buying and selling at round $80,000.

Bitcoin’s Progress Trajectory After The 4th Halving. Supply: Ecoinometrics

Bitcoin’s Progress Trajectory After The 4th Halving. Supply: Ecoinometrics

“At this stage of the cycle, the decrease certain of the historic vary ought to be round $250,000.” – Ecoinometrics commented.

One other essential issue is that Bitcoin demand has dropped to its lowest stage in over a yr, in response to CryptoQuant information. The Bitcoin Obvious Demand metric compares new provide to inactive provide held for over a yr, highlighting the true demand.

Because of this though the halving occasion reduces provide, Bitcoin’s worth could wrestle to rally with out new capital inflows or sturdy investor curiosity.

Bitcoin Obvious Demand. Supply: CryptoQuant.

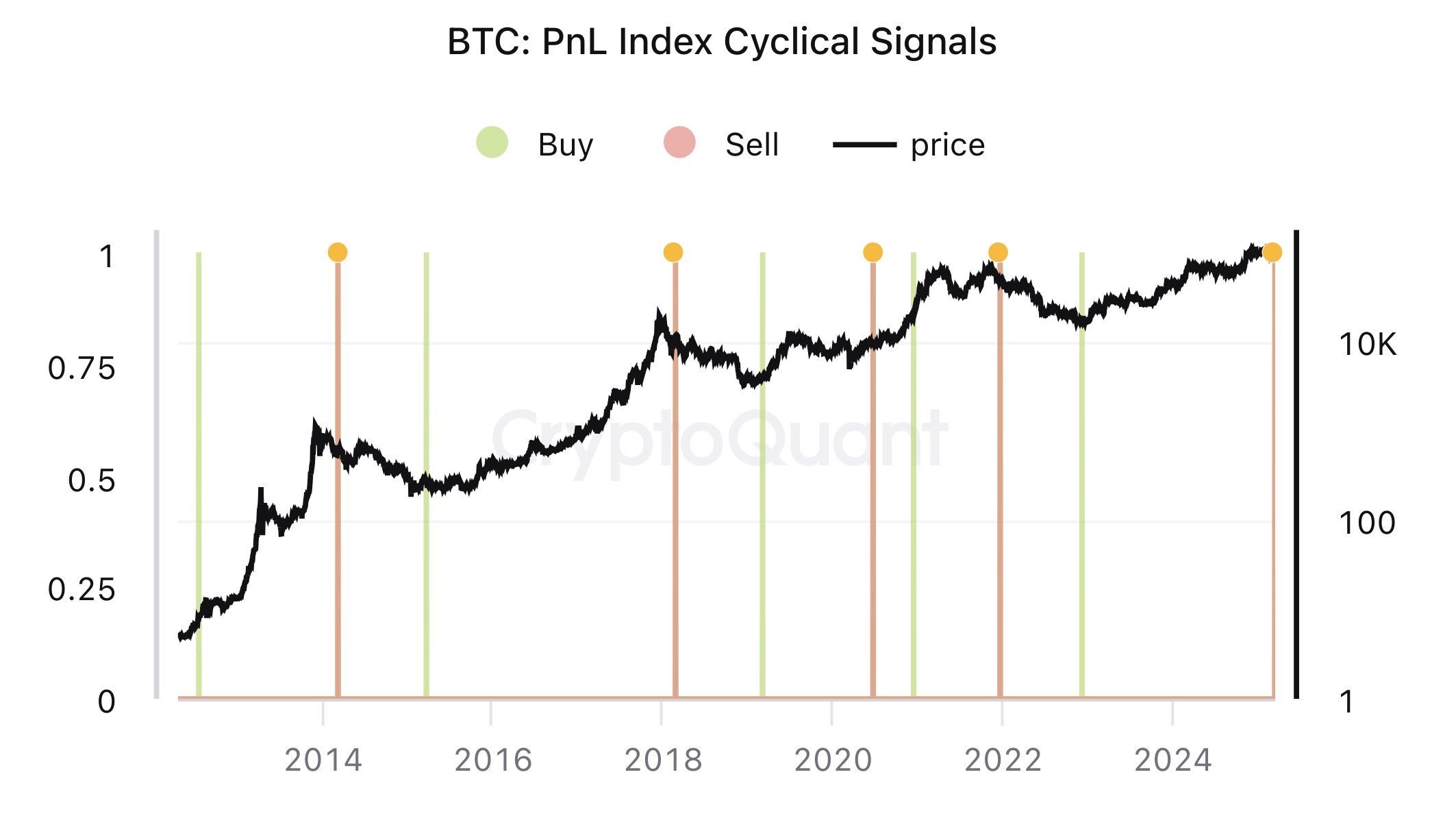

Alongside Bitcoin Obvious Demand, Ki Younger Ju, founding father of CryptoQuant, additionally analyzed the Bitcoin PnL Index Cyclical Alerts. This metric applies a 365-day shifting common to key on-chain information like MVRV, SOPR, and NUPL. It alerts “Purchase” or “Promote” at main turning factors in a big cycle relatively than short-term fluctuations.

Based mostly on this information, Ki Younger Ju predicted that Bitcoin’s bull cycle has ended.

Bitcoin PnL Index Cyclical Alerts. Supply: CryptoQuant

Bitcoin PnL Index Cyclical Alerts. Supply: CryptoQuant

“Bitcoin bull cycle is over, anticipating 6–12 months of bearish or sideways worth motion,” Ki Younger Ju predicted.

Charles Edwards, founding father of Capriole Investments, identified one other key distinction on this Bitcoin cycle. Not like the earlier one, which benefited from expansionary financial insurance policies by central banks, this time, central banks are both tightening or sustaining impartial insurance policies.

Over the past cycle, Bitcoin thrived as central banks injected liquidity into the financial system, creating a good surroundings for threat belongings like crypto. Nevertheless, the present financial stance lacks that very same supportive drive, making it more durable for Bitcoin to maintain sturdy upward momentum.

Regardless of this, Charles Edwards stays considerably optimistic. He famous that US liquidity is displaying technical indicators of a possible restoration.

Bitcoin & US Liquidity Efficiency. Supply: Charles Edwards

Bitcoin & US Liquidity Efficiency. Supply: Charles Edwards

“This Bitcoin cycle we now have largely been battling a flat financial cycle, versus final cycle’s sturdy uptrend (inexperienced). Which may be about to alter. We at the moment are seeing the primary indicators of a possible main multi-year backside in US Liquidity, with an eve/adam backside forming at the moment. It’s been nearly 4 years since tightening started. 2025 would make sense for a financial coverage pattern change amid tariff stressors. Let’s see if this new pattern can stick,” Charles Edwards predicted.

The halving cycle was as soon as a very powerful issue influencing Bitcoin’s worth. Nevertheless, present information paints a special image. Weak demand, unfavorable financial insurance policies, and knowledgeable predictions counsel that Bitcoin has entered a brand new part.

On this surroundings, macroeconomic elements and institutional capital flows will possible dictate Bitcoin’s worth tendencies greater than the halving occasion itself.