Ethereum worth is beneath stress, at the moment buying and selling at $3,699 with a market capitalization of $445.55 billion. The current downturn has raised issues of a possible worth crash, particularly as Ethereum struggles to reclaim the $4,000 stage. On this article, we’ll discover key market insights, knowledgeable predictions, and technical evaluation on the place ETH may be headed subsequent.

By TradingView – ETHUSD_2024-12-19 (1D)

By TradingView – ETHUSD_2024-12-19 (1D)

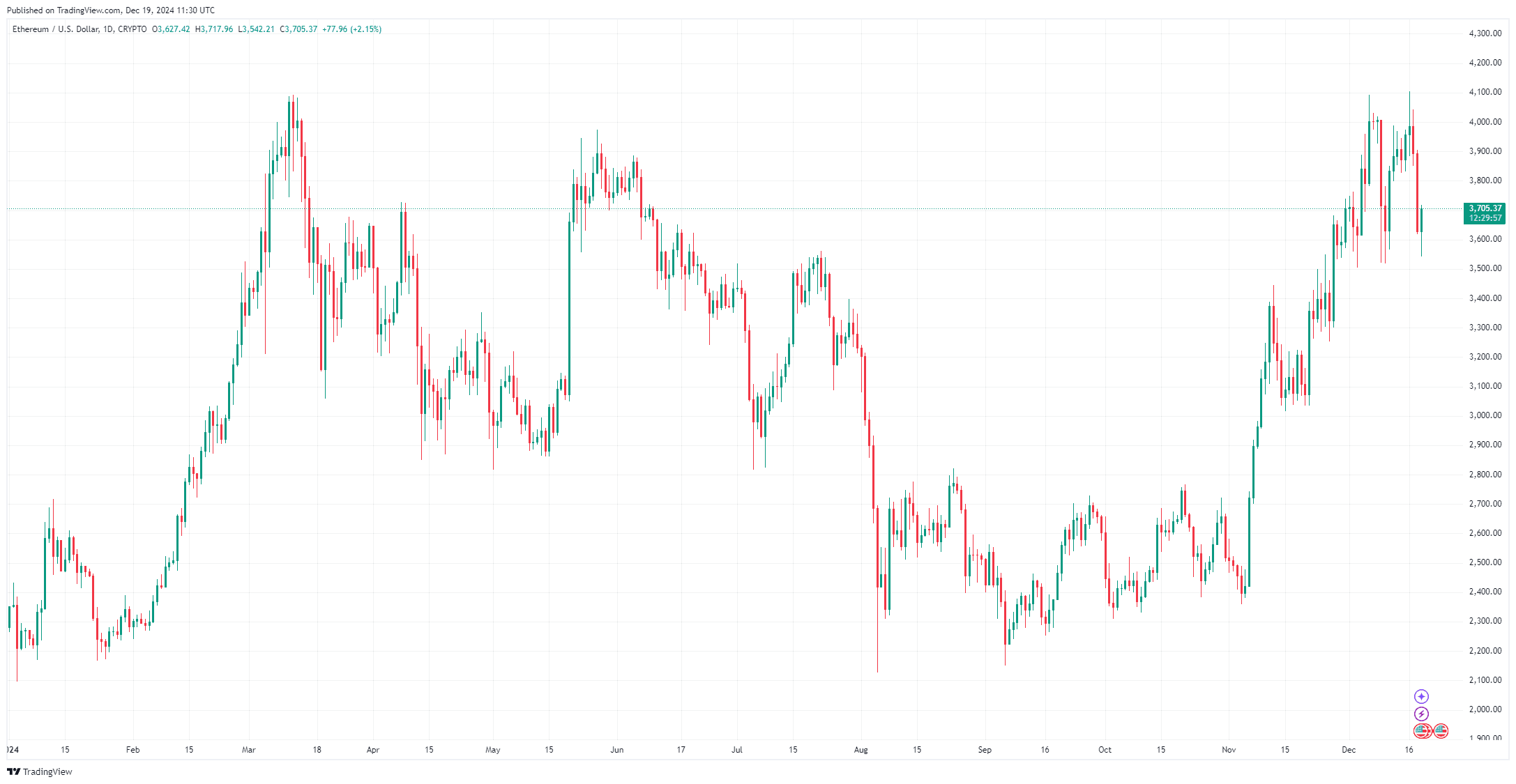

Ethereum Sentiment Drops to a 1-12 months Low

Investor sentiment towards Ethereum has reached its lowest level in a 12 months. Based on crypto analyst Ali Martinez, social sentiment for ETH is at its most destructive stage since December 2023, when ETH was buying and selling between $2,100 and $2,200. Apparently, this bearish sentiment might sign a bullish alternative. Traditionally, when sentiment reached this low, Ethereum’s worth rallied by 30%, ultimately climbing from $2,200 to $2,700 earlier than persevering with its rally to $4,093 in March 2024.

Martinez believes that if ETH follows an identical sample, the value might rise to the $4,900–$5,000 vary. Nevertheless, for this bullish state of affairs to materialize, ETH should first break by means of the $4,100 resistance stage. As soon as that’s achieved, he means that $6,000 might act as a worth magnet for the cryptocurrency.

By TradingView – ETHUSD_2024-12-19 (YTD)

By TradingView – ETHUSD_2024-12-19 (YTD)

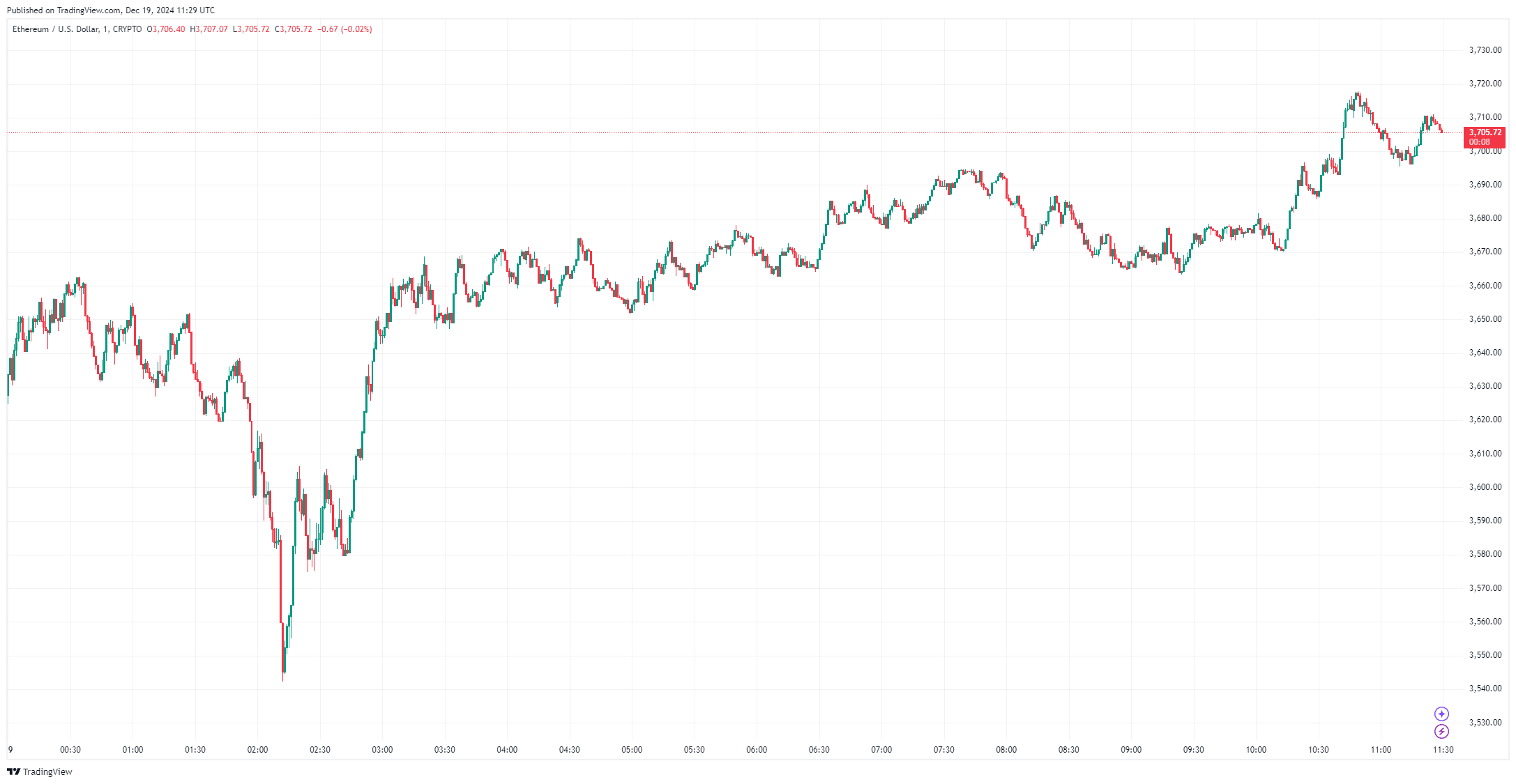

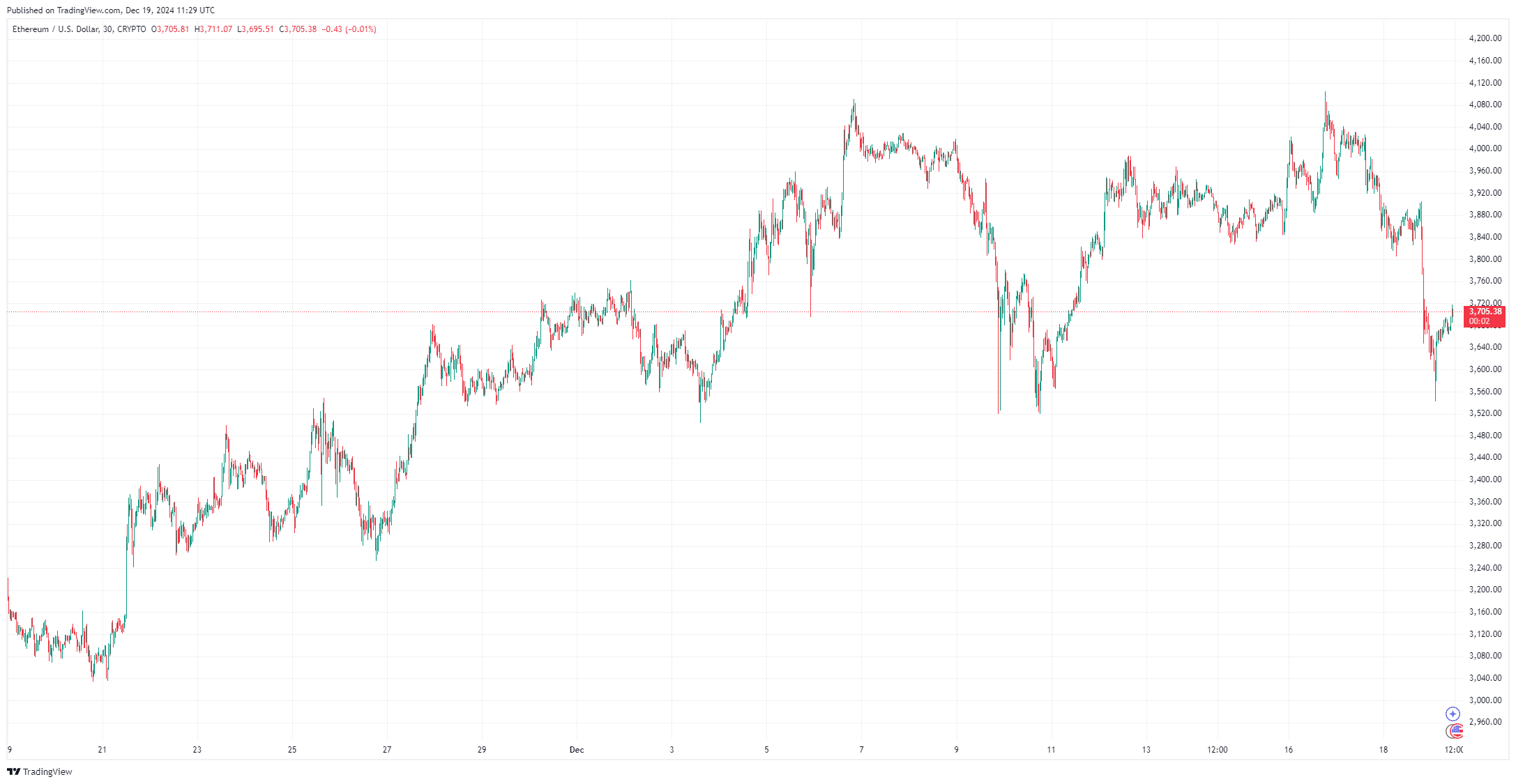

Technical Indicators Sign Extra Losses for ETH

Technical evaluation reveals that Ethereum’s worth is exhibiting sturdy bearish indicators. ETH lately dropped beneath key assist ranges, together with $3,880, $3,800, and $3,680. It’s now buying and selling beneath $3,620 and the 100-hourly Easy Shifting Common. A bearish trendline can be forming, with resistance at $3,800, which might act as a major hurdle for any upward motion.

If ETH fails to clear the $3,680 resistance, additional declines may very well be anticipated. Key assist ranges to observe embrace $3,550 and $3,500. A breach beneath $3,500 might ship Ethereum’s worth to $3,450 and even $3,350. In a worst-case state of affairs, analysts see assist at $3,220 as the ultimate line of protection earlier than a bigger sell-off.

Can ETH Reclaim the $4,000 Degree?

Breaking by means of the $4,000 stage has confirmed to be a significant problem for Ethereum. Current makes an attempt to reclaim it had been met with sturdy resistance, pushing the value again to $3,800 and decrease. Market observers have in contrast ETH’s present worth motion to Bitcoin’s efficiency when it hovered close to the $70,000 mark. Just like BTC’s historic habits, ETH worth might expertise a number of rejections earlier than it will probably sustainably break above the $4,000 mark.

Crypto analyst Altcoin Sherpa notes that ETH’s capacity to reclaim $4,000 might sign the beginning of a brand new bullish run. Nevertheless, this could require important shopping for stress, as sellers have been topping up provide at this worth level. Holding above $3,800 is seen as essential to sustaining any bullish momentum.

By TradingView – ETHUSD_2024-12-19 (1M)

By TradingView – ETHUSD_2024-12-19 (1M)

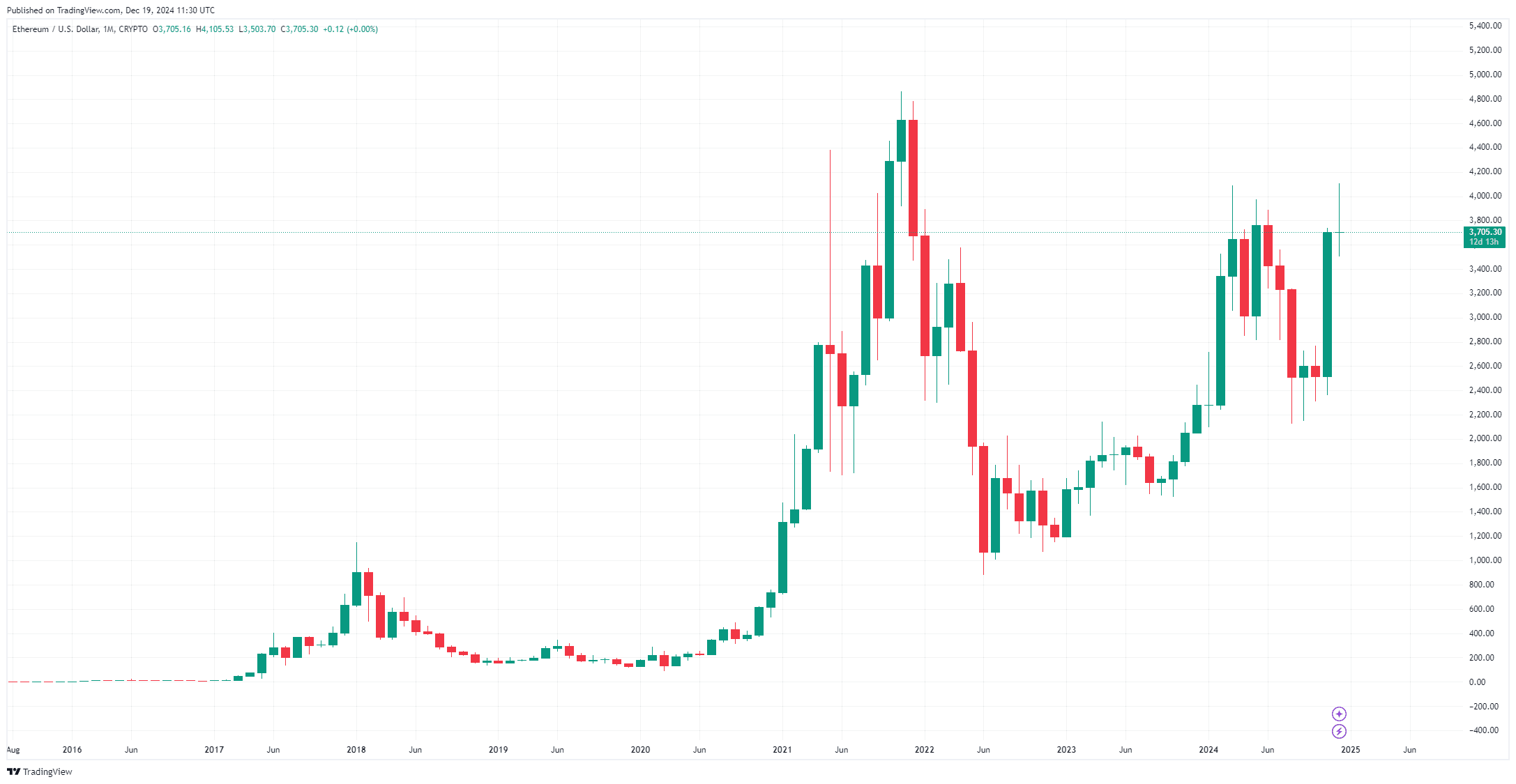

Ethereum’s Position within the Subsequent Altcoin Season

The broader altcoin market might play a major function in Ethereum’s subsequent transfer. Market knowledgeable Lark Davis factors out that the whole altcoin market cap is approaching its 2021 excessive of $1.13 trillion. He argues that after this threshold is breached, it might set off a historic altcoin season. Given Ethereum’s prominence because the "King of Altcoins," any upward motion within the altcoin market might gasoline renewed curiosity in ETH.

Crypto analyst Miles Deutscher echoes this sentiment, noting that ETH has traditionally carried out effectively throughout altcoin seasons. From January to Could, ETH’s month-to-month returns averaged 28%, in comparison with simply 3% for the remainder of the 12 months. As Bitcoin’s dominance rises, it’s typically adopted by a capital rotation into altcoins, which may gain advantage Ethereum considerably.

Ethereum Value Prediction

Analysts are divided on Ethereum worth subsequent transfer. Whereas some predict an additional decline beneath $3,500, others imagine that the bearish sentiment is a traditional indicator of an impending bullish reversal. Right here’s a abstract of attainable situations:

- Bearish State of affairs: ETH fails to reclaim the $3,800 resistance, resulting in additional declines. Key assist ranges to observe are $3,550, $3,500, and $3,350. A breach of $3,220 might set off a pointy sell-off.

- Bullish State of affairs: If ETH breaks above $3,800 and reclaims $4,000, it might set off a transfer to $4,900–$5,000. Ought to it clear $4,100, $6,000 might grow to be the subsequent worth goal.

Ethereum worth is at a important juncture because it faces important resistance at $4,000 and key assist at $3,500. Sentiment is at its lowest level in a 12 months, a possible bullish indicator in accordance with historic information. Nevertheless, bearish technical indicators recommend additional losses could also be on the horizon. The end result will possible rely on whether or not ETH can reclaim the $4,000 stage or if it succumbs to the bearish pressures pushing it decrease. Traders ought to watch key assist and resistance ranges carefully within the coming weeks.

By TradingView – ETHUSD_2024-12-19 (All)

By TradingView – ETHUSD_2024-12-19 (All)