Meta (NASDAQ: META) shareholders have overwhelmingly rejected a proposal to allocate a portion of the company’s cash into BTC despite a push by some Wall Street players and the Trump administration’s support for BTC treasuries.

In a recent Securities and Exchange Commission (SEC) filing, the social media giant revealed that the proposal only received 3.9 million votes in support, with over 4.98 billion votes rejecting it. Of the 14 proposals tabled before the investors, BTC treasury received the least support as Meta investors bucked a trend by some companies in the United States and beyond to hold BTC as a hedge against inflation.

The overwhelming rejection indicates that even founder Mark Zuckerberg, who has been described as a digital asset enthusiast, voted against the proposal. While Zuckerberg only holds a 14% stake in the company, he controls 61% of the voting power, giving him a de facto veto on all major corporate motions.

The other three largest shareholders are Vanguard, BlackRock (NASDAQ: BLK), and Fidelity, who control 8% of the voting power combined. Despite BlackRock and Fidelity being the two largest BTC exchange-traded fund (ETF) providers, they also rejected the proposal.

The proposal was introduced in January by Ethan Peck, who works for the National Center for Public Policy Research, a Washington-based conservative think tank.

In his proposal, Peck claimed that Meta was losing 28% of the value of its cash assets to inflation and suggested BTC as the best solution. He also subtly accused Zuckerberg and Marc Andreessen—a Meta director and the founder of the BTC investor Andreessen Horowitz—of denying Meta investors a chance to enjoy market-beating returns.

“Do Meta shareholders not deserve the same kind of responsible asset allocation for the Company that Meta directors and executives likely implement for themselves?”

Peck submitted similar proposals to Microsoft (NASDAQ: MSFT) and Amazon (NASDAQ: AMZN). Microsoft shareholders voted against the proposal last December, with the tech giant’s board describing it as “unwarranted.” Even a 3-minute presentation to the board by Strategy founder Michael Saylor, in which he claimed Microsoft had lost $200 billion in five years by not investing in BTC, couldn’t sway them.

The $86 billion BTC treasury campaign

While Meta rejects the proposal, over 100 other listed firms have aped in. According to one platform tracking the BTC treasuries, 124 public companies now hold 818,000 BTC, worth $86 billion at current prices.

On Friday, Japanese firm Metaplanet (NASDAQ: MTPLF) announced it would raise $5.4 billion in “the largest stock acquisition rights issuance in Japan” to purchase more BTC.

*Metaplanet Issues 555 Million Shares of Moving-Strike Warrants, Expected Proceeds: ~$5.4b to Buy Additional $BTC; Largest Stock Acquisition Rights Issuance in Japan Capital Markets History & 1st Moving Strike Warrant Ever Issued Above Market* pic.twitter.com/ZgwiRE3GmU

— Metaplanet Inc. (@Metaplanet_JP) June 6, 2025

Strategy (NASDAQ: MSTR) remains the market leader, holding 580,000 BTC, worth $61 billion (its overall market cap is $104 billion; BTC holdings are worth 60% of its value). The company has shifted its business model from being a software firm to a BTC investment vehicle.

Others have joined the bandwagon. Metaplanet, for instance, now fully identifies as a “Bitcoin Treasury Company,” veering off from its original real estate and hospitality business.

The risks abound. For starters, these companies use convertible notes to raise the money to purchase the BTC. If the price of BTC and their stock prices dip, the holders of the convertible notes would demand their cash back, which would force these companies to dump their BTC, kickstarting a spiral that further decimates the digital asset’s price.

B2B payments surge 288% as stablecoins rise continues

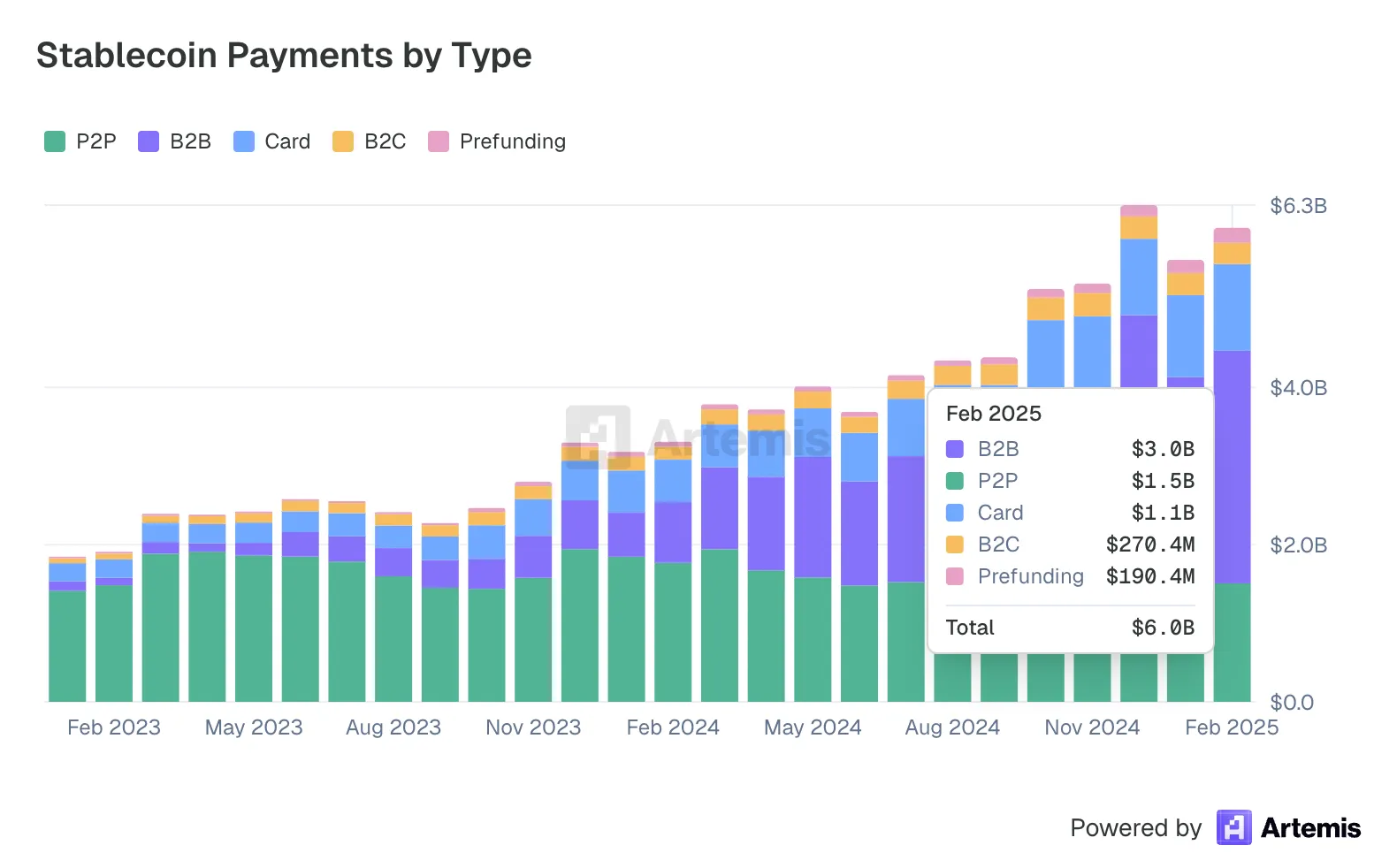

Elsewhere, a new report has revealed that real-world stablecoin payments are growing steadily, with business-to-business (B2B) payments surging 288% year over year.

The report by blockchain analytics firm Artemis revealed that B2B accounted for $3 billion in stablecoin payments, the largest share ahead of peer-to-peer (P2P) at $1.5 billion and card at $1.1 billion.

Source: Artemis

Source: Artemis

USDT dominates stablecoin transfers, accounting for 86.1% of the payments in February and 90% in January, with USDC sitting second. In some economies like Spain, Germany, Japan and South Korea, its dominance topped 98%.

The USDT dominance in payments far exceeds its share of the total stablecoin market cap, which stands just over 60%.

The report further revealed that the United States accounts for nearly 20% of all stablecoin payments, the highest share globally. However, Singapore was a surprisingly close second, accounting for nearly twice as much as third-placed Hong Kong. Japan and the United Kingdom complete the top five.

Additionally, the Singapore-China corridor emerged as the most active globally. However, the next seven largest corridors all involved the U.S.

“Stablecoins fulfill the vision that a generation worth of fintech entrepreneurs having been building towards – collapsing the gap between antiquated financial rails and our digitally native lives through the use of fully programmable internet money,” commented Rob Hadick, whose Dragonfly’ crypto’-focused VC also contributed to the report.

Watch: Richard Baker on engineering a smarter financial world with blockchain