CryptoQuant CEO warns of financial instability and requires reform in South Korea’s monetary insurance policies.

In a Dec. 19 put up on X, Ki Younger Ju, the CEO and founding father of CryptoQuant, expressed grave considerations concerning the standing of the Korean financial system — critiquing the nation’s financial insurance policies, declaring, particularly, the rising worth of the Korean Received and the unattractiveness of home property.

“Home property, together with the Korean Received, are usually not enticing in any respect,” Ju mentioned, highlighting the ineffectiveness of presidency initiatives to maintain the foreign money secure.

Ju identified that the federal government’s efforts to maintain the foreign money secure have principally failed given the state of the financial system. He emphasised that the problem is made worse by the quickly rising foreign money price, which is inflicting financial instability.

Ju additionally identified that the USDT worth on Upbit, a significant South Korean alternate, had already caught as much as the IMF price which is usually a unhealthy signal for the South Korean financial system particularly by way of cryptocurrencies.

You may additionally like: South Korea’s Upbit and Bithumb lists MOVE on Dec. 9

One essential metric for assessing a foreign money’s worth in relation to others utilizing worldwide monetary requirements is the IMF price.

The KRW is declining towards the greenback at an alarming price when the worth of USDT, a stablecoin primarily based on the US greenback, equals the IMF price on native markets like Upbit. Since buyers can use USDT or different secure property as a hedge towards the volatility of the nationwide foreign money, this alignment between the USDT and the IMF price could also be an indication of a insecurity within the Korean financial system.

This may be interpreted by South Korea as a warning indication of capital flight, a phenomenon through which firms and buyers relocate their property overseas so as to defend them from devaluation or inflation. As a result of fewer individuals could be keen to carry the KRW, the tendency may additional destabilize the native monetary system and undermine the nationwide financial system.

Moreover, this may impact worldwide investments and commerce, lowering South Korea’s enchantment to worldwide buyers. Ju’s feedback show the mounting apprehension concerning the federal government’s response to the disaster and its capability to cease the move of capital in another country.

You may additionally like: Lengthy-time stakeholder in Upbit’s mum or dad seeks exit simply day after South Korea lifts martial regulation: report

CryptoQuant’s CEO additionally expressed disapproval of the way in which the federal government was addressing the matter, saying that as an alternative of constructing capital keep within the nation, it must foster an environment that may entice it to return again. Ju referred to as for fewer restrictions and extra incentives for buyers to stay in Korea, saying, “the federal government mustn’t forcefully maintain on to capital that’s fleeing abroad.”

Ju, who has operated his firm in Korea for seven years, expressed growing dissatisfaction with the South Korean authorities. He concluded, “I’ve endured this for 7 years whereas doing enterprise as a home company, however now I’m considering that I ought to depart Korea. It’s so irritating.” His remarks, which urge for reform to cease the capital flight, reveal a deeper fear for Korea’s financial future.

South Korea witnessed extreme political unrest in December 2024 on account of President Yoon Suk Yeol’s later-retracted imposition of martial regulation. The Nationwide Meeting impeached him consequently, and a trial earlier than the Constitutional Courtroom was held to find out whether or not he ought to keep in workplace.

You may additionally like: South Korea halts ‘all work’ on crypto laws amidst martial regulation aftermath

Monetary establishments in South Korea have been enormously impacted by the present political unrest. The inventory market has been risky and the South Korean received has misplaced worth, principally on account of worldwide buyers promoting their native shares.

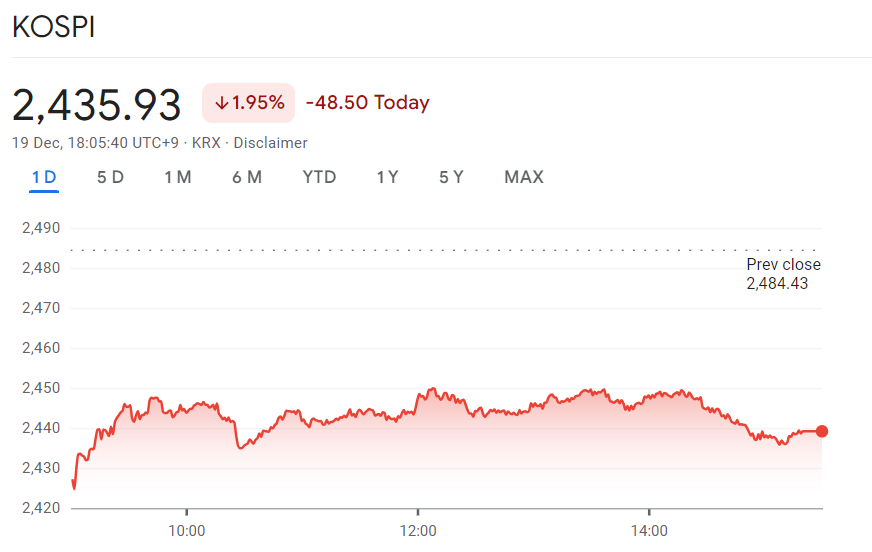

For instance, the KOSPI index, the benchmark inventory index of South Korea that tracks the efficiency of companies listed on the Korea Inventory Trade, fell 2.5% from Dec. 3, the day martial regulation was declared, and since then it has proven bearish momentum and now buying and selling at 2,435.93 as of Dec. 19.

Supply: Google Finance

Supply: Google Finance

Additionally, one of many largest corporations in South Korea and a pioneer in know-how worldwide, Samsung Electronics, had a 9.3% drop in its inventory worth, and at present buying and selling at 53.100 KRW. The South Korean received additionally continued to say no, hitting its lowest degree in 15 months at 1,448.9 versus the US greenback.

With a view to mitigate the dangers related with the present political and financial atmosphere, firms and people are contemplating relocating their property abroad on account of the rising considerations about financial stability.

It’s unclear how the federal government’s measures will have an effect on South Korea’s monetary establishments going ahead and whether or not extra firms, like CryptoQuant, might be compelled to relocate to safe their survival in a extra secure atmosphere whereas the nation experiences political and financial upheaval.

Learn extra: US shuts down North Korean crypto laundering community