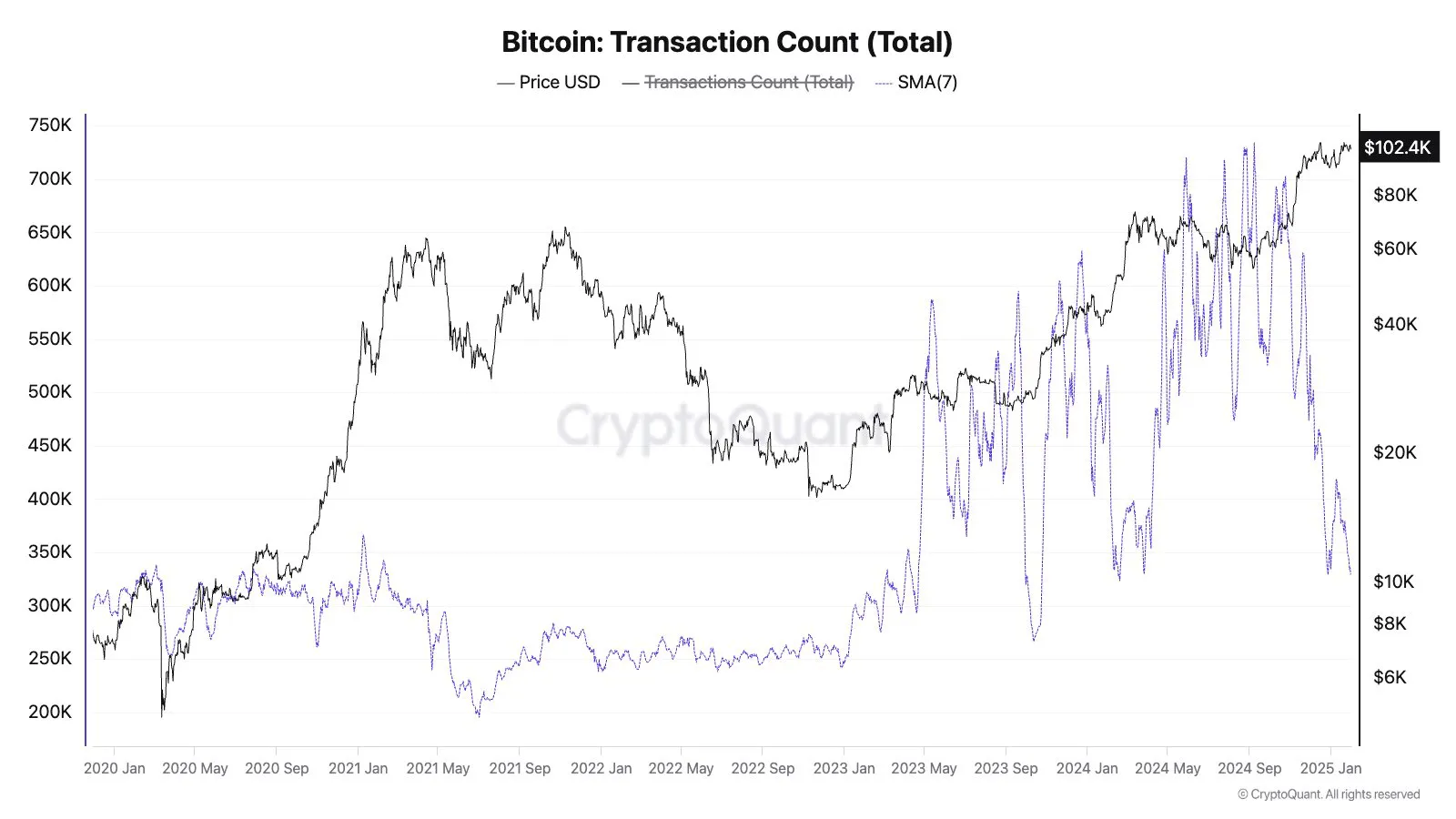

Transactions on the Bitcoin community have dropped to an 11-month low, in accordance with information from CryptoQuant. This continues the decline in community exercise that started final 12 months when the day by day transaction quantity peaked at 810,850 transactions on November 19.

CryptoQuant head of analysis Julian Moreno noticed the drop, noting that Bitcoin exercise is at its lowest since March 2024. Common day by day transactions on the Bitcoin community have fallen to round 400,000 over the previous two months.

Bitcoin community exercise is at its lowest since March 2024. (Supply: Julio Moreno)

Bitcoin community exercise is at its lowest since March 2024. (Supply: Julio Moreno)

The decline in Bitcoin transaction quantity has led to a corresponding drastic drop in community mempool utilization. A Bitcoin mempool is the cupboard space for unprocessed Bitcoin transactions earlier than miners embody them in a block.

The variety of unconfirmed transactions on the Bitcoin community has additionally fallen to round 10,000, a large drop from over 250,000 unconfirmed transactions in December 2024.

Apparently, the decline in community exercise additionally signifies that many mined Bitcoin blocks have gone with out being totally crammed. In a single excessive case, Block 881931, mined by Antpool, had solely 31 transactions and a measurement of 25.35 kilobytes (kB). That is far beneath the typical variety of transactions inside a Bitcoin block, which normally exceeds 2,000.

Transaction charges drop beneath $1 on the Bitcoin community; Miners undergo

The decline in community exercise signifies that charges on the Bitcoin community have additionally fallen, making it extraordinarily low-cost for customers to finish transactions.

Based on information from mempool area, common charges fell as little as 1 sat/vB ($0.14). Though they’ve elevated to three sat/vB ($0.42), it stays comparatively low-cost. This can be a optimistic change in tune after earlier community congestions and excessive charges that customers have complained about on the community.

Nonetheless, a draw back is that Bitcoin miners at the moment are making far much less from transaction charges, with a mean of round $2,000 per block. This provides to the stress miners have confronted because the 2024 Bitcoin halving, which diminished mining rewards to three.125 BTC.

On the time of the halving, which coincided with the launch of the Runes protocol, Bitcoin miners earned document income from transaction charges. This led stakeholders to foretell that transaction charges might substitute the mining rewards misplaced to halving.

Nonetheless, declining community exercise, which Moreno claims outcomes from the drop in hype surrounding RUNES and BRC20 tokens, signifies that miners are caught with solely mining rewards at the same time as they face near-record mining issue.

Bitcoin drops beneath $100k as Trump imposes tariffs on commerce companions

In the meantime, Bitcoin was meant to compensate for the halving by a worth improve, but it surely has struggled in that space not too long ago too. The flagship asset fell 2% within the final 24 hours after President Donald Trump introduced tariffs towards Mexico, Canada, and China.

The president imposed a 25% further tariff on imports from Mexico and Canada and elevated tariffs on Chinese language imports by 10%. This transfer triggered retaliation from the nations, with Canada imposing 25% tariffs on some US items and Mexico and China promising to take their measures. Chinese language authorities additionally plan to file a criticism with the World Commerce Group.

Issues about how these tariffs might result in inflation brought on Bitcoin to drop to $99,000 for the primary time in six days. With that, the hash worth additionally fell $58.46, additional impacting miners’ profitability.

Cryptopolitan Academy: Learn how to Write a Web3 Resume That Lands Interviews – FREE Cheat Sheet