Impartial market technician Dom (@traderview2) has drawn the crypto neighborhood’s eye to an unconventional however more and more watched ratio: XRP priced in West Texas Intermediate crude.

The Hyperlink Between XRP And USOIL

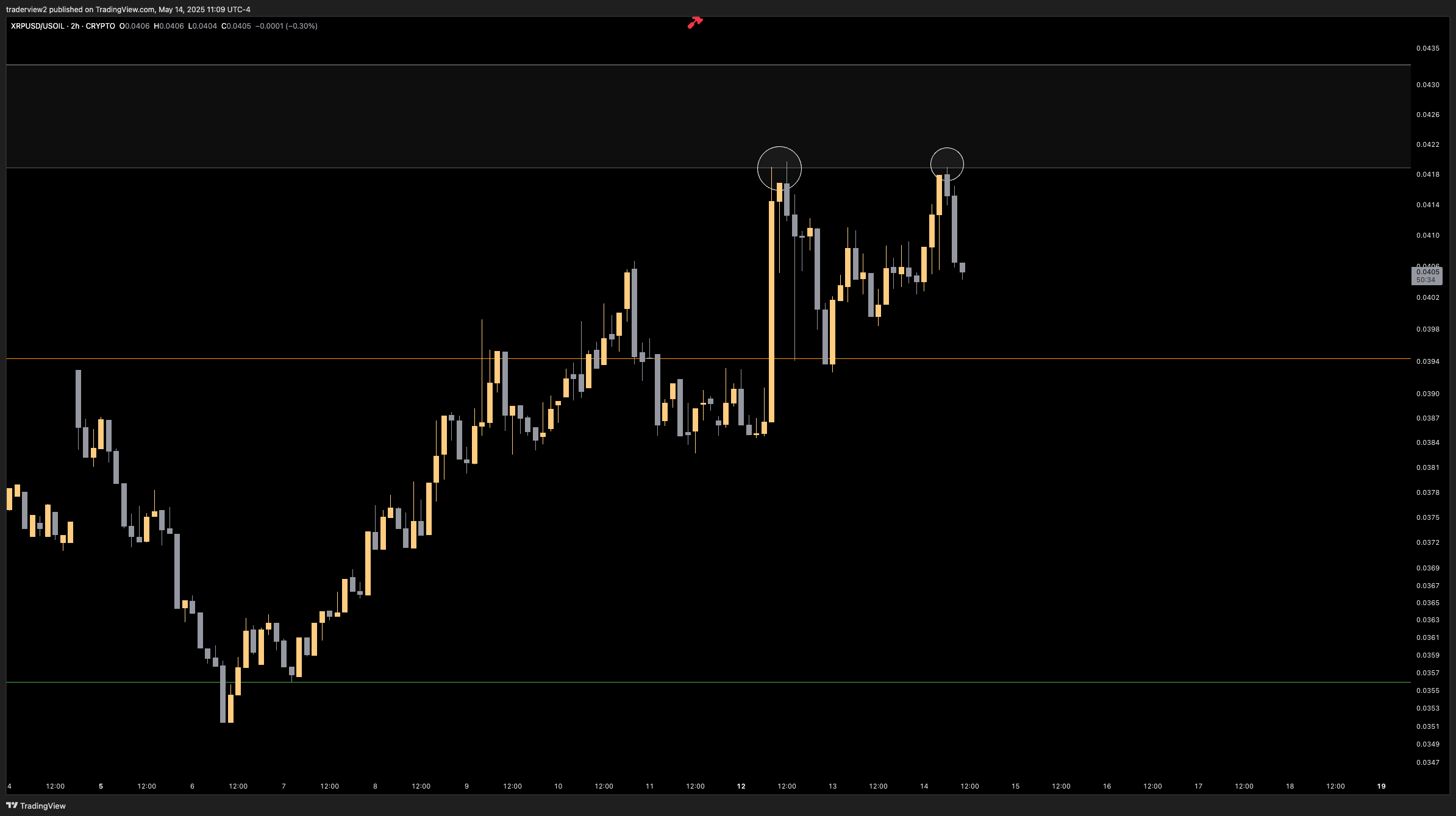

In a two-hour TradingView screenshot posted on 14 Might, the analyst exhibits the XRP/USOIL pair fading—twice—in the very same resistance shelf that has capped value motion since mid-December. “Final evening we tapped the five-month vary excessive once more and value rejected completely,” he wrote, including that “it’s wonderful how a lot we’re respecting this degree because it provides a transparent zone bulls want to completely regain for the subsequent impulse larger.”

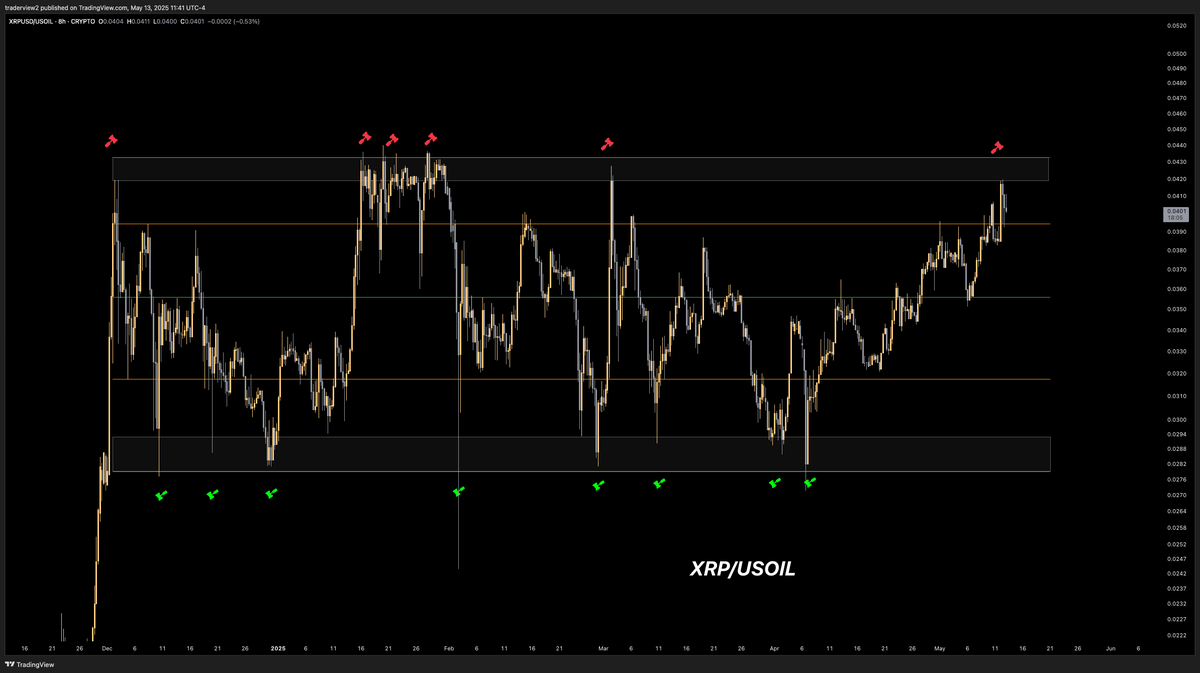

Since December final 12 months, the XRP value has been hammered down six occasions in the very same resistance space. On Might 13, Dom wrote: “ May you ask for a cleaner vary? This chart ought to be in a textbook… We all know the significance of this vary excessive. If it breaks, the chance $XRP goes to a brand new ATH goes up drastically. We all know what occurred proper after BTC / USOIL hit it’s ATH 2 weeks in the past, I’d anticipate one thing comparable right here. Persistence, this wants steam to breakout right here.”

That ceiling is circumscribed on Dom’s chart by a charcoal-grey block from roughly 0.0418 to 0.0430. Every of the final two probes into the band—one throughout Asian commerce on 12 Might, the second in the course of the New-York session on 14 Might—produced sharp draw back wicks.

Momentum, furthermore, is flowing towards heavy promote stress within the spot token. Citing on-chain order-flow analytics, Dom highlighted that “$210 million of XRP has been net-market-sold over the previous seven days—regardless of this, XRP is up twenty %.” He argues that such divergence implies absorption by skilled liquidity suppliers moderately than retail exuberance: “Market makers or whales are possible absorbing aggressive asks by passive restrict bids. When that dynamic persists, it normally precedes an explosive upside as soon as sellers exhaust themselves.”

Group members rapidly requested what a definitive breakout might portend for XRP priced in {dollars}. One follower, The Commonplace (@Xrpdemon589), pressed: “Would you say if it breaks it, it should have one other parabolic transfer up breaking ATH?” Dom responded, “If we see a full breakout, traditionally sure, it’s solely time till XRP/USD prints a brand new excessive.”

Crypto commentator Moon Lambo (@MoonLamboio) queried the mental foundation for linking an energy-based ratio to the standalone token. Dom conceded no elementary thesis is confirmed, however pressured the analytical utility: “I actually simply suppose it supplies one other perspective of value motion once we peg it to one thing deeply woven into the financial system. I don’t suppose there may be any particular relationship—moderately, it’s helpful to see belongings you wouldn’t in any other case see on the USD pair.”

Technically, the map is binary. Dom reiterated that he has “alerts set for a full breakout” above 0.0418–0.0430; any two-hour shut in that area would, in his view, represent decisive vary growth and “give bulls the runway for the subsequent impulse larger.” Ought to patrons as an alternative relinquish the amber pivot at 0.0394, the door reopens to 0.0378 minor assist, with a break there exposing the 0.0357 ground and negating the present collection of upper lows.

Till both boundary yields, XRP/USOIL stays in its five-month field, however the very act of watching the pair, Dom contends, sharpens merchants’ macro lens. “BTC, USOIL, XRP—combining them is simply one other solution to triangulate liquidity,” he wrote. “Generally the sting is solely seeing the identical market from a barely totally different angle.”

At press time, XRP traded at $2.46.

Featured picture created with DALL.E, chart from TradingView.com