Ethereum (ETH) has proven indicators of restoration after a pointy decline brought on by the Bybit hack, which impacted its value. Regardless of this bounce again, ETH remains to be down almost 18% over the previous 30 days, reflecting continued volatility.

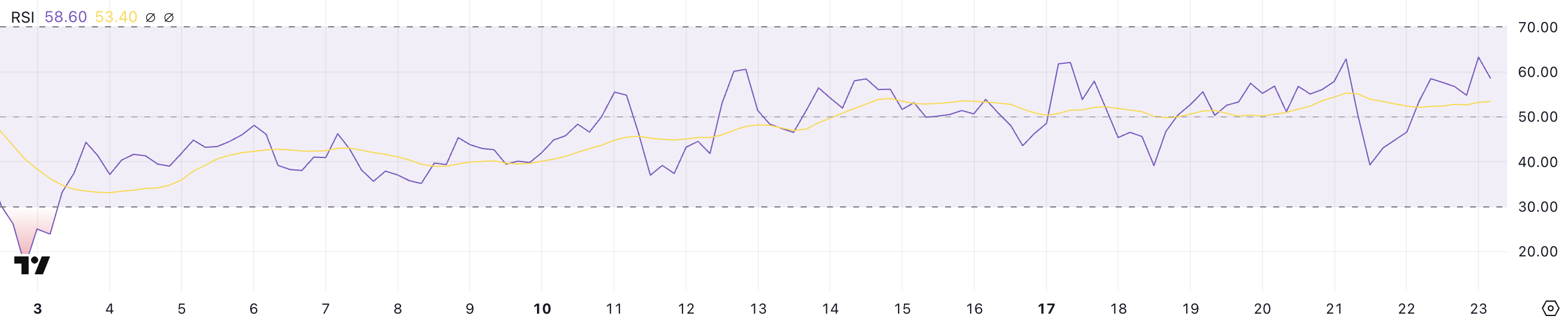

Notably, ETH’s RSI has rebounded to 58.6 from a low of 39.2 through the sell-off, indicating renewed shopping for stress. This restoration in RSI means that market sentiment is step by step enhancing, doubtlessly setting the stage for additional value positive aspects if momentum persists.

ETH RSI Has Recovered From the Current Dip

ETH’s RSI is at the moment at 58.6, a notable improve from the 39.2 degree it reached after the Bybit hack considerably impacted its value.

The restoration in RSI displays the shopping for momentum ETH has gained for the reason that sharp decline.

This upward motion in RSI suggests that purchasing stress has returned, serving to Ethereum value stabilize and doubtlessly paving the best way for additional value positive aspects if momentum continues.

ETH RSI. Supply: TradingView.

ETH RSI. Supply: TradingView.

RSI, or Relative Energy Index, is a momentum oscillator that measures the pace and alter of value actions. It ranges from 0 to 100, with thresholds at 30 and 70.

An RSI under 30 is usually thought-about oversold, indicating potential shopping for alternatives, whereas an RSI above 70 is taken into account overbought, signaling a potential value correction.

ETH’s RSI is at the moment at 58.6, positioned in a impartial zone however leaning in direction of bullish momentum. This degree suggests Ethereum nonetheless has room to develop earlier than reaching overbought territory, doubtlessly resulting in continued value appreciation as shopping for curiosity stays regular.

Ethereum Whales Gathered After Bybit Hack

The variety of Ethereum whales – addresses holding a minimum of 1,000 ETH – has been rising steadily over the previous month, rising from 5,680 on January 25 to five,828 on February 22.

This marks the best degree since December 2023, signaling renewed curiosity and accumulation amongst massive holders. The rise in whale addresses means that institutional traders or high-net-worth people are constructing positions, doubtlessly anticipating future value positive aspects, particularly between February 21 and February 22, when ETH costs decreased following the Bybit hack.

This rising accumulation may present a strong basis for ETH’s value to rise.

ETH Whales. Supply: Glassnode.

ETH Whales. Supply: Glassnode.

Monitoring Ethereum whales is essential as a result of their shopping for and promoting conduct can considerably influence the market.

When whales accumulate, it reduces the circulating provide, doubtlessly driving costs up as demand meets decreased availability. Conversely, once they promote, it may well create important downward stress on costs.

At the moment, the rise in whale addresses signifies rising confidence and a bullish sentiment amongst massive traders.

Though that is the best degree since December 2023, it’s nonetheless comparatively low in comparison with historic information. This implies there’s room for extra accumulation. If this pattern continues, it may result in a sustained upward motion in ETH value as demand outpaces provide.

Will Ethereum Lastly Rise Again Above $2,900?

Ethereum’s EMA strains recommend {that a} golden cross may type quickly. A golden cross usually indicators a bullish pattern and potential upward momentum.

If this happens, Ethereum may first check a value degree close to its long-term line (the blue line within the chart) round $2,876. Breaking this resistance may open the door for a transfer to $3,020.

If the uptrend continues with sturdy momentum, ETH may even attain as excessive as $3,442.

ETH Worth Evaluation. Supply: TradingView.

ETH Worth Evaluation. Supply: TradingView.

Nevertheless, ETH has struggled to reclaim ranges above $2,900 in current makes an attempt, signaling potential resistance and market hesitation.

If it fails to interrupt by as soon as extra and a downtrend begins, ETH value may check the $2,551 assist degree. Dropping this assist may end in a sharper decline, doubtlessly falling to $2,159.