Bitcoin (BTC) recently reached a new all-time high (ATH) of $93,477, as the leading digital asset inches closer to the highly anticipated $100,000 target. Notably, the ongoing price rally has seen relatively muted profit-taking, fueling hopes that BTC has further room to surge.

Low Profit-Taking For Bitcoin In Current Cycle

According to a recent report by Glassnode, the current BTC price momentum is primarily driven by strong spot demand and rising institutional interest. Particularly, the victory of Republican US presidential candidate Donald Trump has added optimism to the digital assets industry.

The report highlights that over 95% of Bitcoin’s supply is currently in profit. However, despite the high proportion of profitable holders, profit-taking has remained relatively muted during this cycle.

Historically, monthly profit realization has typically ranged between $30 and $50 billion during previous Bitcoin ATH cycles. The current price discovery phase has seen about $20.4 billion in realized profit.

This relatively low profit-taking level in the current BTC ATH cycle suggests further room for the BTC price to rise, potentially reaching the $100,000 milestone before demand wanes.

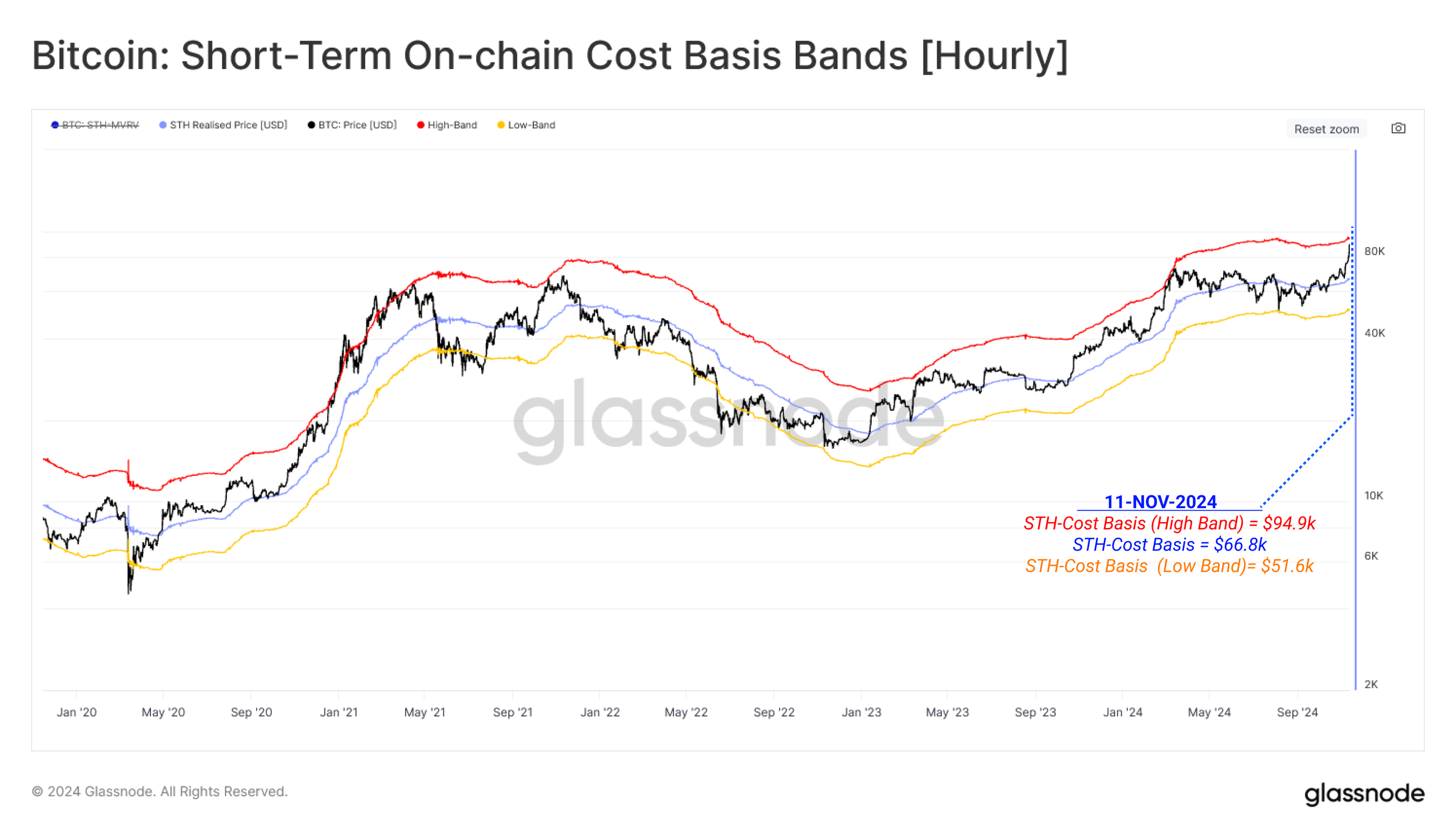

The chart below shows the cost basis of new BTC investors, along with upper and lower statistical bands. According to the report, during an ATH phase, BTC’s price repeatedly tests the upper bands as new investors enter the market at higher price points.

As can be inferred from the above chart, BTC’s current spot price of $91,199 is just below its upper band of $94,900. Keeping track of price movement between these bands can show when the market price might be high enough to force existing holders to sell their holdings.

Excess Leverage Must Be Flushed Before $100,000 BTC

While BTC is trading less than 10% below the $100,000 level, industry experts opine that excess leverage must be flushed out before the top digital asset attempts to hit the 6-figure target.

Data from Coinglass shows that more than $718 million worth of crypto contracts were liquidated in the past 24 hours, impacting 202,074 traders.

Notably, contract liquidations were split pretty evenly between longs and shorts – 49.93% vs 50.07%, respectively – indicating that despite the strong bullish sentiment, there is no clear trading advantage.

Some industry leaders remain optimistic about BTC’s future price action. In October, the BTC mining firm CleanSpark CEO said that the premier digital asset may peak at $200,000 in the next 18 months.

Similarly, BitMEX co-founder Arthur Hayes recently predicted that BTC may hit $1 million under the Trump administration. BTC trades at $91,199 at press time, up 3.9% in the past 24 hours.

Featured image from Unsplash, Charts from Glassnode and TradingView.com