Bitcoin has been exhibiting indicators of restoration after a pointy decline that pushed its worth under $80,000 final week. The cryptocurrency briefly surged to $92,756 within the early hours of at present earlier than retracing to $90,279, marking a 0.7% enhance prior to now 24 hours.

Whereas worth motion stays risky, market sentiment indicators are signaling a vital part for Bitcoin’s trajectory, in response to CryptoQuant analyst Woominkyu.

Bitcoin’s Market Cycle: Coming into the Optimism Stage

In a current evaluation titled “FOMO is Not Right here But”, Woominkyu highlights Bitcoin’s Worry & Greed Index, which tracks general investor sentiment. The index, based mostly on a 30-day transferring common (SMA 30), maps Bitcoin’s market cycles to totally different psychological levels noticed in previous rallies.

This indicator has traditionally helped establish when Bitcoin is within the early levels of a bull run—or when extreme optimism could result in corrections.

Based on Woominkyu, Bitcoin has now entered the “Optimism Stage”, a part traditionally related to the early levels of a robust rally. In previous cycles, when Bitcoin reached this degree, the market typically gained upward momentum, resulting in additional worth will increase.

Nevertheless, the analyst warns that if the index continues rising towards the Euphoria Stage, it might point out extreme market optimism, which has typically preceded steep corrections.

The important thing commentary from Woominkyu’s evaluation is that, regardless of Bitcoin’s restoration, FOMO (worry of lacking out) has not but totally set in amongst buyers.

This means that whereas sentiment is bettering, Bitcoin isn’t but in a speculative bubble. The approaching weeks might be essential in figuring out whether or not the market follows previous patterns—transferring greater from the Optimism Stage—or if exterior elements push Bitcoin right into a correction.

Whale Exercise In The Market

Whereas sentiment indicators present insights into market psychology, whale exercise is one other key issue influencing Bitcoin’s worth motion.

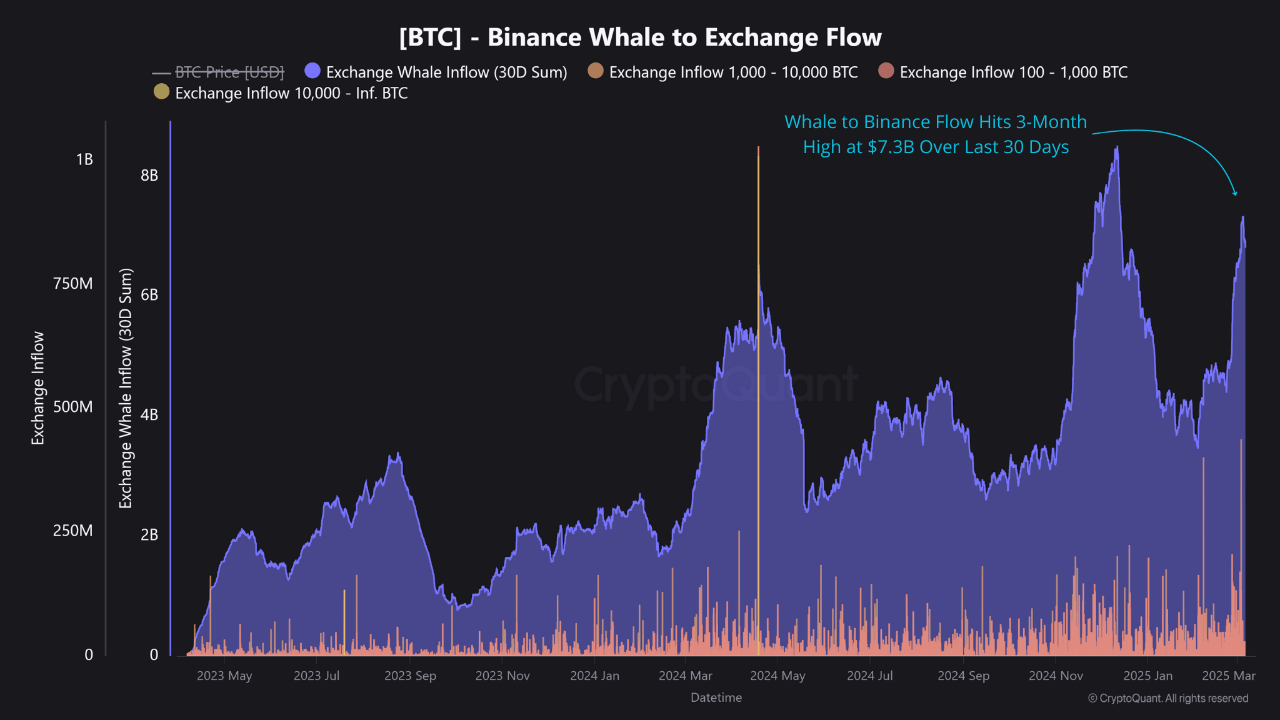

A separate evaluation by maartunn, one other CryptoQuant contributor, has revealed that whale deposits to Binance have reached a three-month excessive, with over $7.3 billion price of Bitcoin despatched to the trade prior to now 30 days.

These actions counsel that large-scale buyers are actively positioning themselves, which might result in elevated volatility available in the market. Traditionally, vital whale exercise has coincided with main worth swings, making it an necessary metric to watch.

Whale to Binance Movement Hits 3-Month Excessive at $7.3B Over Final 30 Days

“This typically occurs alongside heavy modifications in worth and exhibits that enormous holders select Binance as their trade. Watching whale deposits is necessary, as their strikes can drive the market.” – By @JA_Maartun pic.twitter.com/psD3zuDXf3

— CryptoQuant.com (@cryptoquant_com) March 6, 2025

Featured picture created with DALL-E, Chart from TradingView