JPMorgan’s sudden shutdown of a prominent bitcoin executive’s bank accounts is igniting fierce debate as the clash between traditional finance controls and fast-growing crypto-payment rails accelerates with high-stakes implications.

JPMorgan Account Closure Ignites Crypto-Finance Tensions

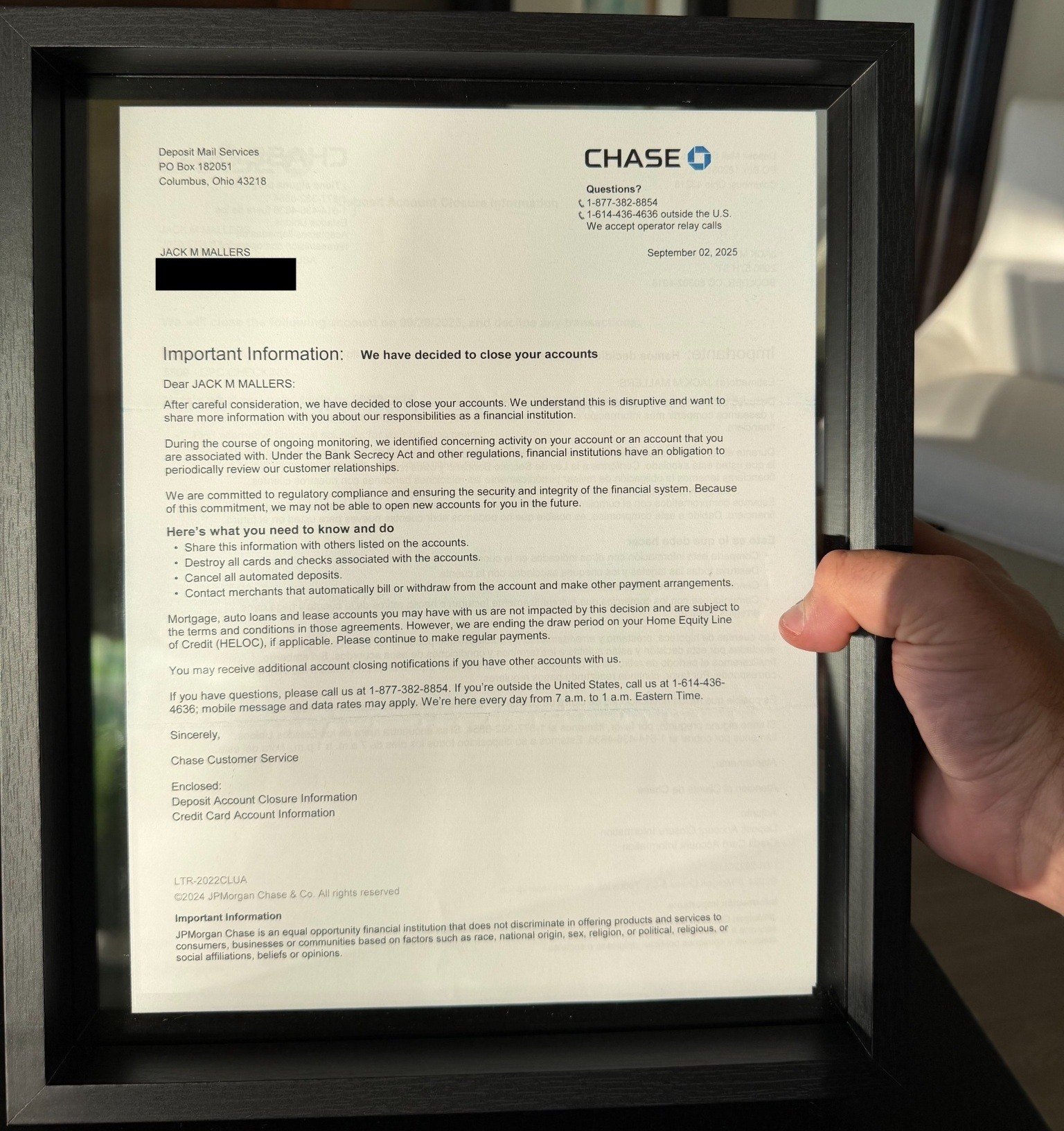

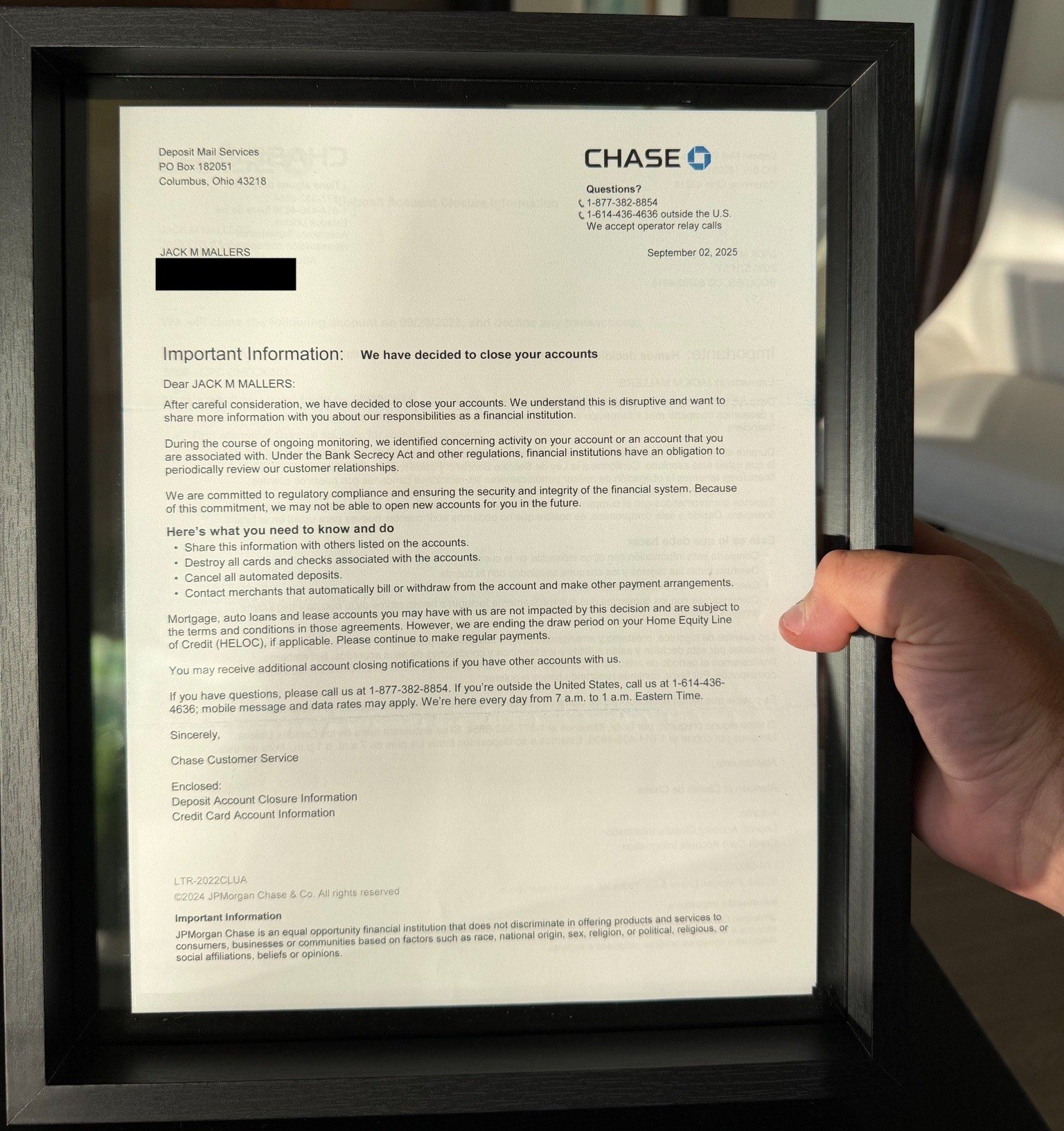

Jack Mallers, CEO of bitcoin payments company Strike, shared on social media platform X on Nov. 23 that JPMorgan Chase & Co. (NYSE: JPM) recently closed his accounts after the bank said its monitoring identified concerning activity. He said that he could not obtain any explanation.

Mallers explained:

Last month, J.P. Morgan Chase threw me out of the bank. It was bizarre. My dad has been a private client there for 30+ years. Every time I asked them why, they said the same thing: ‘We aren’t allowed to tell you.’

In another X post, he stated he was so proud of the letter that he framed it. “A proud moment. So proud I got it framed,” the Strike CEO wrote.

Image of JPMorgan’s letter shared by Jack Mallers. Source: Jack Mallers

Image of JPMorgan’s letter shared by Jack Mallers. Source: Jack Mallers

JPMorgan Chase’s Sept. 2 letter stated that its review identified “concerning activity” on Mallers’ account or on an account he was associated with. It said federal requirements under the Bank Secrecy Act obligated it to report certain activity and that this was part of its responsibility to maintain the integrity of the financial system. The correspondence instructed him to destroy cards, stop automated deposits, cancel automatic payments, and arrange alternative billing. It also noted that although mortgage and auto obligations were unaffected, the draw period on his home equity line of credit would end and regular payments must continue. Strike, the company he leads, enables international transfers using fiat rails and the Bitcoin Lightning Network for faster, lower-cost settlement.

Read more: JPMorgan Back in the Hot Seat as Debanking and DeFi vs. TradFi Rivalries Resurface

The notice warned that the bank may decline to open new accounts for him and that he could receive additional closure communications if he holds other products. It reinforced that JPMorgan Chase would not disclose further details and emphasized its compliance duties. Mallers described the decision as unexpected, given his family’s decades-long relationship with the institution.

His case adds to broader debates about debanking, which critics view as opaque and difficult to challenge. Supporters of crypto argue that bitcoin and ethereum offer transparent, auditable settlement rails that can strengthen oversight, reduce intermediaries, and improve regulatory visibility.

FAQ ⏰

- Why did JPMorgan close Strike CEO Jack Mallers’ accounts?

The bank cited “concerning activity” but declined to give Mallers any specific explanation. - What did the closure letter instruct Mallers to do?

It told him to destroy cards, cancel payments, halt deposits, and arrange alternative billing. - How does Strike factor into the debate?

Strike uses fiat and the Bitcoin Lightning Network, highlighting crypto’s alternative settlement potential. - What broader issue does Mallers’ case highlight?

His experience fuels ongoing disputes over debanking and transparency in traditional financial institutions.