Bitcoin simply collapsed to $80,000, wiping out over $200 billion from the crypto market in one of many worst single-day crashes over the previous 12 months, in line with information from CoinGecko.

Ether additionally crashed, tumbling under $2,000 to commerce at $1,992, a degree we haven’t seen in over six months. The sudden sell-off got here after Donald Trump signed an Government Order on Thursday, formally launching the Strategic Bitcoin Reserve—a choice you’d anticipate would increase costs, not tank them.

Supply: Jai Hamid/TradingView

Supply: Jai Hamid/TradingView

Friday’s White Home Crypto Summit was set to be the massive occasion, however Trump threw a curveball by asserting the reserve forward of schedule. Merchants have been betting on a bullish rally, however as an alternative, Bitcoin dropped from $90,000 to $85,000 inside minutes of the announcement.

The market response was brutal, with choices merchants unwinding lengthy positions, volatility spiking, and put contracts gaining demand as merchants scrambled to hedge in opposition to deeper downsides, per information from Coinglass.

Trump’s Bitcoin Reserve triggers sell-off as an alternative of rally

The Government Order confirms the US authorities’s plan to stockpile Bitcoin, however there’s a catch—there’s no new funding for purchases but. The preliminary reserves can be constructed utilizing Bitcoin seized from legal or civil asset forfeitures, which implies no quick demand strain.

Scott Bessent, the Treasury Secretary, and Howard Lutnick, the Commerce Secretary, have been given the job of determining “budget-neutral” methods so as to add extra Bitcoin to the reserve with out costing taxpayers a dime.

That wasn’t what merchants wished to listen to. The market was on the lookout for aggressive authorities shopping for, not only a relabeling of outdated holdings. With no

signal of recent demand, the sell-off gained momentum.

As buying and selling firm QCP defined in its Friday Telegram observe, danger reversals within the crypto market flipped, which means merchants began pricing in additional draw back danger than upside potential, which solely made the crash worse.

Recession fears and US debt disaster gas the hearth

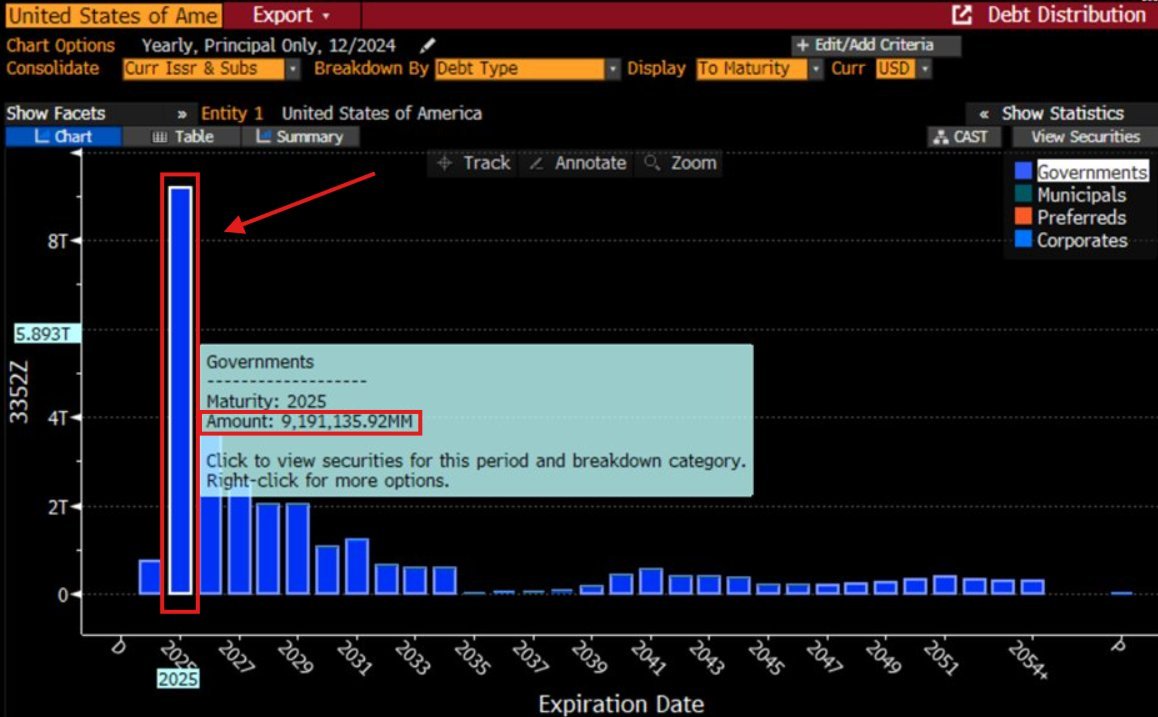

In the meantime, the broader financial image is wanting worse by the day, and merchants are bracing for a recession. The US is observing a $9.2 trillion debt refinancing drawback in 2025, with most of that debt maturing between January and June. The federal government wants decrease rates of interest—badly.

The simplest technique to get them? A recession.

Over the past two months, the 10-year Treasury yield has dropped by 60 foundation factors, an indication that markets are pricing in financial hassle.

Elon Musk’s Division of Authorities Effectivity (DOGE) has been working arduous at spending cuts with a goal of $2 trillion, however these guys aren’t working quick sufficient to repair the debt drawback.

President Donald Trump has been pushing for decrease oil costs to battle inflation, even calling on OPEC to drop costs. However the quickest technique to kill inflation? A recession that crushes demand.

That’s why merchants are holding an in depth eye on the Atlanta Fed, which just lately slashed its Q1 2025 GDP development estimate to -2.8%, in line with an evaluation from The Kobeissi Letter.

Markets have been anticipating the Federal Reserve to chop charges sooner or later throughout the first half of 2025, however inflation retains getting in the way in which.

Supply: Adam Kobeissi X/Twitter

Supply: Adam Kobeissi X/Twitter

US shopper expectations for inflation simply jumped to six.0% over the subsequent 12 months, the very best since Might 2023. That’s the third straight month of rising inflation expectations—an issue for rate-cut hopes.

Trump doesn’t even care concerning the inventory market anymore. As Cryptopolitan reported on March 6, he mentioned, “I’m not watching the market,” although throughout his first time period, he was obsessive about it. That’s not simply an offhand remark—it’s a message. Wall Avenue is by itself.

Bitcoin braces for $75K as liquidation dangers improve

With Bitcoin now at $80,000, merchants are already wanting on the subsequent hazard zone—and it’s ugly. Based on Arthur Hayes, the co-founder of BitMEX, issues might get so much worse earlier than they get higher.

“An unsightly begin to the week. Seems like BTC will retest $78K. If it fails, $75K is subsequent within the crosshairs. There are lots of choices open curiosity at $70K-$75K, and if we get into that vary, it will likely be violent,” Arthur warned in a submit on X.

In the meantime, CryptoQuant information reveals that Bitcoin change reserves are dropping quickly, which implies there’s a potential provide shock—however proper now, that doesn’t matter. When the market is in freefall, supply-side fundamentals take a backseat to sheer panic promoting.

However whereas most merchants are operating for the exits, President Nayib Bukele is shopping for the dip. El Salvador, which has been steadily accumulating Bitcoin, purchased 5 extra BTC immediately—up from its regular 1 BTC day by day buy.

Solely factor that’s gonna save these markets now could be a charge minimize, and the one manner we’re gonna get that’s via a recession. Buckle up, of us.