Bitcoin prices are sliding, but luxury watches are quietly moving in the opposite direction.

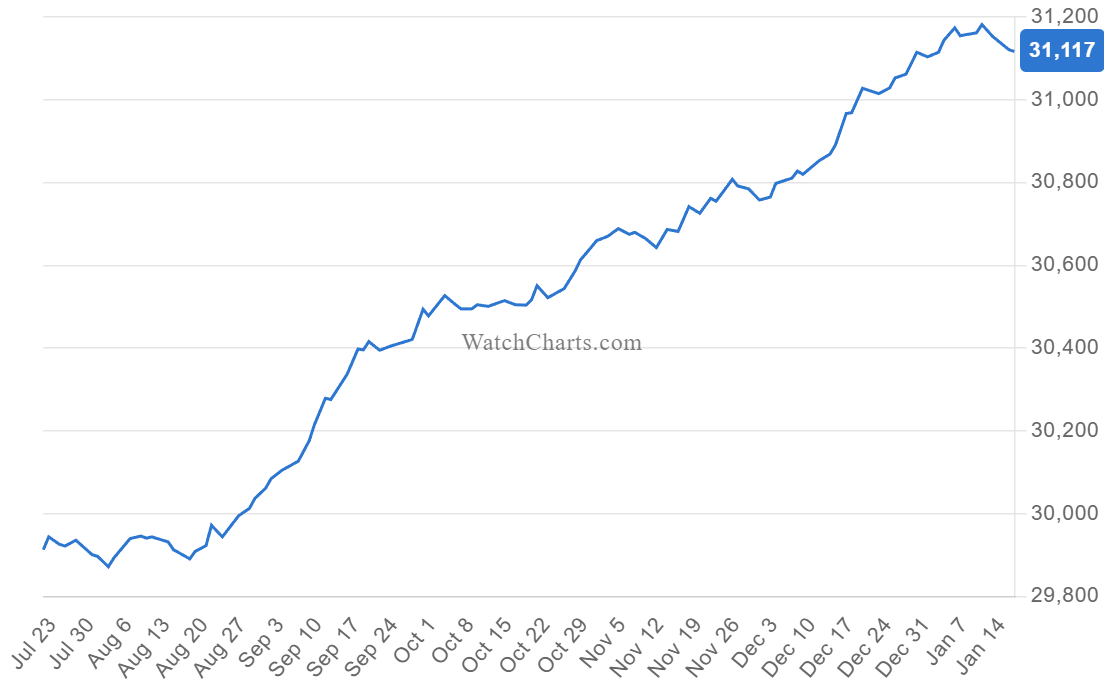

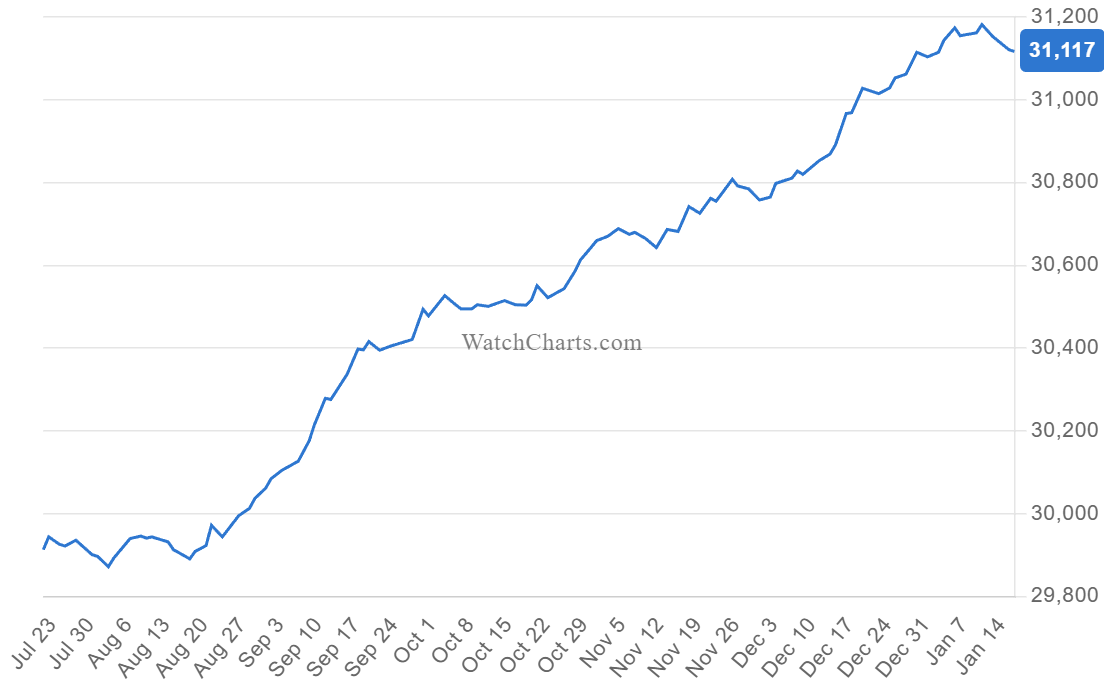

Over the past six months, BTC has fallen about 25% and the CoinDesk 20 is down more than 30%, even as secondary market watch prices have risen roughly 4%, according to WatchCharts data.

The WatchCharts index, which tracks secondary market prices for thousands of luxury watch references across major brands, is up about 4% over the past six months as prices for top-tier watches inch higher. Over the same period, crypto markets have moved sharply in the opposite direction.

WatchCharts Overall Market Index (WatchCharts)

WatchCharts Overall Market Index (WatchCharts)

In a recent report co-authored with WatchCharts, Morgan Stanley said the rise in secondary watch prices reflects stabilization rather than a renewed boom.

After two years of declines, the bank said downside pressure eased in late 2025 as excess inventory cleared, forced selling faded, and sellers became less willing to cut prices further. At the same time, luxury watchmakers raised global retail prices by roughly 7% since early 2025, helping anchor resale values even as transaction volumes remained subdued.

That stabilization stands in sharp contrast to what played out a year earlier.

In 2024, luxury watches and crypto began moving in opposite directions for the first time since the pandemic, breaking a long-running correlation fueled by easy money and speculative excess. As bitcoin surged on anticipation and approval of spot ETFs, watch prices continued to slide under the weight of tighter financial conditions and fading retail speculation.

The recovery has since been narrowly concentrated in brands with genuine pricing power, notably Rolex, Patek Philippe, and Audemars Piguet, while most other brands continue to trade at deep discounts, according to the report. Morgan Stanley also pointed to the growing role of controlled secondary channels, particularly Rolex’s certified pre-owned program, as a stabilizing force that has reduced volatility and supported prices at the top end of the market.

All this comes as gold and silver have surged as investors push macro stress into physical scarcity assets, leaving crypto conspicuously sidelined. Gold is up nearly 70% since early 2025, and silver is up about 150%, with tight physical supply, industrial demand, and policy risk driving volatility higher in metals markets.

The split suggests investors are no longer treating crypto, watches, and metals as interchangeable bets, but are increasingly differentiating between fast-moving financial assets and slower, physical stores of scarcity as macro pressure builds.