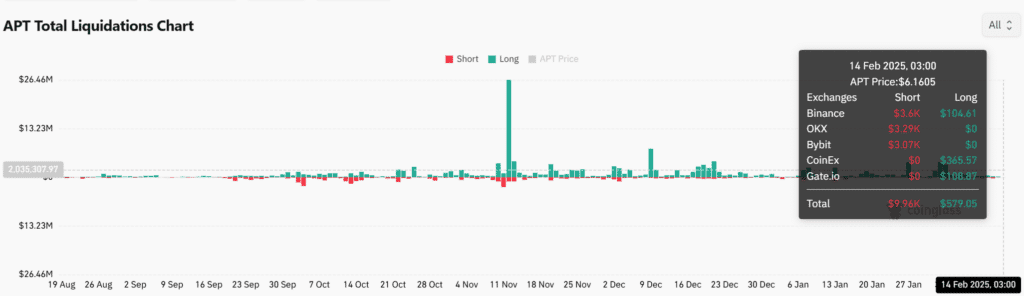

- Aptos lately noticed $9.96 million in brief liquidations, doubtlessly fueling upward momentum.

- APT’s open curiosity rose 9.30% to $165.65 million, reflecting heightened exercise in derivatives markets.

Aptos (APT) value has proven some latest potential to purchase, primarily based on the TD Sequential indicator of its weekly chart. This could imply that the cryptocurrency is doubtlessly organising for a major comeback. However whether or not it should occur or not stays questionable.

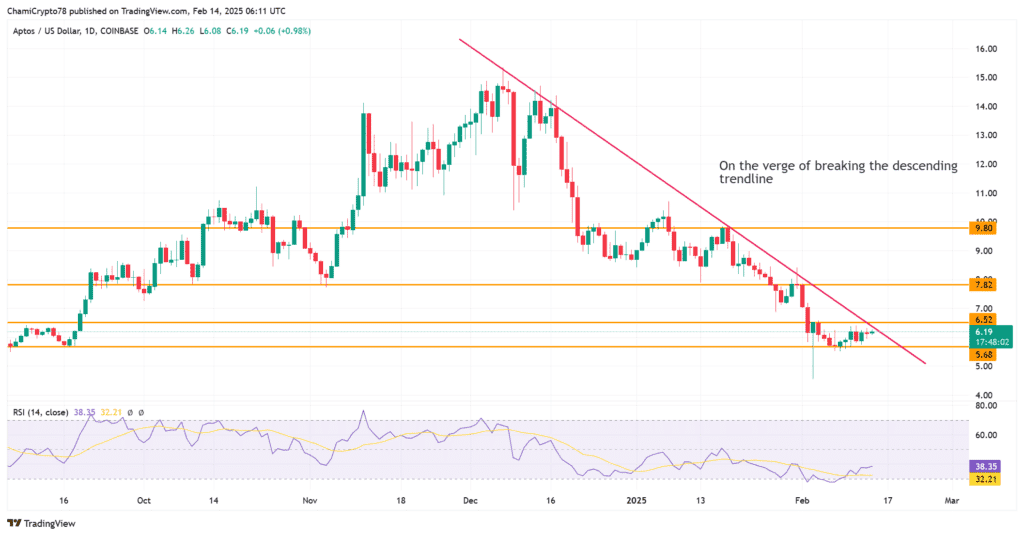

Crucial Resistance Ranges Can Decide Aptos Worth’s Future Motion

Aptos value has seen vital fluctuations over the previous few months. Having peaked at $9.80, it has not been in a position to preserve upward stress and is now buying and selling round $6.19. If the token is ready to overcome its fast resistance, it could rally in direction of $7.82, with a possible retest of its former excessive of $9.80.

On the destructive aspect, a failure to breach these resistance ranges may even see a pullback with key help at $5.68. The approaching buying and selling periods can be instrumental in establishing if Aptos can get away of its consolidation sample and begin a extra bullish development.

The Relative Energy Index (RSI) of Aptos is at the moment at 38.35, which suggests it’s heading in direction of oversold ranges. This indicator implies that if the shopping for stress rises, APT would possibly witness a strong bounce again.

Market Developments & Sentiment Might Form Subsequent Worth Motion

Aptos token has seen liquidations surge by about $9.96 million lately. Apparently, most of them have been brief positions stunned by the worth improve. As increasingly more brief positions get liquidated, additional shopping for momentum might consequence, which can push APT upward within the brief time period. Moreover, as talked about within the earlier story, the Aptos Community is now increasing quick, with over 16 million energetic customers.

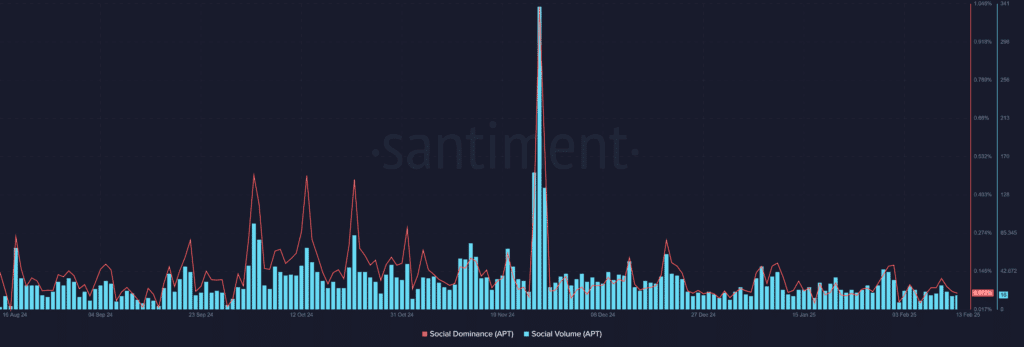

Nonetheless, one worrying facet is the lower in social exercise across the token. Social Quantity lately reached a mere 16 mentions, whereas Social Dominance has fallen to 0.072%. This means waning curiosity from merchants and buyers, which can impede APT’s progress in protecting its rally going. Renewed enthusiasm can be essential in preserving its latest value momentum.

Nonetheless, one worrying facet is the lower in social exercise across the token. Social Quantity lately reached a mere 16 mentions, whereas Social Dominance has fallen to 0.072%. This means waning curiosity from merchants and buyers, which can impede APT’s progress in protecting its rally going. Renewed enthusiasm can be essential in preserving its latest value momentum.

Whereas Aptos has flashed a purchase sign, its skill to keep up momentum relies on breaking key resistance ranges and reigniting market curiosity. If it could overcome these hurdles, the APT value might lengthen its good points. Nevertheless, with out elevated shopping for stress and improved sentiment, the rally might battle to carry. The approaching days can be crucial in figuring out whether or not APT can set up a sustained uptrend.

As of writing, the Aptos value was up by 0.42% to $6.12 on Friday, February 14. While, the market capitalization hit $3.59 billion. Nevertheless, the buying and selling quantity for APT plunged 26.47% to $183.53 million within the final 24 hours.

In the meantime, complete liquidations reached $171,153, in response to Coinglass stats. Lengthy liquidations amounted to $126,590, signaling vital promote stress. Nonetheless, APT value stands robust as open curiosity of 9.30% to $165.65 million, indicating surging curiosity amongst derivatives merchants.