Bitcoin (BTC) value sustains above 200-day EMA and teases a comeback rally above $90k. Will this reversal in BTC value hit the 50-day EMA?

Bitcoin bounces again to the $87,000 mark with a 24-hour surge of 4.25% because the crypto market witnesses an in a single day restoration. The restoration run in Bitcoin alerts a possible increase.

Nonetheless, the elevated value fluctuations and uncertainty available in the market and the altering international dynamics warn of a possible downfall. Amid such warnings, will the Bitcoin value preserve the restoration rally?

Excessive Volatility Drives Bitcoin to Turbulent Waves

The elevated fluctuations within the crypto market have been making large waves over the previous few days. Up to now week, the Bitcoin value has fluctuated from a low of $78,197 with a 7-day excessive of $95,152.

On March 4, Bitcoin bounced off from a 24-hour low at $81,463 to achieve a closing value of $87,240. With the elevated value fluctuations, Bitcoin fluctuates close to the 200-day EMA line.

Presently, Bitcoin is buying and selling at a market value of $87,040 with a minor intraday pullback of 0.23%.

As Bitcoin struggles to keep up dominance above the 200-day EMA line, the prevailing downfall warns of a possible bearish crossover between the 50- and 100-day EMA strains. Nonetheless, the day by day RSI line maintains a sideways shift barely beneath the midway degree.

Regardless of the continuing uncertainty and volatility, the 7-day value vary is proving essential as each help and resistance ranges. The 7-day low of $78,197 might act as an necessary help degree if Bitcoin falls beneath the 200-day EMA.

On the bullish facet, the 50-day EMA, across the $94,000 mark, might function a key overhead resistance degree.

Analyst Alerts Clear Skies Forward For Bitcoin

Bitcoin’s value motion stays unsure resulting from elevated volatility. Nonetheless, crypto analyst Ali Martinez suggests {that a} bullish rebound is feasible. Martinez highlighted Bitcoin’s tendency to get better when the loss margin hits a unfavorable 12%.

Presently, knowledge from Santiment exhibits the dealer realized value and profit-loss margin at a unfavorable 15.4%, indicating a robust chance of a bullish rebound, because the market is considerably oversold.

#Bitcoin $BTC has traditionally rebounded when the dealer loss margin reaches -12%. Proper now, it's sitting at -15.4%, signaling a possible reversal! pic.twitter.com/tzbNxY1LIp

— Ali (@ali_charts) March 4, 2025

Moreover, the analyst factors to the Bitcoin Sharpe ratio as a instrument for figuring out potential buy-the-dip alternatives.

Based on Martinez, the Sharpe ratio usually resets to a low-risk part after reaching a high-risk zone. Presently, the Sharpe ratio is present process an analogous pullback after a high-risk part.

#Bitcoin $BTC Sharpe Ratio usually resets to "Low Threat" after hitting "Excessive Threat." This may very well be the time to begin setting money apart and prepare for a possible buy-the-dip alternative! pic.twitter.com/PrDsfy3Eic

— Ali (@ali_charts) March 4, 2025

Institutional Outflows in BTC Spot ETFs Proceed

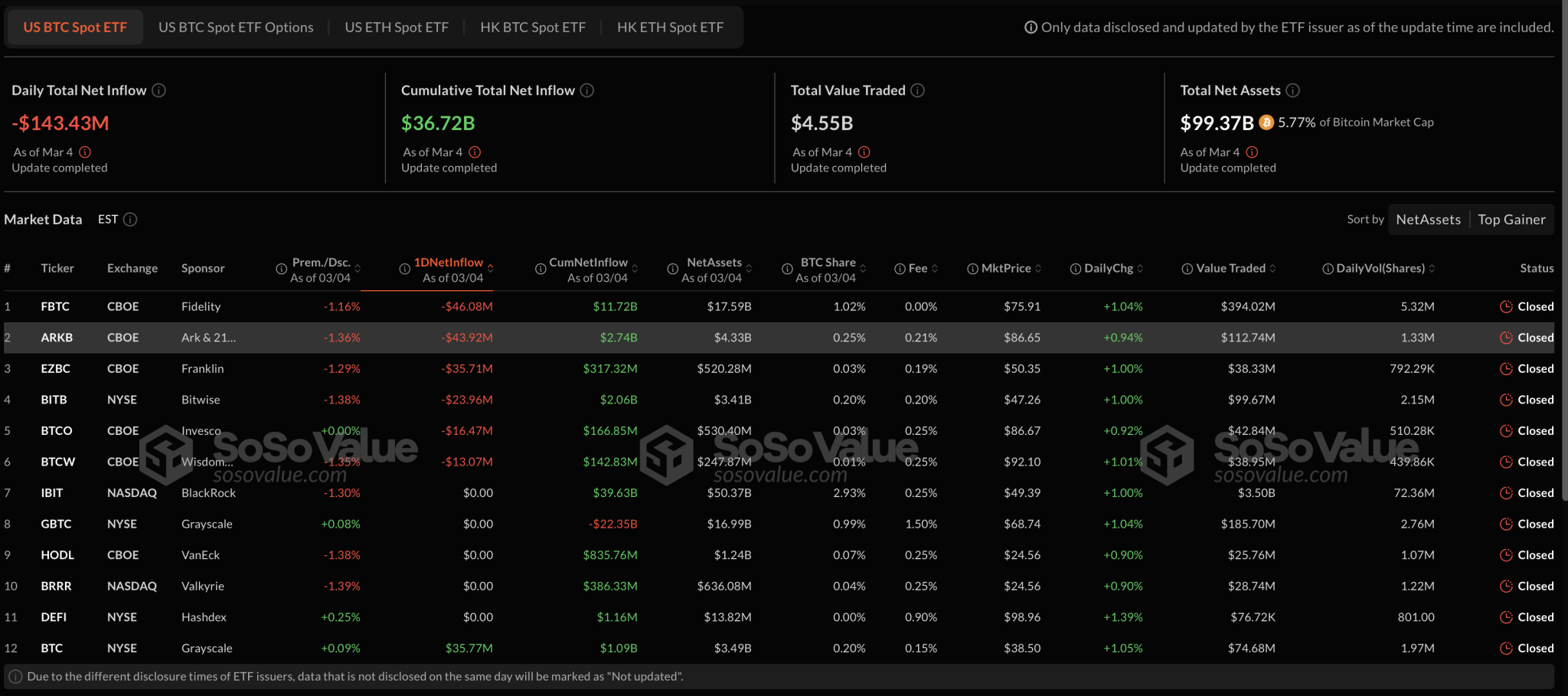

In the meantime, institutional outflow in U.S. Bitcoin spot ETFs continues on March 4. The most recent knowledge exhibits that the day by day whole web outflow on March 4 stood at $143.43 million.

Bitcoin ETFs

Bitcoin ETFs

Grayscale Bitcoin Belief was the one ETF on March 4 to document an influx, amounting to $35.77 million. Constancy led the outflows with $46.08 million, adopted by ARK and 21Shares with $43.92 million in outflows.

Franklin, Bitwise, Invesco, and WisdomTree recorded outflows of $35.71 million, $23.96 million, $16.47 million, and $13.07 million, respectively. The remaining 5 Bitcoin ETFs, together with BlackRock, reported no web outflow.