It has been lower than two weeks since Donald J. Trump stepped again into the White Home, and he has already rattled the cages with quite a few controversial selections. The newest got here on Saturday night as he levied hefty taxes on China but additionally its two neighbors – Canada and Mexico.

Given the truth that his actions got here in the course of the weekend when just one monetary market was open for buying and selling, it was anticipated that this explicit market would face the music.

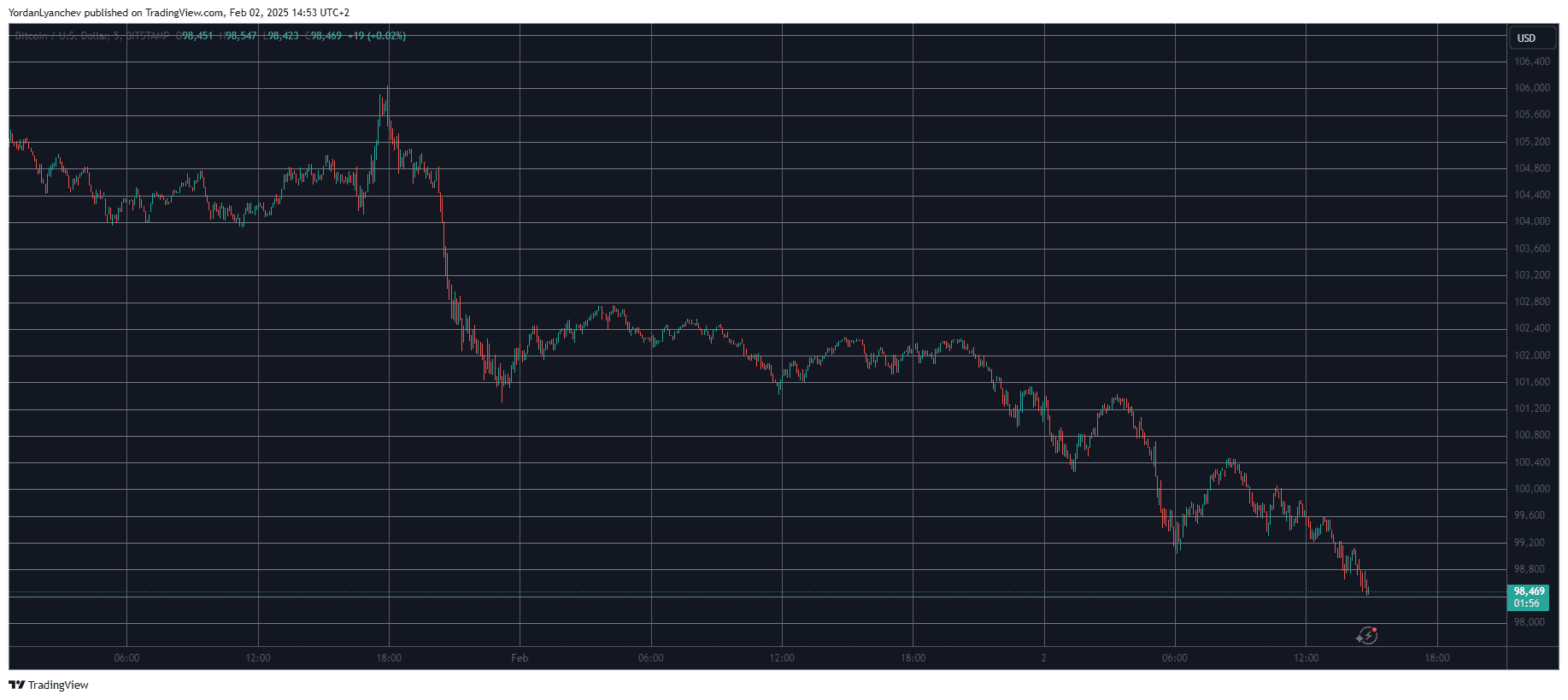

Bitcoin Slumps Throughout the Weekend

Trump’s 25% tariffs on Canada didn’t go unnoticed, and the latter’s Prime Minister, Justin Trudeau, responded kindly by imposing the identical tax on American items. Following Trump’s justification, claiming that these taxes purpose to guard Americans, in addition to decreasing the circulation of medicine and undocumented immigrants into the US, Trudeau had this to say:

“We don’t wish to be right here; we didn’t ask for this.” Nonetheless, he added that his nation would “not again down” and that their retaliation was an indication that they’d be “standing up for Canadians.”

With Mexico making ready its response and China stated to problem Trump’s tariffs on the World Commerce Group, the state of affairs appears removed from reaching a peak, and there’s no de-escalation in sight. Furthermore, the US president has a clause within the order he signed that enables him to impose even larger taxes ought to the aforementioned nations retaliate, as they appear to be doing.

The political panorama worsened in the course of the weekend as Trump’s orders have been signed on Saturday, and the one opened monetary market acquired the most important blow. Being a 24/7 tradable asset, BTC’s worth slumped from over $106,000 on Friday to beneath $98,500 earlier right this moment.

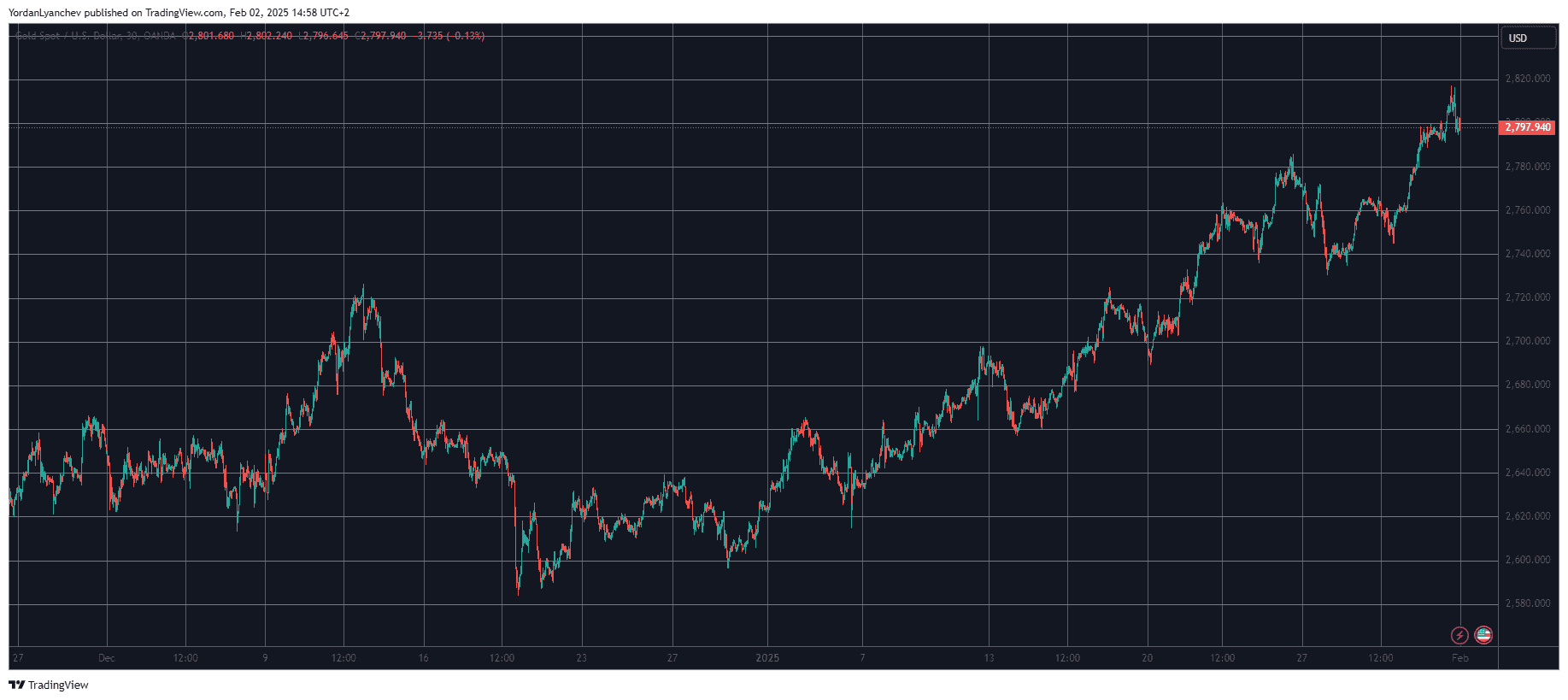

Gold Hits ATH

On the floor, gold’s worth actions up to now a number of days appear to distinction with these of BTC. In spite of everything, the dear steel shot as much as a recent all-time excessive of virtually $2,820/oz on Friday. Nonetheless, the bullion additionally retraced after its new peak and closed Friday (and January) at slightly below $2,800.

Furthermore, gold, similar to shares and all different non-crypto monetary markets, is closed for buying and selling in the course of the weekend, so the impression on it’s but to be seen. The futures markets provide little perception as of press time, so when the Asian buying and selling session opens on Monday morning, it can reveal the true image behind Trump’s actions.

On the identical time, the impression on crypto and BTC may additionally worsen if a much bigger sell-off transpires within the subsequent few days.