Bitcoin traded at $84,222 on March 15, 2025, with a market capitalization of $1.67 trillion, a 24-hour international commerce quantity of $25.99 billion, and an intraday worth vary between $82,705 and $85,139, exhibiting indicators of potential consolidation amid combined technical indicators.

Bitcoin

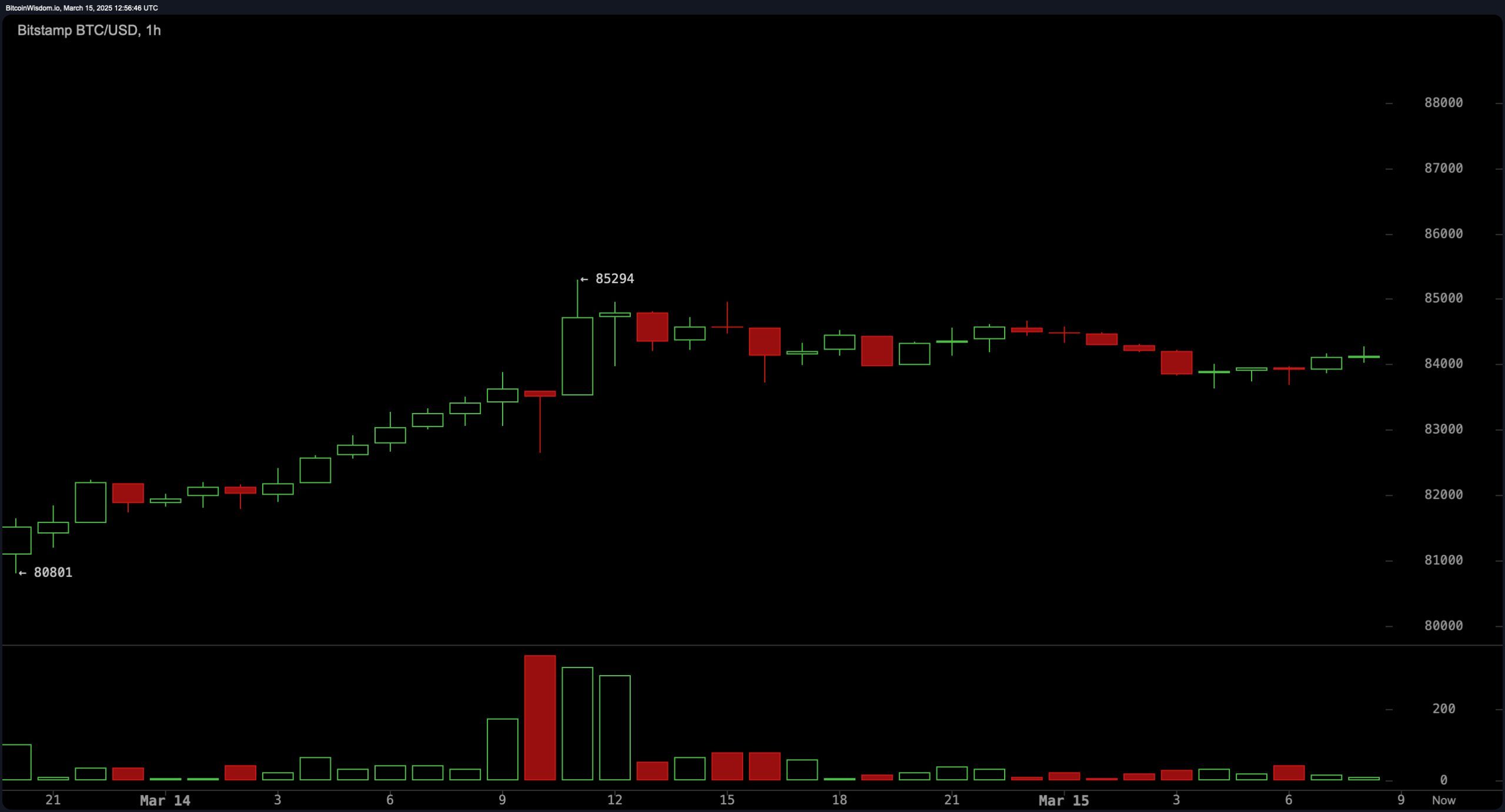

On the 1-hour chart, bitcoin‘s current momentum stalled after reaching $85,294, suggesting a short-term pullback. Rapid help lies close to $83,500, with resistance forming at $85,000. A collection of small purple candlesticks point out profit-taking, whereas the drop in shopping for quantity implies market individuals are ready for extra favorable entry factors. If bitcoin breaks beneath $82,500, additional draw back towards $80,000 might happen, whereas a profitable protection of $83,500 might set off one other upward check of resistance ranges.

BTC/USD 1H chart on March 15, 2025.

BTC/USD 1H chart on March 15, 2025.

The 4-hour chart presents a barely extra optimistic outlook, as bitcoin has rebounded from an area backside of $76,600 and briefly peaked at $85,294. The help degree at $80,000 stays essential for sustaining bullish momentum, whereas resistance close to $85,000 have to be surpassed for continued upside. Nevertheless, declining quantity following the bounce suggests waning bullish conviction. If bitcoin retraces to the $82,000–$83,000 vary and exhibits renewed shopping for energy, it might present a viable lengthy entry alternative, whereas one other rejection at $85,000 might result in a bigger corrective transfer.

BTC/USD 4H chart on March 15, 2025.

BTC/USD 4H chart on March 15, 2025.

On the each day chart, bitcoin is consolidating after a big drop from its current excessive of $100,185 to a low of $76,600. Key resistance sits close to $90,000, with main help established at $76,600. Candlestick patterns recommend a stabilization section, however shopping for stress wants to extend to maintain a restoration. The market has seen a mixture of bullish and bearish exercise, with the potential for one more leg down if bitcoin fails to carry the $80,000 degree.

BTC/USD 1D chart on March 15, 2025.

BTC/USD 1D chart on March 15, 2025.

Oscillators stay impartial total, with the relative energy index (RSI) at 44, Stochastic at 35, and the commodity channel index (CCI) at -36, indicating a scarcity of robust directional momentum. Nevertheless, momentum (10) sits at -6,483, signaling a bearish bias, whereas the transferring common convergence divergence (MACD) degree (12,26) at -3,104 presents a purchase sign. Transferring averages (MAs) present combined indicators, with short-term exponential transferring averages (EMA) and easy transferring averages (SMA) favoring shopping for, whereas longer-term indicators, such because the 50-day, 100-day, and 200-day EMAs and SMAs, stay bearish.

Fibonacci retracement ranges point out that $85,609 (38.2% degree) is appearing as speedy resistance, whereas $82,166 (23.6% degree) serves as minor help. A break above $85,609 might result in a transfer towards $88,392 (50% degree), with $91,176 (61.8% degree) representing a stronger resistance level. Conversely, if bitcoin drops beneath $82,000, a retest of $76,600 is probably going. The general market outlook suggests a necessity for bitcoin to carry above $80,000 to keep up its bullish construction, whereas merchants ought to look ahead to breakouts above $85,609 to substantiate a possible development reversal.

Bull Verdict:

Bitcoin’s skill to keep up help above $82,000–$83,000, coupled with bullish indicators from the MACD and short-term transferring averages, suggests a possible rebound. If bitcoin efficiently breaks via the $85,609 resistance degree, it might set off a rally towards $88,392 and past. A detailed above $90,000 would verify renewed bullish momentum, making greater worth targets, together with $95,138, achievable within the coming days.

Bear Verdict:

With declining quantity, bearish momentum readings, and longer-term transferring averages signaling a downtrend, bitcoin stays susceptible to a deeper correction. A failure to carry above $82,000 might speed up losses, with a drop beneath $80,000 opening the door for a retest of the $76,600 help zone. If promoting stress intensifies, additional draw back towards decrease Fibonacci ranges and psychological boundaries might materialize.